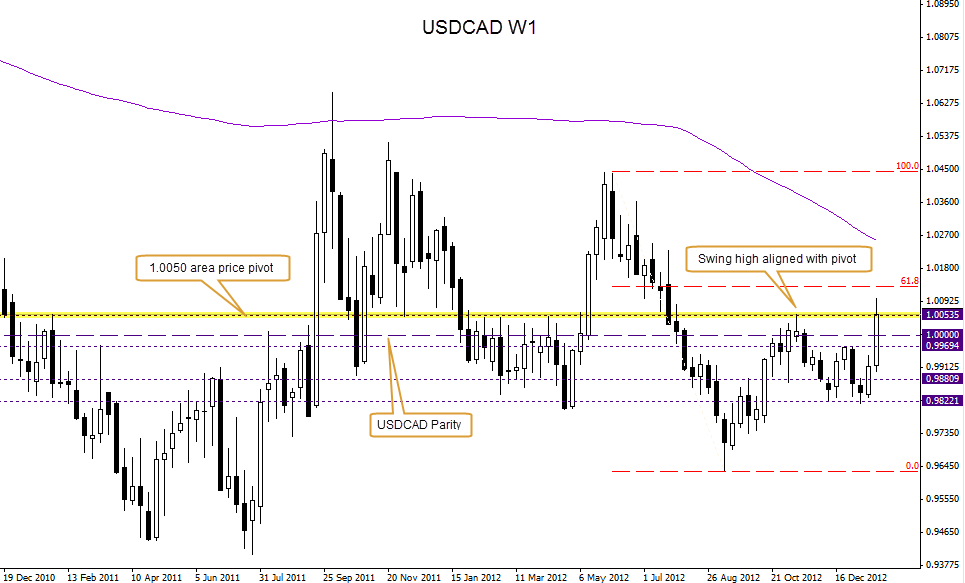

USDCAD rallied above the 200-day SMA (simple moving average) and previous swing high level around the 0.9970 – 0.9980 area on Wednesday – with a subsequent break above parity seen on Thursday.

Friday had the Loonie move as high as 1.0098 before retracing just shy of 61.8% of the daily range and back to the 1.0050 area for the weekly close.

Guest post by Nick Simpson of www.forex-fx-4x.com

1.0050 is aligned with a major price pivot area, as can be seen on the attached weekly time frame USDCAD chart. A close above this level would add weight to the Loonie upside scenario.

USDCAD ended the week with a 1.38% gain. The 196 pips covered represents 178% of the average weekly range over 20 weeks – a significant increase in volatility.

Any further corrective move lower once again brings the 1.000 parity level into focus as a potential support area.

Any news, opinion, analysis, price quote or any other information should be taken as general market commentary only and not as advice to trade on. Omissions and errors may occur