The euro was lower yesterday and kept its losses today against the US dollar and the Japanese yen after the International Monetary Fund cuts it growth forecast for the eurozone and predicted that inflation will slow, leading, perhaps, to lower interest rates. The IMF predicted that the economy of the euro area will rise 0.2 percent in 2013, while the previous estimate was 0.7 percent. The economy is expected to decline by 0.4 percent … “Euro Stays Lower on IMF Projections”

Month: October 2012

Swissie Gains vs. Euro on Unemployment Rate & CPI

The Swiss franc gained today against the euro after macroeconomic reports showed that the nation’s unemployment rate remained stable, proving expectations for an increase to be wrong, and inflation picked up. The Swissie was down versus the US dollar and the Japanese yen. The unemployment rate was stable at 2.9 percent in September, while forecasters predicted an increase to 3.0 percent. The Consumer Price Index rose to 0.3 percent last month, while it … “Swissie Gains vs. Euro on Unemployment Rate & CPI”

Koruna Slides Ahead of Inflation Report

The Czech koruna slipped today on speculations that tomorrow’s report will show inflation rising slower than estimated by the nation’s central bank as the European crisis and the domestic spending cuts deterred economic growth. Analysts estimated that consumer prices rose 3.4 percent in September, while the central bank’s forecast was 3.4 percent. Inflation was 3.3 percent in August. Economists are worried that the decrease of investment spending and the increase … “Koruna Slides Ahead of Inflation Report”

Indian Rupee Falls Before European Leaders Meet

The Indian rupee fell today ahead of the European leaders’ meetings later this week. Forex traders are unsure whether the politicians are capable to reach an agreement and find a way out the persistent economic crisis. German Chancellor Angela Merkel will go to Greece on October 9, hers first visit since the crisis of 2008–09. Spanish Prime Minister Mariano Rajoy will meet with French President Francois Hollande in Paris … “Indian Rupee Falls Before European Leaders Meet”

Loonie Drops against Greenback, Gains against European Currencies

Loonie is heading lower against the greenback today, dropping as safe haven currencies gain the advantage over their riskier counterparts. Canadian dollar is losing ground against the US dollar, but gaining against European currencies, as fears of recession set in. The latest news out of Asia and the eurozone has encouraged risk aversion on the Forex market, and that is sending many high beta currencies lower. The loonie is … “Loonie Drops against Greenback, Gains against European Currencies”

Japanese Yen Heads Higher on Risk Aversion

Risk aversion is back in the markets, and the Japanese yen is getting a boost today. Even though Japanese markets are closed today, the yen is heading higher on concerns about what’s next for the global economy. Many Forex trader fears were spurred by the latest news out of China. Japanese auto producers in China are reporting sharp drops in sales, and production is being cut in China. The news about China’s … “Japanese Yen Heads Higher on Risk Aversion”

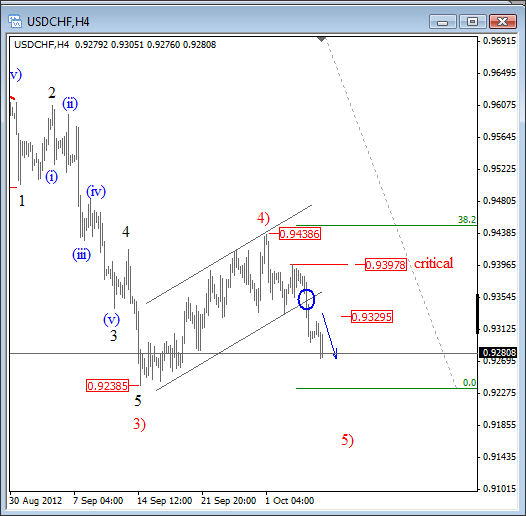

USDCHF Bears In Progress – Elliott Wave Analysis

USDCHF successfully moved through the falling trend-line of a corrective channel which is the first indication for a completed wave 4 at 0.9438 and wave 5) underway. We expect an impulsive bearish price action through September’s lows and ideally a move towards 0.9100 projected fifth wave target. USD CHF Elliott Wave Analysis – Click image … “USDCHF Bears In Progress – Elliott Wave Analysis”

Euro Rallies After Two Week of Losses, Can It Keep Gains?

The euro had a big rally this week amid risk appetite, caused by comments of central banks. The rally followed two consecutive weeks of losses. Yet there are no guarantees that the currency will be able to keep its gains. The monetary policy decision of the European Central Bank was the major bullish factor for the shared 17-nation currency. ECB President Mario Draghi did not say anything new, but at least … “Euro Rallies After Two Week of Losses, Can It Keep Gains?”

Nonfarm Payrolls Do Not Harm Dollar to a Great Extent

The US dollar closed somewhat lower against the euro today as favorable non-farm payrolls spurred a wave of risk appetite across the Forex market. The US currency managed to jump versus the Great Britain pound and retained its gains against the Japanese yen. The positive nonfarm payrolls turned the Forex, as well as other markets, to a risk-on mode. The Standard & Poorâs 500 Index of stocks rose 0.7 percent. The greenback felt some downside … “Nonfarm Payrolls Do Not Harm Dollar to a Great Extent”

Good Employment in US & Canada Pushes Loonie Higher

The Canadian currency jumped after positive employment data from the United States and Canada itself boosted the attractiveness of the loonie, though the currency gradually moves lower as of present time. Canada’s employers added as much as 52,100 jobs in September, the second consecutive month of employment growth. That is compared to the median forecast of 11,700 and the previous reading of 34,000. At the same time, the unemployment rate rose by 0.1 percentage point to 7.4 percent, while analysts … “Good Employment in US & Canada Pushes Loonie Higher”