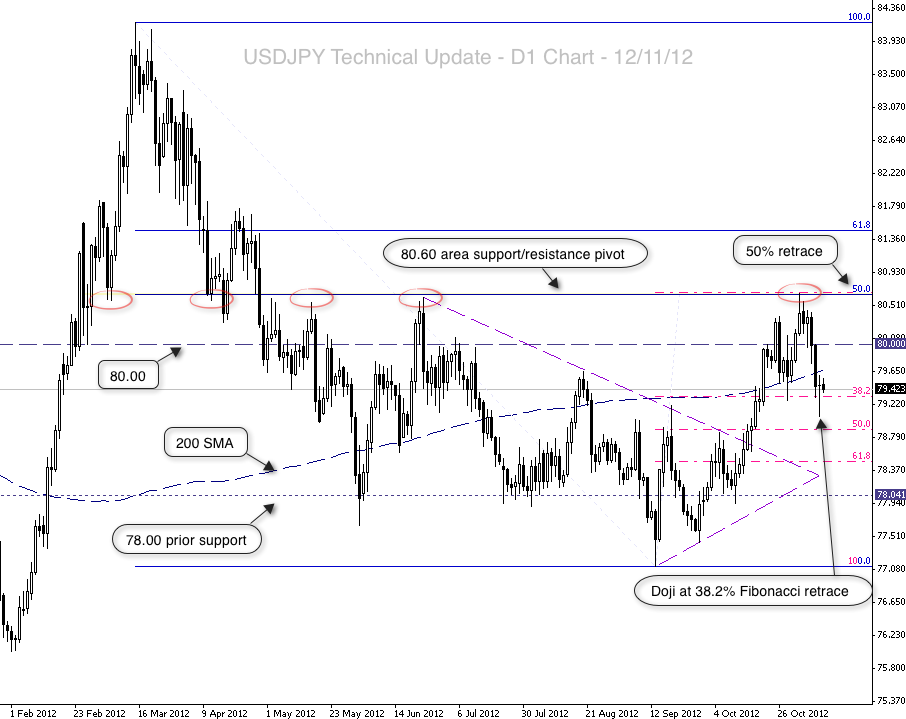

The dollar/yen pair has seen extended downside after price was capped on the 2/11/12, when it hit the 50% retrace of the last swing lower from 84.17 – 77.12. This level coincides with the historical 80.55-65 price pivot area on the USD/JPY. This price pivot is clear to see on the attached daily timeframe chart.

Guest post by Nick Simpson of www.forex-fx-4x.com

USD/JPY technical update 2012-11-12 – Click image to enlarge

Interim support was found around the 80.00 handle, but price has ultimately dropped to a low of 79.31 over recent trading and formed a doji candle. The doji closed just above the 38.2% Fibonacci retrace of the rally from 77.12 – 80.66.

The key near term technical levels which could yet prove to be supportive are as follows:

- 38.2% Fibonacci retrace of the rally from 77.12 – 80.66, around 79.32.

- 19/9/12 daily high at 79.21.

- 50% retrace of 77.12 – 80.66 and 5/10/12 daily high are roughly aligned around 78.86.

- 78.00 prior support.

The potential resistance levels we see in play are as follows:

- 200 day SMA, currently around the 79.64 level.

- The 80.00 area (double zero psychological round number).

- The 80.60 area, 50% retrace of 84.17 – 77.12 and price pivot zone. This is also the highest level seen since the end of April.

Going forward, price action around current levels could help determine the near term directional bias. A daily timeframe close above the 200 day SMA would encourage USD/JPY bulls somewhat, as would a prolonged failure to close under the 38.2% retrace area.

Ultimately, if any sustained upside is to be seen the 80.60 area resistance is key, a break above here could see a resumption of the rally from the mid September 77.00 area lows. A failure to progress higher and regain the 80.00 level may see price gravitate back down to the 78.00 area previous support level.