The New Zealand dollar sank today versus its US counterpart after Japan cut its exports and the meeting of European finance ministers ended without meaningful conclusion. The kiwi, as the New Zealand currency is nicknamed, managed to advance versus the Japanese yen. European finance chiefs were meeting yesterday to discuss an aid for Greece. Yet the outcome disappointed Forex market participants and the indebted country did not get help without … “NZD Drops vs. USD on Japan’s Exports & Greece, Rises vs. JPY”

Month: November 2012

RBA Minutes Weaken Australian Dollar

The Reserve Bank of Australia released its monetary policy minutes today, weakening the Australian dollar. The minutes suggested that further monetary easing is possible, while Australia’s economy may grow slower than was previously anticipated. The RBA released the minutes of its policy meeting on November 6, when it has left the key interest rate unchanged. Yet most analysts expect an interest rate cut on the next meeting … “RBA Minutes Weaken Australian Dollar”

AUD/USD: Trading the Chinese Flash PMI Nov 2012

Chinese Flash Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible … “AUD/USD: Trading the Chinese Flash PMI Nov 2012”

Canadian Dollar Falls, Losses Limited

The Canadian dollar fell against some of its major peers, including the US dollar and the euro, today together with falling prices for crude oil, the major Canada’s export commodity. Losses were limited because of some good news for the currency. Crude dropped as much as 2.9 percent to $86.73 per barrel in New York today. Canadian wholesale sales declined 1.4 percent to $48.8 billion in September instead of rising 0.5 percent … “Canadian Dollar Falls, Losses Limited”

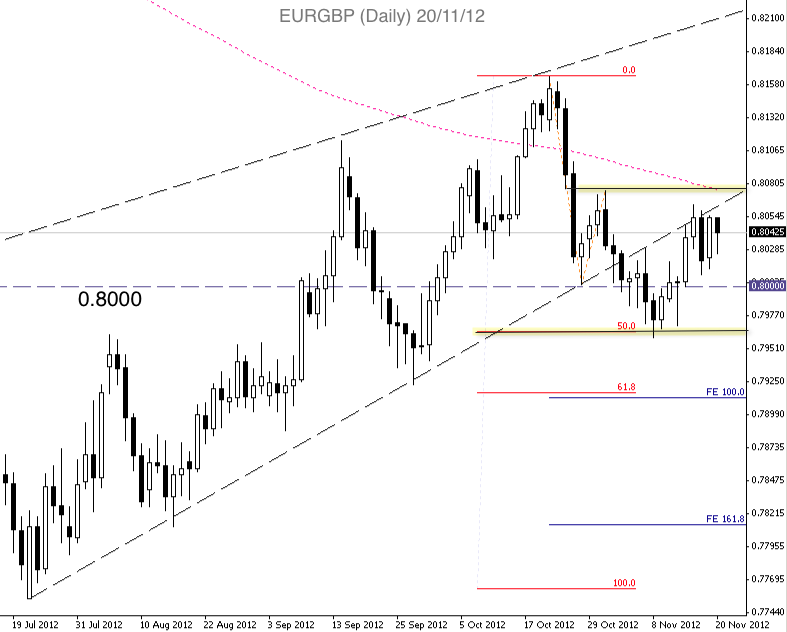

EUR/GBP Technical Update 20th November 2012

The EUR/GBP currency pair is currently trading in a tight consolidation range above the 0.8000 psychological level and previous support trend line, which has recently acted as resistance. This pair formed an inside day yesterday and is once again trading within the prior days range, which may see another inside day if price closes around … “EUR/GBP Technical Update 20th November 2012”

Quick Fiscal Cliff Resolution Could Be Dollar Negative

While it is hard to expect politicians to strike a deal before the 11th hour, initial headlines from the negotiations about the fiscal cliff were positive. An early resolution of the cliff could trigger a “risk on” reaction, weakening the US dollar, at least initially, says David Rodriguez of DailyFX. In the interview below, Rodriguez … “Quick Fiscal Cliff Resolution Could Be Dollar Negative”

Euro Struggles Following France Downgrade

Euro is struggling once again, trying to gain the upper hand against the US dollar, as continued concerns about the eurozone crop up. Even though there appears to be a promise of a new bailout for Greece coming, France has been downgraded, and that is causing some worry. Earlier, European officials indicated that an agreement on Greece is going to be announced soon. The news is positive, and helpful for the euro, but … “Euro Struggles Following France Downgrade”

Spain Ponders Creative Yet Imperfect Cure for Housing Slump

The Spanish government is discussing a proposal to grant residency to foreign buyers of homes. The idea is to attract capital back into the troubled housing sector, which experienced a huge bubble and no less painful bust. The idea is that the residency permit will allow home buyers from outside the EU to live in … “Spain Ponders Creative Yet Imperfect Cure for Housing Slump”

Loonie Pulls Back after Earlier Gains

Loonie is slightly lower right now, following earlier gains. Earlier, the prospect of a better situation in Europe, as well as fiscal cliff talks in the United States, helped boost risk appetite. Additionally, the Canadian dollar received some support from the news that the International Monetary Fund is thinking about adding the loonie to its list of reserve currencies. Earlier, the Canadian dollar showed strength on the latest news about a variety of subjects. … “Loonie Pulls Back after Earlier Gains”

USD/JPY: Trading the US jobless claims Nov 2012

US Unemployment Claims, a key indicator, is released weekly. It measures the number of people who filed for unemployment benefits for the first time. A reading which is higher than the market forecast is bearish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Wednesday at 13:30 GMT. Indicator … “USD/JPY: Trading the US jobless claims Nov 2012”