This Wednesday, March 20th the FOMC will make their statement at 2 PM EST. This is the second FOMC meeting this calendar year and the big question is what will they say?

From a monthly point of view, it is one of the most anticipated reports over the course of a month.

It isn’t so much that anyone is concerned about the Fed raising rates as no one at this point anticipates an increase in the FFR (Federal Funds Rate) aka the Overnight Rate. They’re already drawn a line in the sand so as to not raise rates until the Unemployment Rate in the United States is at least 6.5%. No, today it’s about what they’ll say and how they say it. Analysts and pundits will be glued to their TV’s or the Internet to hear what they say and more importantly how the market will interpret it.

The FOMC also has a dual mandate. One is to keep the Unemployment Rate low and the other is inflation. I mentioned that should the United States see full sequestration, we could see the return of inflation, as consumer prices will rise. This past Friday, March 15th CPI numbers were released at 8:30 AM EST. This showed the largest increase in consumer prices in nearly 4 years. The last time it was this high percentagewise was June, 2009 and the US economy was in the midst of the Great Recession. Understand that at this point the sequester is only two weeks old and most of the effects have not kicked in yet. Time will tell if we’ll have the dire results of inflation but the FOMC has also drawn a line in the sand for that too. If inflation expectations rise above 2.5% on an annualized basis then the Fed may consider an increase in the Overnight Rate.

Believe it or not there are some people who want an increase in interest rates. Who are they? Investors with long term holdings in bonds, money markets and just plain folks who want an increase in their bank interest. I’ll be the first to admit my bank interest rate could use an increase too; but not at the expense of the US economy. Let’s examine the domino effect that will occur if the FOMC increases the Overnight Rate. First, the Overnight Rate is the rate of interest the Fed charges banks, the banks of course are legally obligated to abide by it and then passes that on to the consumer. Currently the rate is 0.25%, a bank loan to buy an auto (if the consumer has a stellar credit score) is around 3.00%, which means the bank pockets 2.75% interest over 4 years. If the FOMC increases, that rate will go up.

There has been much criticism of FOMC Chairman Ben Bernanke in the United States and politically if the GOP had won this past November, there’s no doubt he would have been replaced. Ben Bernanke is an avid student of business history and one of the things he studied intently was the cause of the Great Depression of the 1930’s. These studies became quite valuable during the Financial Meltdown of 2008 as he knew that without credit, no modern society can exist. One of the fallacies of the TARP program was that banks received money but did not lend it out. They basically kept in reserve and just paid the Federal government back.

Do I think the FOMC will stop the recent rally on the Dow? No. In terms of what may happen; if history is any judge at the last FOMC meeting in January, the USD rose and the markets fell, momentarily. In February the markets took off again.

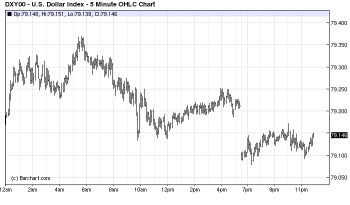

This is a chart of the USD between January 30-31 when the FOMC had their last meeting. After the announcement at 2 PM EST, the USD rose in value.

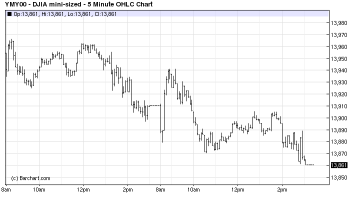

In contrast on the 30th after announcement the Dow fell and the very next day rose in value in the morning but fell off for the rest of the trading day. Could this happen again? Time will tell.

Given that there’s no expectation that the Fed will raise rates and will probably use the same language for the announcement as the last meeting, in all likelihood we will probably see the same pattern develop. But again, time will tell.