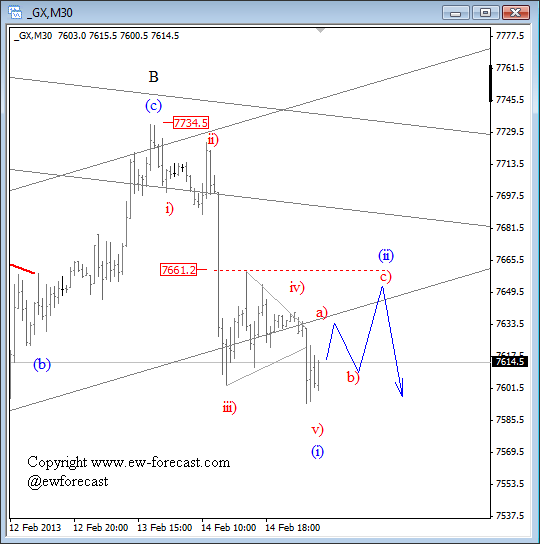

The German DAX index is in down-trend during this week, the same as EUR/USD from the Feb 13 high. Also, both markets reached new lows this morning at the same time, so we can say that correlation between these two is very tight. This tells us that for the near-term predictions on EURUSD we should focus on the DAX more often and not so much on the US stock market which is still in an uptrend. OK, now let’s go and see the DAX intraday structure.

We can count five waves down from 7734, with a triangle in wave iv). That’s very important. Why? Because triangles occur prior to the final move of the larger pattern, so our wave v) should then be last leg in wave (i).

The interesting part is that we know that after every five waves correction follows, and this is what we expect on DAX; 3-wave retracement in wave (ii) ideally back to 7650/70.

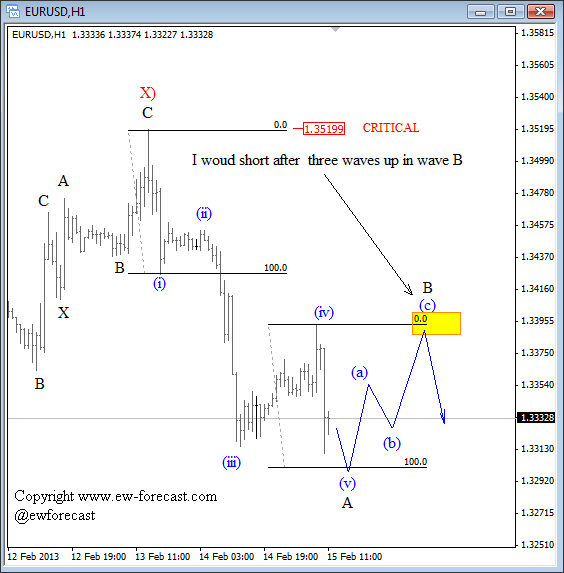

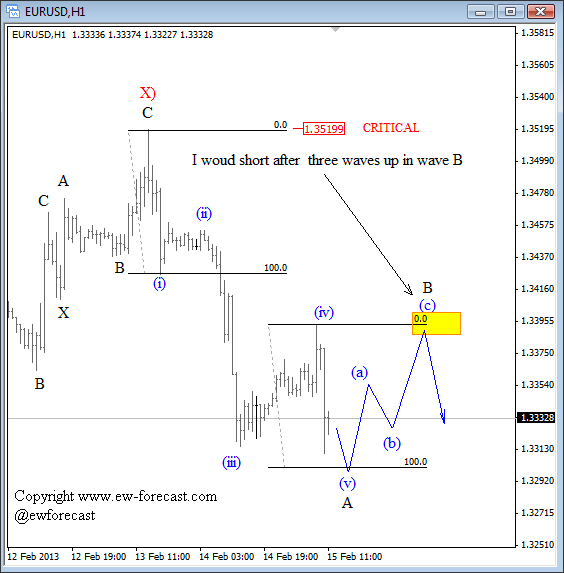

So, if correlation between the DAX and EURUSD will remain tight, then a bounce on EURUSD would also not be a surprise. A three wave retracement in wave B back to 1.3400 should be interesting for a short position…if we get a pull-back.

Traders, I hope this analysis makes sense. Have a good weekend.

Grega

Visit our website and Get more charts and forecasts with free access through 7-Day Trial Offer.

You can also follow us on twitter @ewforecast