The Canadian dollar advanced versus its US peer and jumped to the highest since 2010 against the Japanese yen on robust employment growth and the falling unemployment rate in Canada. The currency fell against the euro. Canada’s employment rose by 39,800 jobs in December from November. At the same time, the unemployment rate dropped 0.1 basis point to 7.1 percent. The positive data allowed economists to speculate that the Bank of Canada may raise borrowing costs … “CAD Gains vs. USD & JPY on Robust Employment Growth in Canada”

Month: January 2013

Euro Struggles Against the Greenback

Euro continues to struggle against the greenback today. After spending some time gaining against the US dollar, the euro is now down again. It’s been a bit of a see-saw today as Forex traders look for direction. Right now, a lot of the EUR/USD action is coming as a result of the dramatic drop in gold today. Gold and the euro often move together, with the euro gaining against the US dollar when gold prices rise. … “Euro Struggles Against the Greenback”

UK Pound Loses Ground on Economic Data, Risk Aversion

UK pound is losing ground today, heading lower on risk aversion, as well as on disappointing economic data. There is a bit of concern about what’s coming next for the global economy, led by the United States, and that is weighing on the sterling to some degree. UK pound is a little bit lower today, thanks to some disappointing news. First of all, the Services Sector PMI data for the United Kingdom came in below forecasts. … “UK Pound Loses Ground on Economic Data, Risk Aversion”

Italian elections could very well be an over-hyped event

Coinciding with the sequel of the fiscal cliff, Italy holds general elections. This is considered a risk event as Italy has a high debt-to-GDP ratio and is the euro-zone’s third-largest economy. Christopher Vecchio of DailyFX analyzes the elections in the context of the European debt crisis, and plays down the hype. Christopher Vecchio is a … “Italian elections could very well be an over-hyped event”

AUD/USD Hasn’t Rallied, But It’s Just Short of Record

The link between China and the Aussie hasn’t gone away: the decreased risk from China supports the Australian dollar, says David Rodriguez of DailyFX. In the interview below, Rodriguez discusses the the Aussie, the prolonging of the fiscal cliff saga, the situation around Greece and the very weak yen. David Rodriguez is a quantitative analyst … “AUD/USD Hasn’t Rallied, But It’s Just Short of Record”

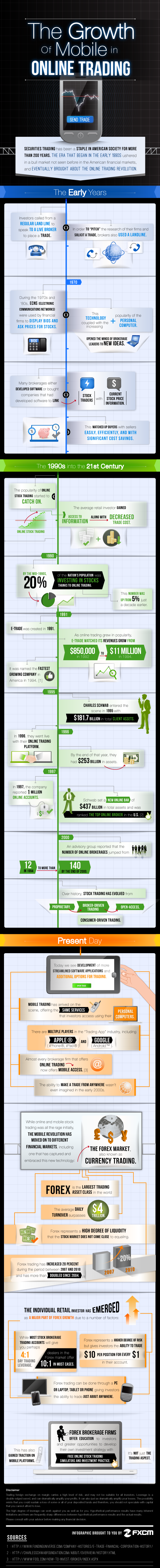

The growth of mobile in online trading – Infographic

Foreign exchange trading has evolved together with technology over the years, with the level of innovation staying high at all times. Technology also opened up forex trading to individuals in the retail market. Recent developments make it easier to trade from anywhere. The following infographic is a visual timeline that begins when digital trading first began … “The growth of mobile in online trading – Infographic”

Yuan Rises, Threatened by Uncertainty on FX Market

The Chinese yuan rose a little versus the US dollar today, but may yet slip back amid all the uncertainty that haunts the Forex market. The US employment data did little to direct trading. The yuan, as well as other Asian currencies, is not sure where to go as traders are uncertain about the well-being of the US economy. US non-farm payrolls came out at 155,000 for December, a little better than was … “Yuan Rises, Threatened by Uncertainty on FX Market”

Won Swings Between Gains and Losses

The South Korean won rose today, but slipped back later and currently is shifting between gains and losses as the traders’ mood was swinging back and forth between optimism and pessimism about the future of the US economy. The fiscal cliff problem in the United States was resolved, but now the issue with the debt ceiling came to light. Many traders were caught in a trap when riskier currencies rallied and then dropped down. … “Won Swings Between Gains and Losses”

EUR/USD: Trading the US Non-Farm Payrolls Jan 2013

US Non-Farm Employment Change measures the change in the number of employed people in the US, excluding workers in the farming industry. This indicator is released one day after the ADP Non-farm payrolls, which is an unofficial release. A reading which is higher than the market forecast is bullish for the dollar. Here are the … “EUR/USD: Trading the US Non-Farm Payrolls Jan 2013”

Swissie Falls vs. Dollar on Poor Swiss Fundamental Data

The Swiss franc extended its drop versus the US dollar for the fifth straight session today as the fundamental data from Switzerland was not favorable for the currency. The Swissie dropped against the Japanese yen yesterday, but turned up today. The Swiss currency also continued to rise against the euro. The KOF Economic Barometer fell from 1.50 in November to 1.28 in December, declining for the third month in a row. The report said: In comparison to previous months … “Swissie Falls vs. Dollar on Poor Swiss Fundamental Data”