US dollar is struggling today, particularly against the euro, as the US economy is compared with the eurozone economy. Disappointing economic news is weighing on the greenback. Expectations had been for modest growth in the fourth quarter of 2012. However, when the numbers were reported, US GDP was shown to have declined by 0.1 per cent in the last quarter of 2012. As a result, concerns about the US economy have been renewed. The US … “US Dollar Weakens on Disappointing Economic Data”

Month: January 2013

Weakness Continues for the Japanese Yen

Weakness continues for the Japanese yen, as the currency heads lower based on the expectation that future economic policy will continue to encourage weakness in the yen. With the election of Prime Minister Shinzo Abe, economic policy has been changing dramatically. The Bank of Japan will begin buying 13 trillion yen in long-term securities each month. Additionally, Abe effectively ended the BOJ’s independence, putting monetary policy in the hands of the Council on Economic and Fiscal … “Weakness Continues for the Japanese Yen”

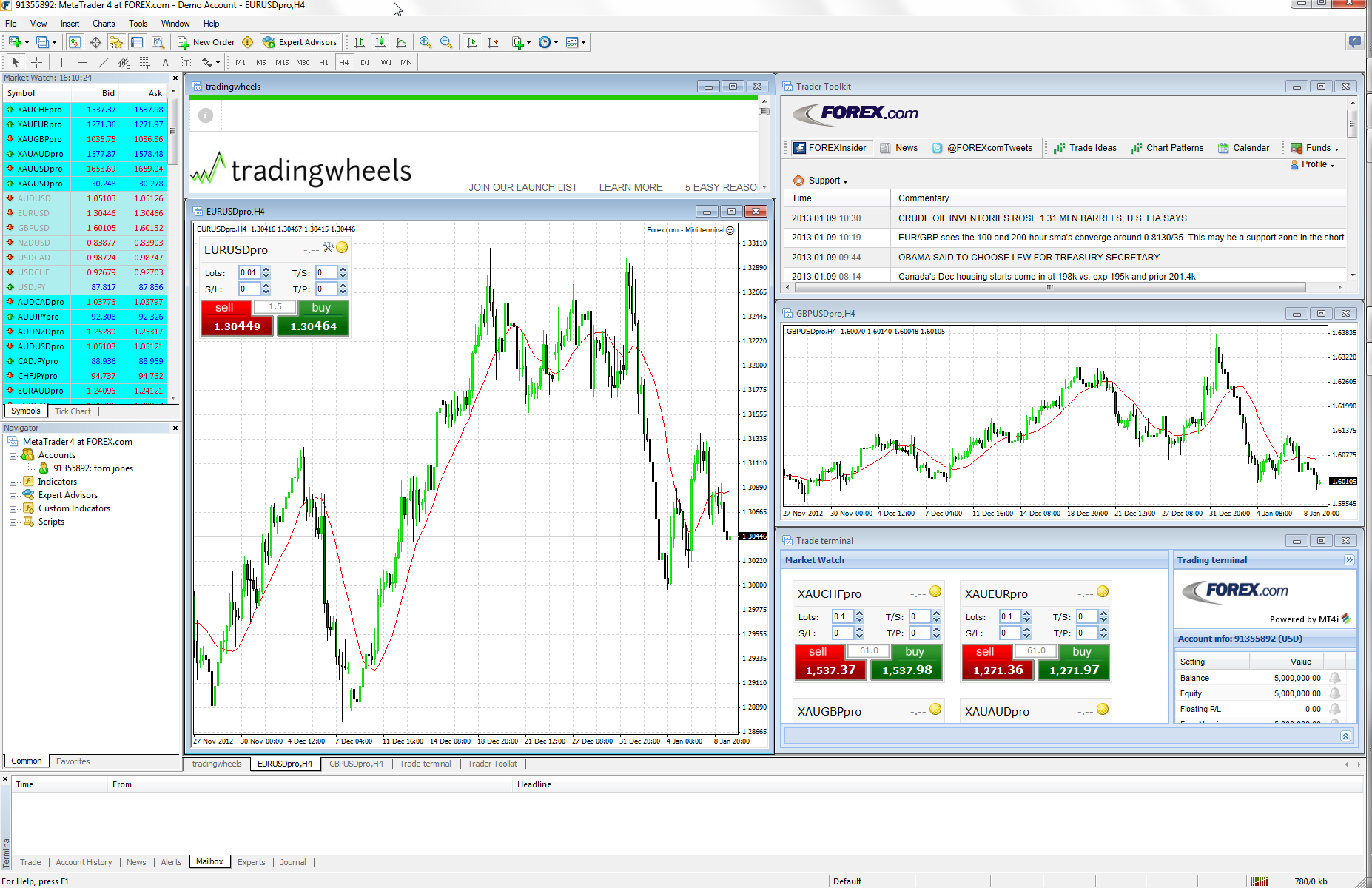

tradingwheels Launches – Bridges the Gap Between Demo and

TradingWheels is a highly innovative product from Matthew Carstens. The software bridges the gap between demo accounts and real accounts. Demo trading has its advantages, but Carstens explains here very nicely 3 Reasons Why Demo Trading is Killing You. The product enable new traders to gradually enlarge their exposure to real trades, building their confidence. Here is … “tradingwheels Launches – Bridges the Gap Between Demo and”

RBI Attempts to Bolster Economy, Rupee Gains

The Indian rupee advanced today on hopes for increasing foreign capital inflows as the nation’s central bank is attempting to bolster the country’s economic growth. The Reserve Bank of India cut its key interest rate from 8 percent to 7.75 percent yesterday. The bank said in the statement that inflation had likely peaked and would be range-bound in the future. That allows India’s central bank to take additional stimulating measures. For now, the country’s … “RBI Attempts to Bolster Economy, Rupee Gains”

EUR Highest Since 2010 vs. JPY as Economic Confidence Improves

The euro rose today, reaching the highest level since November 2011 against the US dollar and the highest since April 2010 versus the Japanese yen, after a report showed improvement of the European economic confidence. The European Commission reported that the Economic Sentiment Indicator for the eurozone rose from 87.8 in December to 89.2 in January. The actual value beat the forecast 88.2. The index advanced for the third straight month, but remained well below the long-term … “EUR Highest Since 2010 vs. JPY as Economic Confidence Improves”

USD/CAD: Trading the Canadian GDP Jan 2013

The Gross Domestic Product (GDP) is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and its release is always eagerly anticipated by the markets. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the … “USD/CAD: Trading the Canadian GDP Jan 2013”

Loonie Rises for Second Day

The Canadian dollar rose today for the second trading session after the huge drop against the US dollar and the euro that has started in the middle of this month. The bounce was supported by favorable fundamentals, including rising stocks and commodities. Analysts said that CAD rebounded after reaching some key technical levels. Crude oil advanced as much as 1 percent to $97.39 per barrel in New York. The Standard & Poorâs 500 … “Loonie Rises for Second Day”

EUR/USD Reaches Highest Rate Since 2011

The euro rose today, erasing its previous losses versus the Japanese yen and touching the highest level since December 2011 against the US dollar, as the sentiment of German consumers was stable this month. The currency fell against the Great Britain pound. The GfK German Consumer Climate remained almost unchanged at 5.8 in January amid optimism of German consumers. The positive data added to last week’s favorable German ZEW Economic Sentiment, … “EUR/USD Reaches Highest Rate Since 2011”

Higher US yields – Not only QE related – Could

Benchmark US 10 year bond yields recently touched the 2% mark. This round number is the highest since April 2012. The move has been attributed to the growing chances that the Fed’s quantitative easing could be unwound at the end of the year. Those chances remain low. Other forces are also in play. If higher … “Higher US yields – Not only QE related – Could”

EUR/USD: Topside break coming sooner than later

Well the Euro zone crisis is far from over as well all know, but you can’t beat a bit of positive sentiment and the Euro has caught a bid tone in the last week as further position unwinding (of long CHF and JPY i.e safe havens and to a lesser extent £) allied to early … “EUR/USD: Topside break coming sooner than later”