The British CPI (Consumer Price Index), which is released each quarter, is an inflation index which measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on … “GBP/USD: Trading the British CPI January 2013 outlook”

Month: January 2013

Bearish Triangle on US Dollar Index – Elliott Wave

One week ago, we discussed two possibilities regarding the US Dollar Index in wave (B) position: we mentioned a flat and a triangle pattern. It seems that the triangle appears to be the case now after seeing a three wave rise from 79 to the 80.90 level. Triangles are five wave patterns, so be aware of … “Bearish Triangle on US Dollar Index – Elliott Wave”

State of Currency Wars – January 2013

Various countries want to have weaker currencies in order to boost their exports. The term “currency wars” was already coined in 2010 by Brazil’s finance minister, but has intensified since then. An escalation in these currency wars was seen in December, and is likely to continue in January. * This article is part of the … “State of Currency Wars – January 2013”

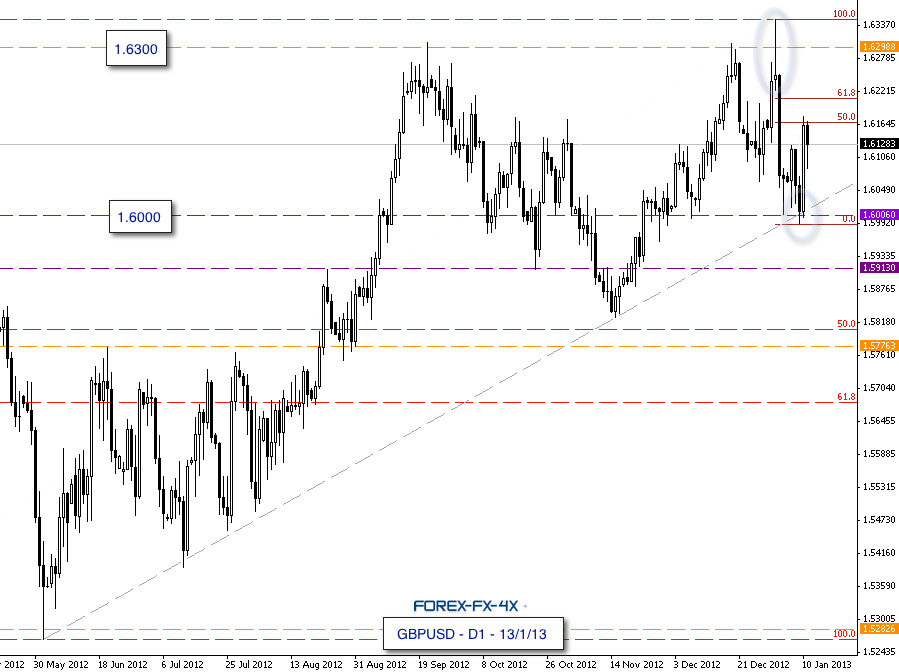

GBPUSD Had a Pinbar Reversal – Where Next?

Cable is currently trading in a loose range between the 1.6000 and 1.6300 areas, having recently tested a break below and above the respective levels. The break above 1.6300 (to 1.6347) brought a pinbar reversal which has subsequently seen price drop as low as 1.5990 on the 9/1/13. We note that the 1.6000 level has … “GBPUSD Had a Pinbar Reversal – Where Next?”

ECB Makes Week Good for Euro

This week was very good for the euro even though the beginning of the week did not suggest such an end. The European Central Bank boosted the shared 17-nation currency as it said about a recovery later this year. At the beginning of the week the market was digesting the news of the previous week, especially the hint that the Federal Reserve may end its quantitative easing program. The euro struggled amid uncertainty about the future Fed … “ECB Makes Week Good for Euro”

NZ Dollar Drops After Rally

The New Zealand dollar fell today even after China’s inflation grew more than expected, adding to the positive market sentiment. The currency dropped on speculations that the recent rally was overdone and as Asian stocks paused their advance. The National Bureau of Statistics of China reported that the Consumer Price Index grew 2.5 percent in December from the same time in the previous year, beating the analysts’ estimate of 2.3 percent growth. Usually, … “NZ Dollar Drops After Rally”

The Fed is likely to remain gold’s best friend

Recent announcements from the US Federal Reserve implying a possible end to very lose monetary policy has created upside resistance for the gold price. However, growing desperation among policy makers to bring about sustained economic recovery is likely to be supportive for the yellow metal. Last week the Fed’s FOMC minutes revealed that a number of its … “The Fed is likely to remain gold’s best friend”

Swiss Franc Drops vs. Euro as CPI Declines

The Swiss franc rose against the US dollar today, following the euro. The Swissie dropped against the shared European currency itself for the second day as Switzerland’s consumer prices fell last month more than was expected. The Consumer Price Index declined 0.2 percent in December from a month ago, while analysts have expected a 0.1 percent drop. The index was down 0.3 percent in November. The annual decline was 0.4 … “Swiss Franc Drops vs. Euro as CPI Declines”

Euro Gains Ground on Optimism in the Eurozone

Euro is still gaining ground against other majors today, heading higher as optimism remains from yesterday’s ECB announcement and Mario Draghi’s enthusiastic comments. Even though risk appetite is fading in some other markets (equities are struggling), the euro is heading a little bit higher. Yesterday, the European Central Bank announced that it is keeping interest rates steady for now. This was expected … “Euro Gains Ground on Optimism in the Eurozone”

Canadian Dollar Slips after Trade Report

Canadian dollar is slipping today after a rather spectacular performance yesterday. Focus has turned from the good economic data posted by China and the equity performance that followed, and turned to look at the economic data out of Canada. The latest trade deficit is weighing on the loonie today. Yesterday, risk appetite pushed the Canadian dollar higher. Expectations that China would help pull the global economy out of its funk helped … “Canadian Dollar Slips after Trade Report”