The world’s No. 1 economy is holding elections for the top post: President of the US as well as for Congress. The so called “fiscal cliff” is a major, burning issue in the near term, that the next occupant of the White House will have to deal with promptly. There is a significant difference between the approaches of both candidates on this topic, as well as on other economic issues, making the outcome of the elections very significant for the US dollar. In addition, the race is very close, making uncertainty and potential volatility high.

Update: Obama is re-elected – EUR/USD jumps towards resistance – will the dollar continue weakening, or could this turn around?

Here is some background on the fiscal cliff, market sentiment, 4 possible scenarios and potential reactions for EUR/USD.

Fiscal Cliff Resolution

Without any intervention, the US is on course for automatic tax hikes and spending cuts in 2013. The uncertainty about the potential resolution is already blamed for some of the slowdown in the US and abroad. Basically, Romney and the Republicans would like to see more spending cuts than tax hikes, while Obama and the Democrats would prefer a different mix. The gap is wide, as we’ve seen with the debt ceiling issue in the summer of 2011, politicians know how to secure a last minute deal.

Yet we’ve also seen that President Barack Obama and the Republican majority in the House have a hard time getting along together. The last minute negotiations resulted in a historic credit rating downgrade by S&P.

Market Sentiment

The sentiment is not positive in the markets. Greece is set to run out of money on November 16th if no solution is found. At the time of writing, negotiations are practically stuck on the topic of labor reforms. In Spain, the government seems reluctant to ask for a bailout.

China is showing signs of slowdown amid a regime change, and Japan is struggling to lift its economy as deflation is creeping back. In the US, economic indicators remain mediocre, with unconvincing growth, yet as other countries are struggling as well, many still hope that the US will lead the world to recovery, at some point.

In this environment, a favorable result would trigger “risk appetite” and dollar selling, while a less favorable result could trigger a “flight to safety” (risk aversion), which strengthens the US dollar and the Japanese yen.

4 Scenarios

- One party sweep: Low probability. In general, a result where one party wins the House, the Senate and the White House is the most favorable one, as decision making would become easier. However, polls show little chance of change in both houses of Congress. If this does happen, the dollar will likely plunge and stocks will rise.

- Romney wins: Medium probability. This is the favorable result for the markets, as there are expectations for a faster and better resolution of the fiscal cliff. In his capacity as governor of Massachusetts, he managed to work quite well with a majority of Democrats. In this scenario, the dollar will likely fall.

- Obama wins (including popular vote): Medium probability. This is a less favorable result, as expectations are for a less convincing and slower solution on the fiscal cliff. In this scenario, the dollar is likely to rise.

- Obama wins without popular vote: Low probability – the winner of the elections usually wins the popular vote as well. However, some polls show that Obama could win enough states to win a majority of electors, but not have an outright majority with American voters. The chances are a bit higher after the Sandy storm: in some northeastern “blue states”, turnout could be lower than usual, but Obama is still expected to win there easily. If Obama wins without the popular vote, there is a chance that Republicans will be more demanding in the negotiations. What could happen is a repeat of the debt ceiling debacle – an very unsatisfactory short term compromise that could result in more credit rating downgrades. In this scenario, the dollar will likely skyrocket.

Big Moves?

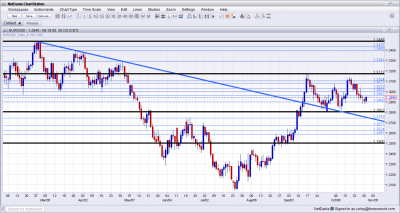

With a lot at stake and high uncertainty, moves could be large. Key lines have been highlighted in the thick black lines.

EUR/USD Towards the Presidential Elections – Click image to enlarge

EUR/USD is basically trading in a range between 1.28 to 1.3170 for almost two months. There is good chance that these lines will be challenged. Outside this range, 1.25 is a key line on the downside and 1.3480 is a significant barrier on the upside – that’s were the broken downtrend (in blue) began.

Further reading:

- For more lines, events and analysis, see the EUR/USD forecast.

- See US elections analysis on FXStreet.

- Update: Analyzing the wide market reaction to the NFP, an Obama victory could already be priced in, at least partially.

- 5 Reasons Why Greece Could Leave the Euro-Zone After the US Elections

- Election Day Update: Obama Set to Win, EUR/USD Slides

- And here is the US Election Results Timetable

- Additional trade idea: Sell EUR/USD on Obama Win, Buy AUD/USD on Romney Win