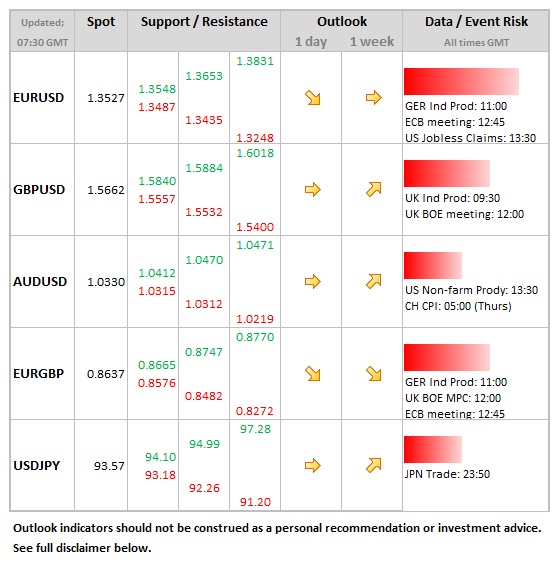

Data/Event Risks

Data/Event Risks

- USD: Plenty of labour market news to contemplate today, with unit labour costs and jobless claims out at 13:30, followed by consumer credit at 20:00.

- GBP: Ahead of the latest MPC decision (no change expected either in the size of the asset purchases program or the base rate), industrial production is released at 09:30. There is some potential for a positive surprise after real weakness in recent months which would be supportive for sterling. Eyes are on incoming Bank of England Governor (Carney) as he appears before the UK Treasury select committee in Parliament.

- EUR: Expect the currency to be a greater focus at the ECB press conference today, especially after comments from French PM Hollande this week alluding to some sort of target for the euro. Markets comfortably dismissed these.

Idea of the Day

The rise in the euro since the last ECB meeting (3.5% in trade-weighted terms) is the largest seen between policy meetings for 27 months. From one angle, this should not matter that much. The Eurozone is what’s known as a relatively closed economy (less reliant on external trade compared to Switzerland for example), so the economic impact is not as great as for others. But the political impact is different. Some nations pride themselves on a strong currency, but with the Eurozone as a whole still likely to be in recession for most of this year, it’s not a welcome development. This is why we’ve heard more talk on the currency from officials this week. A few years ago, when this got somewhat frenzied amongst central bank heads, there was an unwritten (but widely understood) rule that on the head of the ECB (Trichet) would be the only one to mention the currency. We’re not at that stage yet, but this will be the first time Draghi is really pushed, so it will be notable to see what stance he takes.

More: ECB Preview – Will Draghi drag the euro down?

Latest FX News

- JPY:. The yen is taking a breather, which perhaps is not such a bad thing after the recent volatility. USDJPY nudged above the 94.00 level yesterday, but there was little appetite to follow through. More consolidative activity looks likely below this level.

- EUR: There was mention yesterday that the euro was on the defensive on fears of the return of the former PM Berlusconi, but the weaker tone was also down to the fact that the euro does remain vulnerable after the recent strong run higher.

- GBP: Currently struggling to pick itself up from the floor against the dollar, holding close to the 1.5650 area. There’s a similar picture against the euro.

- AUD:. AUDUSD finding some buyers at the bottom end of the broad 1.03 to 1.06 range that has held for 3 months now. Some relief with the labour market numbers, which recovered from the weakness seen last month. Employment was up 10.4k, with the unemployment rate steady at 5.4%.

Further reading: Shadow of Spain and Italy looms over the Euro zone