The US dollar gained somewhat against most major currencies last week as risk aversion returned to the Forex market. What traders can expect from the greenback this week and what the major driving factors for the US currency will be? The Federal Reserve was responsible for the last week’s rally as its minutes made traders believe that the central bank may remove stimulus early. Fed Chairman Ben Bernanke will … “Major Events for USD During This Week”

Month: February 2013

Falling Chinese PMI Leads to Drop of Aussie

The Australian dollar dropped today as the manufacturing data from China, Australia’s major trading partner, disappointed market participants, showing unexpected slowdown of sector’s growth. The HSBC Flash China Manufacturing Purchasing Manager’s Index unexpectedly fell from 52.3 in January to 50.4 in February. Analysts have predicted it to stay little changed. Most traders thought that China’s economic growth had bottomed out and now stabilized, making the unexpected … “Falling Chinese PMI Leads to Drop of Aussie”

Rand Rebounds on Speculations Losses Were Overdone

The South African rand rose today, erasing previous decline and touching the highest level in more than a week, on speculations that the recent losses of the currency, which was the worst performer among the currencies of emerging economies, were excessive. Three credit-rating downgrades and persistent labor unrest drove away investors from South Africa and reduced the appeal of the nation’s assets. This resulted in the 3.7 percent loss for the rand this year. Yet specialists … “Rand Rebounds on Speculations Losses Were Overdone”

UK Pound Drops vs. Euro on Credit Downgrade

UK pound saw a bit of a drop today in response to the recent downgrade for Britain’s credit rating. however, the loss of its triple-A rating hasn’t weighed too heavily on the pound, even though it has had an effect. On Friday, Moody’s downgraded Britain’s credit rating from Aaa to Aa1. The downgrade came after the United Kingdom had outlasted the United States and France, both of which have already lost their triple-A ratings. … “UK Pound Drops vs. Euro on Credit Downgrade”

Euro Gains Ground on Optimism

Euro is higher today, thanks in large part to optimism about the eurozone and risk appetite in general. Some of the euro’s gains are being limited, but the overall mood is one of hope that the eurozone can move forward. Earlier, an Italian bond auction produced good results, supporting the euro. The strong demand for Italian debt is one of the indications that the eurozone might be on the way to recovery. Even though there … “Euro Gains Ground on Optimism”

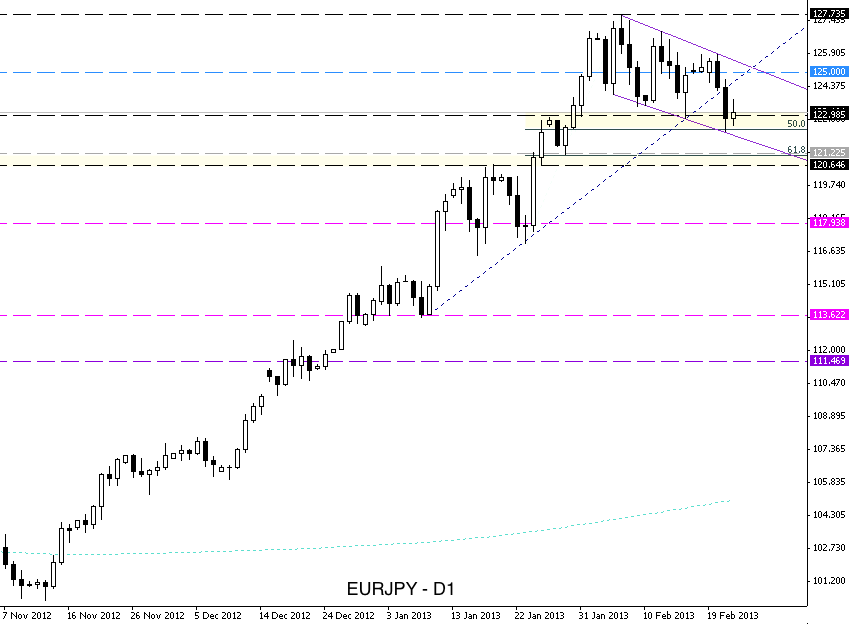

EURJPY Technical Update Feb. 25 – Mar. 1

The EURJPY pair has seen a decline and test of the descending channel lows, which coincide with the 50% corrective retrace level, as seen on the attached D1 chart. EUR/JPY weekly analysis Click image to enlarge Friday has seen an inside day candle form, with a marginally higher close, after two consecutive daily basis moves … “EURJPY Technical Update Feb. 25 – Mar. 1”

AUD/USD: Trading the Chinese Flash PMI Feb 2013

Chinese Flash Manufacturing PMI is based on a survey of purchasing managers in the manufacturing sector. This indicator is a key release, and should be treated as a possible market-mover. A reading which is better than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. … “AUD/USD: Trading the Chinese Flash PMI Feb 2013”

Fed’s Minutes Boost USD, Do Not Prevent Weekly Loss vs. JPY & AUD

This week’s minutes of the last Federal Reserve’s meeting spurred risk aversion on the Forex market, driving the US dollar upward. Yet some currencies held ground against the greenback quite well, most notably the Japanese yen and the Australian dollar. The beginning of the week did not foretell anything special for dollar and the currency was slowly going down as the positive market sentiment was eroding the appeal of the greenback. The Fed’s minutes were not … “Fed’s Minutes Boost USD, Do Not Prevent Weekly Loss vs. JPY & AUD”

Stevens’ Comments Lead to Surge of Australian Dollar

The Australian dollar jumped and closed with a big gain yesterday after the central bank’s head signaled that he may pause interest rate cuts and said that he is not going to target a particular level of the exchange rate. Reserve Bank of Australia Governor Glenn Stevens was speaking to the House of Representatives Standing Committee on Economics yesterday. He mentioned impact of the strong currency on inflation: The high exchange rate has … “Stevens’ Comments Lead to Surge of Australian Dollar”

CAD Falls on Declining Retail Sales & Slowing Inflation

The Canadian dollar dropped, touching the lowest since June against its US counterpart, today as retail sales dipped in December and annual inflation was slowest in three years. The currency managed to trade sideways versus the Japanese yen, which was weakened by prospects of intervention. The Consumer Price Index rose 0.5 percent in January from a year ago after rising 0.8 percent in December. This was the smallest gain since October … “CAD Falls on Declining Retail Sales & Slowing Inflation”