Better than expected employment data is helping the Canadian dollar today, sending the loonie higher against its major counterparts. The surprise economic data is boosting Canadian dollar, and providing hope that economic weakness will not persist. Canada added a surprising 50,700 jobs to the economy in February, more than double what some analysts were expecting. On top of that, according to Statistics Canada, industrial companies used … “Loonie Gets Boost from Jobs Report”

Month: March 2013

UK Pound Struggles on Outlook

The UK pound outlook continues to be a sore point. Outlook is weaker for the sterling, with continued economic troubles predicted, and more stimulus expected. Just about every aspect of the UK economy is showing deterioration right now. Growth is expected to remain sluggish, and the Bank of England is expected to continue stimulus efforts. While the asset buying program remains unchanged for now, many Forex traders and analysts expected more … “UK Pound Struggles on Outlook”

GBP/USD: Trading the British Manufacturing Mar 2013

British Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the health of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background The … “GBP/USD: Trading the British Manufacturing Mar 2013”

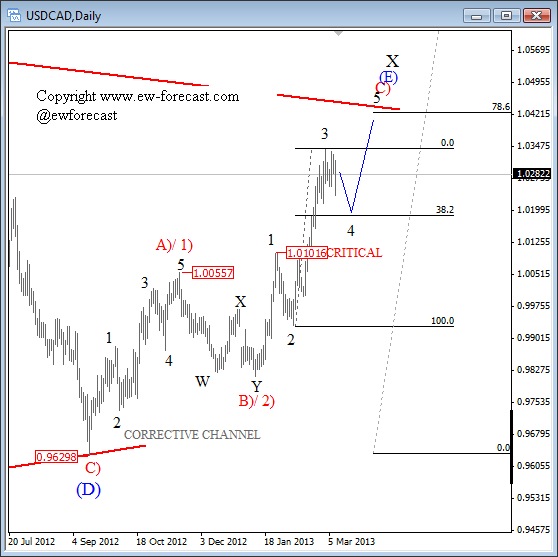

USDCAD: Impulsive Trend Could Resume From 1.0200

USDCAD is trading nicely higher for the past few weeks, a move which was expected after the wave B) pull-back down to 0.9800 support at the end of 2012. We know that after the pair completed a correction the market will make an impulsive price action, and that is exactly what we are tracking now … “USDCAD: Impulsive Trend Could Resume From 1.0200”

The USD – Why is it so High?

On February 7th the ECB held their meeting whereby they decide on what the minimum bid rate is. This is similar to the FOMC meeting in the United States where the Federal Reserve decides what the FFR (Federal Funds Rate) aka the Overnight Rate will be. This is used to determine what banks and other … “The USD – Why is it so High?”

Another Week of Gains of US Dollar

The US dollar extended its rally for another week. The currency paused its advance versus the euro after the European Central Bank talked about economic recovery, but resumed the rally on the very next day on the better-than-expected non-farm payrolls. Several central banks held policy meetings this week, including the ECB, the Bank of England, the Bank of Canada, and the Reserve Bank of Australia. There were no surprises as the banks left their monetary … “Another Week of Gains of US Dollar”

US Non-Farm Payrolls Much Better Than Expected, Lifting Dollar

The US dollar climbed yesterday on the very good non-farm payrolls, demonstrating that recovery of the US economy is gaining momentum despite all the budget issues that the United States have. US non-farm employment grew by 236,000 jobs in February after rising 157,000 in January. Forecasts were not as optimistic, promising an increase by 162,000. Moreover, the unemployment fell from 7.9 percent to 7.7 percent, even though it was expected … “US Non-Farm Payrolls Much Better Than Expected, Lifting Dollar”

Canadian Dollar Ends Friday on Positive Note

The Canadian dollar ended Friday higher against most of its major peers as employment data came out much better than was predicted by analysts, making Canadian assets more appealing to investors. The currency also advanced versus the US dollar, but later erased the gain. The Canadian employment grew by 50,700 in February from January, when it declined by 21,900. Analysts have predicted much smaller growth by 7,800. The unemployment … “Canadian Dollar Ends Friday on Positive Note”

AUD/USD Falls on Chinese Trade Balance, AUD/JPY Extends Rally

The Australian dollar fell against its US counterpart today after the Chinese trade balance demonstrated an unexpected surplus. The currency extended its rally versus the Japanese yen. China’s trade surplus had a negative impact on the Aussie. The surplus was caused not just by rising exports, but also by the bigger-than-expected decline of imports. It was bad for Australia as most of nation’s goods are sold to the Asian country. AUD/USD fell from … “AUD/USD Falls on Chinese Trade Balance, AUD/JPY Extends Rally”

Goodbye Mr Shirakawa and a Strong JPY

Masaaki Shirakawa chaired his last monetary policy meeting this week as governor of the Bank of Japan, but even before his departure tolerance of a strong JPY was already killed off by the new government. What follows now could be the next big leg down in the JPY exchange rate. Haruhiko Kuroda, widely expected to … “Goodbye Mr Shirakawa and a Strong JPY”