Markets are slightly in risk-off mode with Asian shares trading lower after Apple released weaker-than-expected results. We can also see some EUR weakness after higher unemployment numbers were reported in Spain; more than 25%. Spain yields should continue to the upside, into a wave (c) rally which will cause bearish pressure on the EURUSD.

EURUSD Elliott Wave Analysis – Click image to enlarge

EURUSD extended nicely into a new low which was expected after only three waves up to 1.3022 as highlighted yesterday. We are looking at the whole decline now from 1.3140 that appears incomplete, but corrective. We are observing a double zig-zag in wave Y with more weakness to come while 1.3022 holds. 1.2850 will be a strong support; trend-line connected from October 1st.

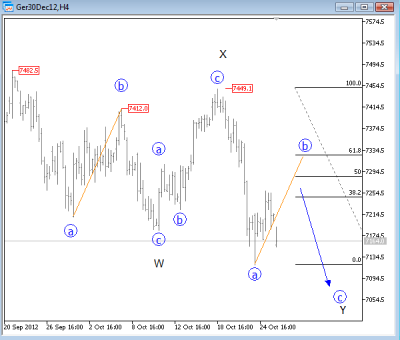

Both S&P-cash and German DAX Futures are still in a risk-off mode within incomplete corrections from September highs. It now seems as price is now in a (b) wave of a second zig-zag. Resistance for S&P is at 1422-1434, and on DAX futures 7255-7335.

DAX Elliott Wave Analysis – Click image to enlrage

Traders, we are still sitting on the side-line; no trades for now. Actually many pairs are still in a range-bound mode and we definitely do not want to get stuck into this. However, if you have more aggressive approach, then we recommend smaller position sizes as normally. Take care, Grega.