The Brazilian real dropped as worries about the global growth reduced chances that the nation’s central bank will perform an interest rate hike. Analysts estimated that the Brazilian economy grew just 1 percent in the last year. The Central Bank of Brazil slashed interest rates to the record low of 7.25 percent to stimulate growth. The bank is not likely to change the policy as macroeconomic indicators from various countries across the world, including … “Brazilian Real Suffer from Worries About Global Growth”

Month: February 2013

US Dollar Index Hits Three-Month High on Risk Aversion

The US dollar index reached a three-month high during the session today, thanks in large part to risk aversion. However, the latest minutes from the recent Federal Reserve meeting are also helping the greenback. Risk aversion is one of the stories today, thanks in large part to the latest economic data out of the eurozone. Also not helping the risk situation is the fact that unemployment claims in the United States rose again. With … “US Dollar Index Hits Three-Month High on Risk Aversion”

Risk Aversion Causes Decline of Stocks & Commodities, Aussie Follows

The Australian dollar fell against the Japanese yen and touched the lowest level since October versus the US dollar today as Asian stocks declined. The Aussie rebounded versus the greenback but stayed weak against the Japanese currency. The MSCI Asia Pacific Index of equities dropped as much 1.6 percent. The Standard & Poorâs GSCI Spot Index of commodities fell 1.1 percent, reducing the appeal of commodity currencies, including AUD. The Forex market … “Risk Aversion Causes Decline of Stocks & Commodities, Aussie Follows”

Euro Drops as Recession Fears Resurface

Euro is heading lower today, dropping on worries that the eurozone recession might not be coming to an end. Thanks to the latest manufacturing survey, concerns about the economic state of the 17-nation currency region are on the rise. It’s not helping that uncertainty is emerging in other areas as well. Even though many of the fears regarding the eurozone have been assuaged with the idea that the worst is over, there are … “Euro Drops as Recession Fears Resurface”

EUR/USD: Trading the German IFO Feb 2013

The German Ifo Business Climate is a monthly composite index of about 7,000 businesses, which are surveyed about current business conditions and their expectations concerning economic performance over the next six months. A reading which is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the German IFO Feb 2013”

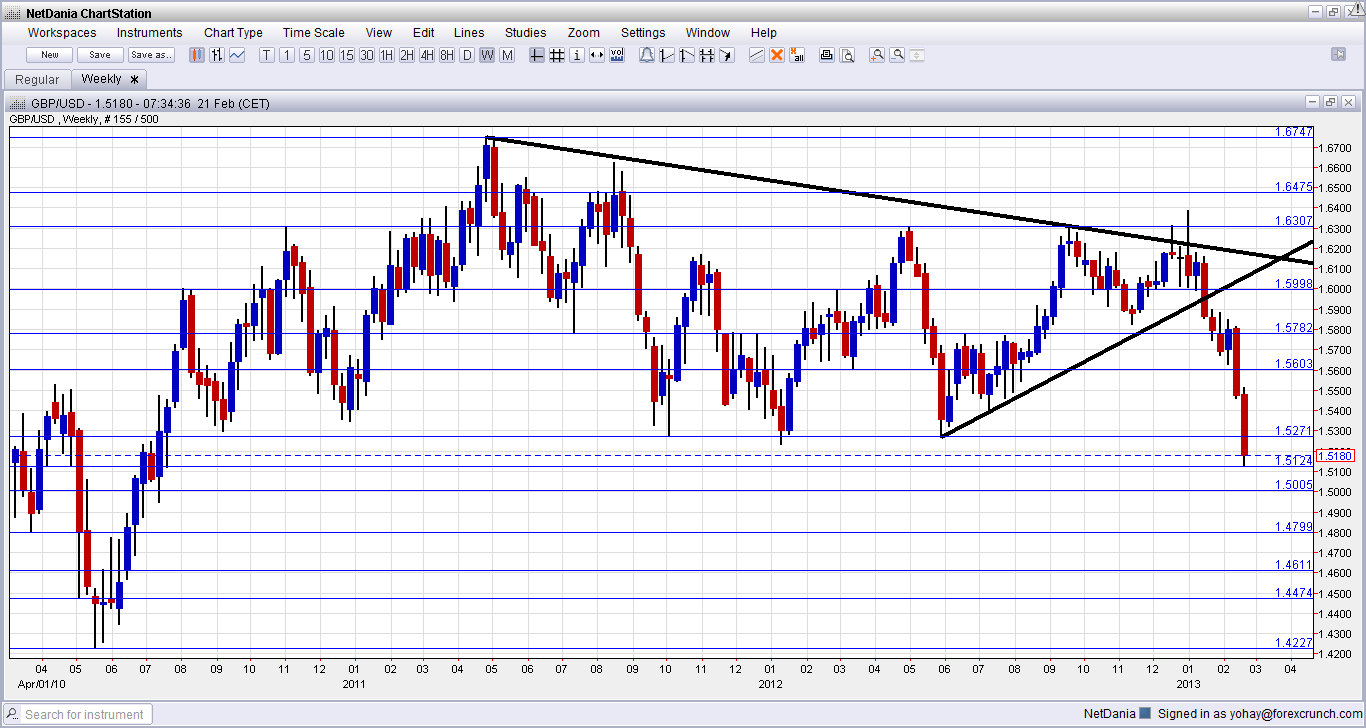

GBP/USD Collapse – Guide to the next big levels

The collapse of GBP/USD started with the dovish meeting minutes of the MPC, and turned into an avalanche, with an extra push of a dollar-loving market following the minutes of the Federal Reserve on the other side of the Atlantic. The fall eventually led it to levels last seen in July 2010 – lows of … “GBP/USD Collapse – Guide to the next big levels”

Pound Maintains Losses After BoE Minutes

The Great Britain pound dropped after yesterday’s release of the Bank of England’s minutes and extended the decline today. The minutes suggested that some policy makers want more monetary stimulus. Governor Mervyn King and Paul Fisher joined David Miles in voting in favor of increasing the asset purchase program by £25 billion to £400 billion. Other members of the Monetary Policy Committee outvoted them though. Still, the growing number of central bankers preferring … “Pound Maintains Losses After BoE Minutes”

Economic Concerns Continue to Weigh on Loonie

Canadian dollar is at its lowest level in nearly seven months against the US dollar as economic concerns continue to weigh. Oil prices are fluctuating and it looks as though retail sales will show a decline when the data is released on Friday. Retail sales data is expected to be released on Friday the 22, and there are concerns that the report will show a decline. This is not the only problem … “Economic Concerns Continue to Weigh on Loonie”

US Dollar Gains Ground

US dollar is gaining ground today as a mixture of economic data and risk aversion send Forex traders toward the the greenback. Concerns about what will happen if Silvio Berlusconi in Italy, as well as a dramatic drop by gold, are also contributing to a stronger dollar. With PPI on the rise in the United States, the greenback is finding some support, thanks to concerns about inflation. However, there is greater focus on the items contributing … “US Dollar Gains Ground”

USD/JPY Likely to trade in 92-96 range in a much

The G-20 statement did not single out Japan, but we cannot expect more significant weakening, as the yen has already weakened in a magnitude seen only once in 5 years or so, says Simon Smith of FxPro. In the interview below, Smith also discusses the state of the US consumer, the impact of the European … “USD/JPY Likely to trade in 92-96 range in a much”