The Great Britain pound closed stronger, erasing the previous losses, on the last trading session of this week. The losses were caused by the report that showed decline of retail sales last month. Retail sales dipped 0.6 percent in January from a year ago on a seasonally adjusted basis, putting a halt to the year-on-year growth seen in the retail sector since August 2011. Analysts have hoped for 0.5 percent growth. The data added to signs … “Retail Sales Put Pressure on Sterling But Currency Resists”

Month: February 2013

Yen Falls as G20 Meeting Starts

The Japanese yen slipped today against other major currencies amid rumors that Japan will not be blamed for currency manipulation on the Group of Twenty meeting. The two-day G20 meeting of finance ministers and central bankers started today in Moscow. There were speculations that currency wars would be the main theme of the meeting. Yet now there are indications that politicians are not going to point at specific countries … “Yen Falls as G20 Meeting Starts”

Swedish Exporters Complain About Strenght of Krona

The Swedish krona fell today as exporters, who are already strained by the financial problems of the European Union, complained about the strength of the currency. Exporting companies said that the strong exchange rate diminish their earnings. Usually such comments are followed by efforts of policy makers to weaken a currency, but it may be not the case with the krona. Finance Minister Anders Borg explained that businesses should get used … “Swedish Exporters Complain About Strenght of Krona”

Canadian Economic Concerns Sends Loonie Lower

Once again, the economy is back in the spotlight for Canada. Worries about the Canadian economy have been increasing recently, and the latest manufacturing sales data isn’t helping matters. With the latest plunge, the loonie is heading lower against its counterparts. December 2012 manufacturing sales dropped by 3.1 per cent. This was a big surprise, since many analysts had expected that the drop would be limited to 0.8 … “Canadian Economic Concerns Sends Loonie Lower”

US Dollar Index Edges Higher on Improving Data

US dollar index is edging higher today, gaining ground on improved economic data. However, even with the earlier gains, against individual majors the greenback is mixed. Risk appetite is trying to push through, and forex traders are considering higher yielding currencies. Optimistic comments from Federal Reserve Chair Ben Bernanke have helped spur a little hope for the US economy. On top of that, consumer sentiment … “US Dollar Index Edges Higher on Improving Data”

G-20 Allows For Currency Wars: 4 Winners & 4 Losers

The G-20 statement was a compromise on a global level. Not only did the statement refrain from mentioning Japan and spark a USD/JPY rally, but it also allowed for wider currency wars. The 8 important currencies are now split between those who participate in the currency wars and will see their currencies weakening, and those … “G-20 Allows For Currency Wars: 4 Winners & 4 Losers”

Peso Down After Chilean Central Bank Maintains Interest Rates

The Chilean peso retreated today after the central bank left interest rates unchanged on its yesterday’s meeting as inflation was not high enough to prompt an interest rate hike. The Central Bank of Chile left its key interest rate at 5 percent. That bank said in the statement that global “financial conditions are stable” and domestically “recent output and demand indicators exceeded forecasts”. Yet the bank felt no need … “Peso Down After Chilean Central Bank Maintains Interest Rates”

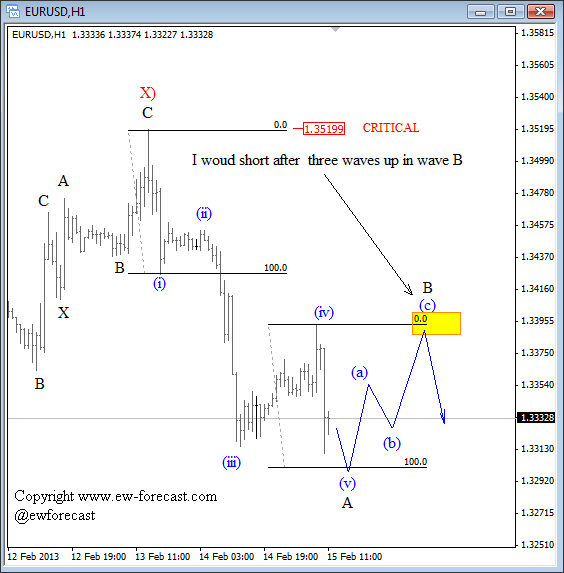

German DAX pointing to a weaker EURUSD – Elliott Wave

The German DAX index is in down-trend during this week, the same as EUR/USD from the Feb 13 high. Also, both markets reached new lows this morning at the same time, so we can say that correlation between these two is very tight. This tells us that for the near-term predictions on EURUSD we should focus … “German DAX pointing to a weaker EURUSD – Elliott Wave”

Japan’s open ended bond buys – key to next battle

Current G-20 negotiations will likely curb some of the immediate concern regarding competitive currency devaluation. However, if Japan brings forward the plan for open ended purchases from 2014, we may see an escalation in currency wars, says John Kicklighter of DailyFX. In the interview below, Kicklighter also discusses the risk in the Italian elections, the impact of … “Japan’s open ended bond buys – key to next battle”

RORO is not dead, it’s just resting

RORO is an abbreviation for Risk On / Risk Off. This has been the mode that characterized trading in the past few years after the crisis. In this mode, there was a high correlation between various assets: good news concerning the global economy (US data, euro crisis news, Chinese indicators, etc.) triggered a rise in … “RORO is not dead, it’s just resting”