On December 1st, Enrique Peña Nieto will become Mexico’s President for the next six years. His election marks a return to power by the PRI after a 12-year hiatus under the rule of the more conservative PAN. The fundamentals of the Mexican economy make the case for a stronger currency, but social and political issues as well as external factors have depreciated the currency in the second half of 2012.

By Alfonso Esparza

Senior Currency Strategist, OANDA

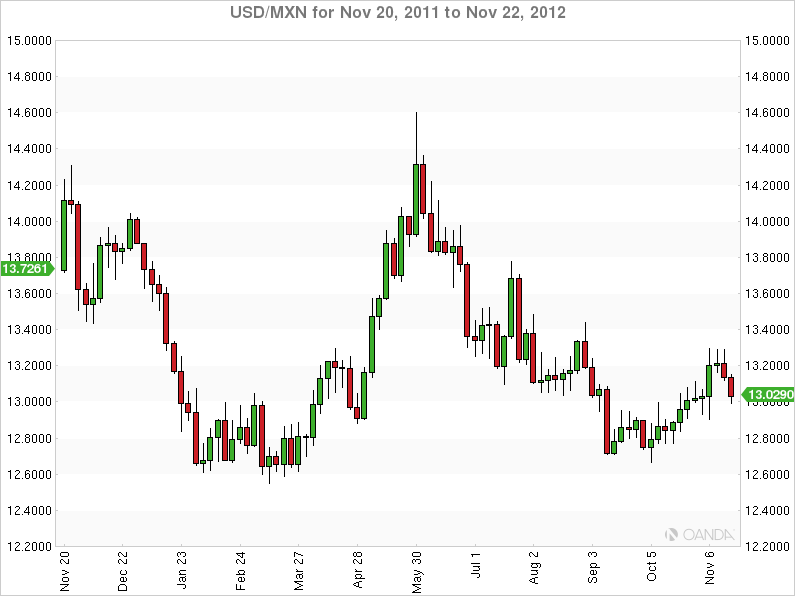

USD/MXN 2011-11-20 1Y – Click image to enlarge

The rise of China devastated the Mexican manufacturing industry, but as China has grown and the CNY has appreciated, Mexico has adapted. Mexico is now manufacturing heavy machinery and high-tech products. The United States remains its largest trading partner (78%), which means that Mexico will benefit from a fiscal cliff avoidance scenario and stronger demand from its northern neighbor. Often compared to Brazil, Mexico is now pulling ahead of South America’s largest economy due to steady growth in contrast to the start and stop of Brazil’s economic trend. Mexico’s economy will grow at close to 4% this year while Brazil has struggled to regain the form seen in 2010. In 2011, Brazil GDP grew at a 2.7% pace and is forecasted by its Central bank to grow only 1.6% in 2012.

Mexico has also approved a new labor reform policy. It will give employers more flexibility when hiring and firing employees and offer part-time work. The objective of the reforms is to boost employment and direct investment by easing existing labor laws. Peña Nieto has vowed to follow the labor changes with much needed energy and tax reforms. He has also vowed to tackle the country’s violence problem, which is a direct result of the ongoing drug war. To accomplish this Mexico needs to work closely with the US to boost national security for both nations.

Investors around the world are taking notice – in particular, retail investors. Japanese currency traders are picking up positions in the MXN in preference to their previous emerging market favourite, BRL. The Mexican interest rate is lower than comparable emerging market economies, but its growth forecasts appear more solid considering the US has turned a corner.

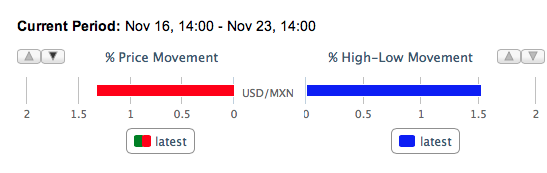

The USD/MXN has lived through a number of ups and downs since the summer. It was one of the hardest hit currency pairs in the wake of the European crisis. The OANDA volatility tool shows a close to 1.21% appreciation of the MXN versus the USD. This movement came with strong momentum, as overall high-low movement was around 2.11%. Weekly high was 13.2832 while the low was 13.0086.

This week started with a Mexican holiday and will be bookended with the US Thanksgiving holiday, making for light trading on both sides of the border. The Greek debt failure and the China manufacturing recovery stories have kept the market moving, but it is expected that they will be priced in by Monday when all traders come back from holidays.

Upcoming Economic Events:

- Nov 26 Mexico Trade Balance

- Nov 30 Mexico Central Bank Interest Rate

- Nov 30 Mexico Fiscal Balance