The three party coalition in Greece continues losing members. The smallest coalition partner, Democratic Left, has ousted two members over their position on the Lagarde List. This expulsion is only the last in a long series: The two other parties, New Democracy and PASOK didn’t need Democratic Left in order to form a coalition, but … “Greek Coalition Eroding – Lagarde List and Austerity Weigh”

Month: January 2013

Rand Drops vs. US Dollar After End of Holiday Season

The South African rand fell today after the holiday season ended as importers thought it is to good time to buy dollar after the local currency has rallied last month. The three-week holiday season has starter in December 17 and ended today. The rand was going down after importers returned to work and began buying dollar. The greenback itself was somewhat soft against most majors today following last … “Rand Drops vs. US Dollar After End of Holiday Season”

MarketsPulse Introduces Binary Options within MetaTrader 4

MarketsPulse, a provider of solutions for binary options, now allows brokers to offer binary options from within MetaTrader 4. MarketsPulse recently received the ISO-9001 Certification. For more on the new feature, here is the official press release: LONDON–MarketsPulse, the leading Binary Options enterprise solution provider, now gives brokers the option to diversify by adding binary options … “MarketsPulse Introduces Binary Options within MetaTrader 4”

Euro Looks to Eke Out Gains against the US Dollar

Euro is paring its earlier losses to the US dollar, and looking to try to find some gains as the US session gets solidly underway. Without economic data, though, many traders are simply still considering last week’s news out of the Federal Reserve. Last week, the Federal Reserve indicated that its quantitative easing efforts might be coming to an end by the end of 2013. The news gave the US dollar a jolt, … “Euro Looks to Eke Out Gains against the US Dollar”

Yen Heads Higher, Even After 12 Trillion Yen Extra Budget

Yen is heading higher today, thanks in large part to a combination of risk aversion and consolidation. After last week’s heady risk asset gains, many Forex traders are taking their profits, and re-positioning themselves for whatever comes next. The current state of affairs means that the yen is higher today, in spite of Japan’s latest budget announcement. The Japanese government just announced an extra budget of 12 trillion yen. Up … “Yen Heads Higher, Even After 12 Trillion Yen Extra Budget”

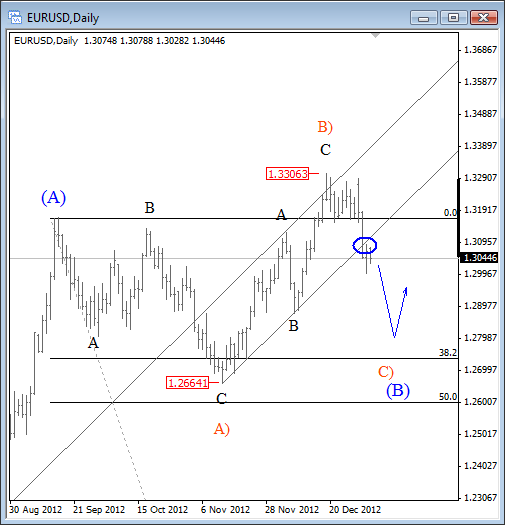

EURUSD Moved Beneath Channel Support Line – Elliott Wave

EURUSD made a deep and unexpected pull-back last week, falling slightly below trend-line connected from 1.2660 that indicates that temporary highs could be in place. As such, we would not be surprised to see even lower levels in the next few days or even weeks. However, keep in mind that this decline is still part … “EURUSD Moved Beneath Channel Support Line – Elliott Wave”

Januay 2013 Monthly Outlook Released

The Forex monthly outlook for January 2013 is available for subscribers of the Forex Crunch newsletter. The outlook is available both on the site and in PDF format.. To download it for free, just join the mailing list below. Welcome to January 2013 monthly report from Forex Crunch. December was not that quiet, thanks to the fiscal … “Januay 2013 Monthly Outlook Released”

Protected: Forex Monthly Outlook January 2013 – Web Version

1 2 3 4 5 6 7 8 9 10 11 12 13

Volatile First Trading Week of 2013

The first trading week of the new year was full of unpredictability and surprises. Traders have seen sharp rallies and fast drops and it it’s likely that quite a few of market participants experienced losses because of such volatility. The US dollar was also caught in the turmoil, emerging victorious against some currencies, but losing against others. At first, it looked like the year has begun on the positive note as the issue of the US … “Volatile First Trading Week of 2013”

AUD/USD Falls on Poor Services PMI in Australia & China, Rebounds

The Australian dollar fell against its US counterpart as the service industry performed poorly both in Australia and in China, adding to investors’ concerns. The currency rebounded later and closed with a small gain. The Aussie rose a little versus the euro and surged against the Japanese yen. China’s Services Purchasing Managers’ Index declined from 52.1 in November to 51.7 in December. The index still indicated growth, but the expansion was slowest since August 2011. … “AUD/USD Falls on Poor Services PMI in Australia & China, Rebounds”