The Australian dollar was little changed today as the trading session was quiet while US markets were closed for a holiday. The currency was soft against the Japanese yen, which was especially strong today. The Aussie held its ground today, but may fall later as traders anticipated bad fundamental data. Tomorrow’s report is expected to show slowdown of inflation from 1.4 percent in the third quarter of 2012 to 0.4 … “Australian Dollar Flat, Decline is Possible”

Month: January 2013

What Would the Euro Look Like without Angela Merkel?

Many recognize that German Chancellor Angela Merkel has been a strong leader for the eurozone, and key to many of the negotiations related to keeping the euro together during the recent sovereign debt crisis. So, what would happen if Merkel was no longer the German Chancellor? While Angela Merkel is fairly popular in general, her ruling coalition might not be. This past weekend, her coalition suffered a defeat … “What Would the Euro Look Like without Angela Merkel?”

US Dollar Mostly Lower in Rangebound Trading

US dollar is mostly lower today as rangebound trading is the norm. With US markets closed for a holiday, volume is rather low, and currencies are trading rangebound in the FX market. Even though the US dollar is mostly lower, and the dollar index is lower today, there isn’t much action. Greenback is lower, but not by much. Most of the major currency pairs are rangebound as US markets … “US Dollar Mostly Lower in Rangebound Trading”

Yen Advances as BoJ Starts Meeting

The Japanese yen advanced against other majors today even as the Bank of Japan has started its two-day policy meeting, which is likely to result in additional monetary easing. The BoJ will likely yield to the demands of the new government that wants more aggressive actions for supporting the economy and weakening the currency. The yen did not pay heed to the expectations of quantitative easing, which usually is negative for currencies. Perhaps it is … “Yen Advances as BoJ Starts Meeting”

GBP/USD Rises from Lowest Since November, GBP/JPY Drops

The Great Britain pound rose against the US dollar today for the first time in seven sessions as house prices advanced this month. The currency extended its drop versus the Japanese yen for the second day. The Rightmove House Price Index increased 0.2 percent in January following the 3.3 percent drop in December. The report said that confidence of market participants improved. That allowed the sterling to rise from the lowest level since November … “GBP/USD Rises from Lowest Since November, GBP/JPY Drops”

New Zealand Dollar – Weaker Economy Limits Gains

During December, the kiwi reached levels last seen in 2011, but was unable to sustain them. NZD/JPY is the currency pair of the year. On one hand, a relatively hawkish statement by the RBNZ pushed the pair higher, but a weak GDP figure and a big current account deficit kept the pair from rising. During … “New Zealand Dollar – Weaker Economy Limits Gains”

EUR/USD: Trading the German ZEW Jan 2013

The German ZEW Economic Sentiment Index is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the Euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 10:00 GMT. … “EUR/USD: Trading the German ZEW Jan 2013”

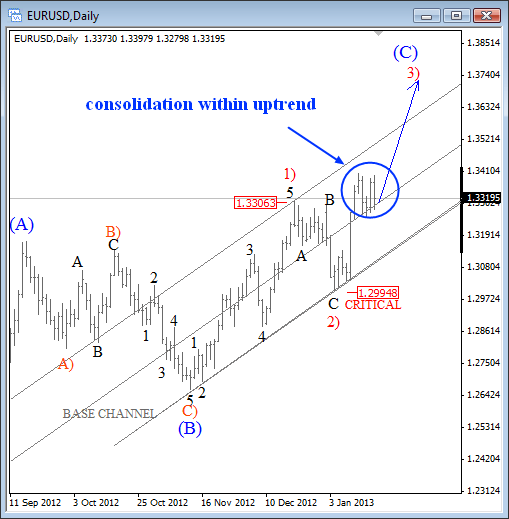

EURUSD: 1.3200-1.3400 Consolidation (Elliott Wave Analysis)

EURUSD bounced sharply from the 1.3000 psychological level at the start of January which was most-likely the low of a red wave 2). Notice that bounce from 1.3 is very strong and this typically represents a third wave of a five wave Elliott Wave model. EURUSD Elliott Wave Analysis – Click image to enlarge As … “EURUSD: 1.3200-1.3400 Consolidation (Elliott Wave Analysis)”

Another Bad Week for Yen Ahead of Policy Decision

The Japanese yen continued its downfall this week as most market participants are certain that the Bank of Japan will ease its monetary policy further next week. The short bounce of the currency did not help it very much, though the yen managed to outperform the pound. The Japanese government wants weaker yen and it looks like the BoJ is going to do everything possible to achieve that goal. For a brief … “Another Bad Week for Yen Ahead of Policy Decision”

Pound Drops as Retail Sales Confirm Weakness of UK Economy

The Great Britain pound after the data showed that retail sales dropped last month, unpleasantly surprising market analysts and confirming the weakness of Britain’s economy. The currency fell to the lowest closing price since March. Retail sales fell 0.1 percent in December after showing no growth in the month before. Experts have hoped for an increase of 0.2 percent. Year-on-year, sale grew 0.3 percent. That was almost the worst December … “Pound Drops as Retail Sales Confirm Weakness of UK Economy”