The Great Britain pound extended its rally versus the US dollar for the second day today, but erased yesterday’s gains against the Japanese yen. Yesterday, the Bank of England released its monetary policy statement, showing that the policy remained unchanged. The BoE left the main interest rate at 0.5 percent and the asset purchase program at £375 billion. Mark Carney, the current Bank of Canada Governor and the next head of BoE, testified to the parliament … “GBP/USD Rallies for Second Day, GBP/JPY Erases Gains”

Month: February 2013

FXStreet Awards 2013: Forex Crunch Nominated in Two Categories

Forex Crunch is proud to announce that it has been nominated in the Best Fundamental Analysis category and in the Best Buy-Side Analysis Contributor category. You are welcome to participate and vote for Forex Crunch in the survey right here. One vote is allowed per person, and if there is a category where you don’t … “FXStreet Awards 2013: Forex Crunch Nominated in Two Categories”

Euro Lower after Mario Draghi’s Comments

Euro is lower today, and Mario Draghi’s comments aren’t helping. A combination of concern about the eurozone and general risk aversion is leading to losses for the 17-nation currency. Today, the ECB Governing Council announced that it would keep the eurozone’s benchmark rate at 0.75 per cent. This news was largely expected, and many were more interested in ECB President Mario Draghi‘s assessment of the economic situation. Draghi pointed out … “Euro Lower after Mario Draghi’s Comments”

Loonie Struggles on Latest Permits Data Release

Canadian dollar is struggling today, engaging in rangebound trading against other majors in spite of the general volatility being seen elsewhere in the currency market. The latest building permits numbers are weighing on the loonie, indicating that the economy might be struggling. Loonie is trapped in narrow trading today, particularly against the US dollar. The latest difficulty for the Canadian dollar is that building permits issued in December fell. The value of building … “Loonie Struggles on Latest Permits Data Release”

Is NZ Dollar Attractive After Employment Declines?

The New Zealand dollar weakened today as New Zealand employment unexpectedly fell last quarter even though the unemployment rate significantly dropped. But that does not necessary mean that the currency has lost its attractiveness. Employment fell 1 percent in the fourth quarter of 2012, while an increase by 0.4 percent was expected. At the same time, the unemployment rate fell 0.4 percentage point to 6.9 percent. Traders paid … “Is NZ Dollar Attractive After Employment Declines?”

Aussie Picks Up as Employment Data Unexpectedly Good

The Australian dollar picked up today, erasing its previous losses, after the employment data came out better than expected, easing concern about economic slowdown in Australia. Australian employers added 10,400 jobs in January from December, when employment fell by 3,800. Much smaller growth by 5,800 was expected by specialists. On top of that, the unemployment rate stayed at 5.4 percent even though it was expected to tick … “Aussie Picks Up as Employment Data Unexpectedly Good”

ForexTime Launches – Backed by Andrey Dashin

Alpari co-founder and shareholder Andrey Dashin launches a new forex brokerage called ForexTime. The new broker is regulated in Cyprus and is managed by CEO Olga Rybalkina. For more on the new broker, here is the official press release. New forex broker ForexTime Ltd (FXTM) today announces the official start of its operations with the activation … “ForexTime Launches – Backed by Andrey Dashin”

US Debt: Can kicking is seen as positive, but the

Towards the “sequester” deadline and the following debt ceiling hurdle, markets seem to have become more immune and expect a “positive outcome”: another delay of long term solutions. However, the can just gets bigger, says Simon Smith of FxPro. In the interview below, Smith also discusses what the ECB could do or not do about … “US Debt: Can kicking is seen as positive, but the”

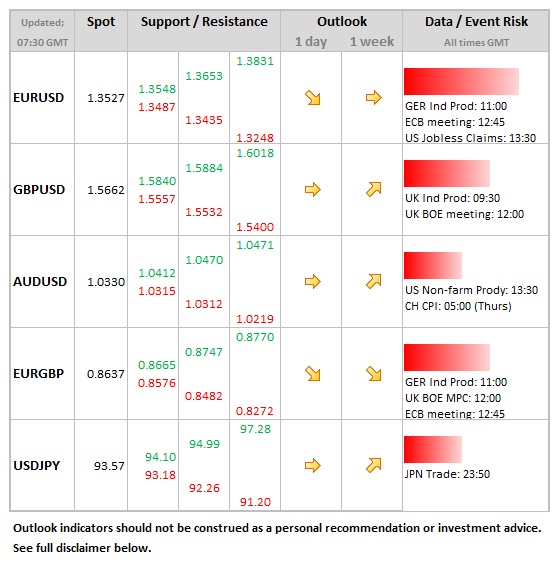

Eyes and Ears on the ECB

Data/Event Risks USD: Plenty of labour market news to contemplate today, with unit labour costs and jobless claims out at 13:30, followed by consumer credit at 20:00. GBP: Ahead of the latest MPC decision (no change expected either in the size of the asset purchases program or the base rate), industrial production is released at … “Eyes and Ears on the ECB”

USD/CAD: Trading the Canadian Jobs Feb 2013

Canadian Employment Change is an important leading indicator which has a significant impact on the markets. Traders and analysts carefully scrutinize employment figures, and a reading which is higher than forecast is bullish for the Canadian dollar. Here are the details and 5 possible outcomes for USD/CAD. Published on Friday at 13:30 GMT. Indicator Background Job creation … “USD/CAD: Trading the Canadian Jobs Feb 2013”