The Italian elections weighed on the euro and shook financial markets. The uncertainties around Italy may hurt the single currency, but another sharp selloff could come from the upcoming ECB decision, says David Song of DailyFX. In the interview below, Song discusses the implication of the Italian elections on the euro, the safe haven trade, … “The next selloff of the euro could come from Mario”

Month: March 2013

The key to an ECB rate cut is the unwinding of the LTRO

In the euro-zone, unemployment is rising, inflation is falling and the debt crisis is still weighing. However, the ECB’s incentive to cut interest rates could come from a different direction: the unwinding of the LTROs, says Simon Smith of FxPro. In the interview below, Smith also discusses the gap between Japanese rhetoric and deeds, the … “The key to an ECB rate cut is the unwinding of the LTRO”

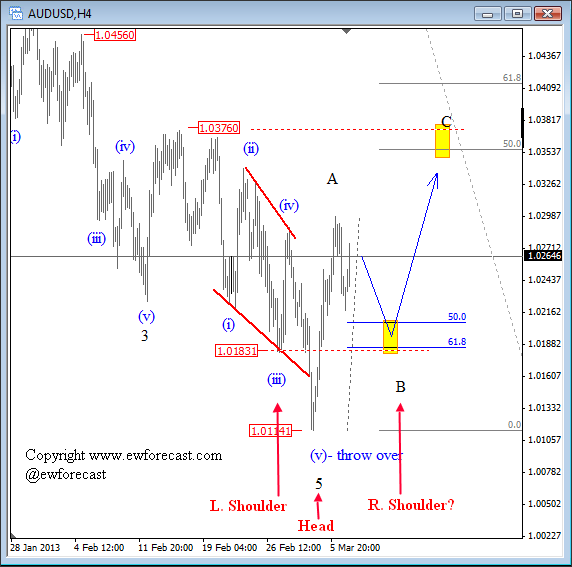

AUD/USD: Reversal Pattern Is Pointing Towards 1.0375

A sharp impulsive reversal higher in this week suggests that AUD/USD found a temporary low and completed an ending diagonal in wave 5 with a throw-over formation. A throw-over occurs when volume is high in the fifth wave that approaches the lower trendline of the pattern, and extends slightly beneath it before a reversal occurs. … “AUD/USD: Reversal Pattern Is Pointing Towards 1.0375”

Leverate’s FXPN Now Available for Binary Options

Leverate’s FX Partners Network (FXPN) which is an independent affiliate group, has now expanded into the market of binary options, answering the growing demand for this product. Leverate recently introduced a Toolkit for Social Marketing. For more on the expansion to binary options, here are details from the official press release: March 5, 2012 – FXPN … “Leverate’s FXPN Now Available for Binary Options”

Zloty Drops as Central Bank Cuts Rates More than Expected

The Polish zloty dropped today as the Polish central bank cut interest rate more than was expected, reducing attractiveness of the currency. Yet not all specialists were bearish on the zloty. The National Bank of Poland cut its benchmark interest rate by 50 basis points to 3.25 percent. The bank voiced concern about “a marked economic slowdown” in the fourth quarter of 2012 and said: Economic activity may gradually improve in the coming quarters. … “Zloty Drops as Central Bank Cuts Rates More than Expected”

USD/JPY: Trading the Japanese Current Account March 2013

The Japanese Current Account measures the difference in value of imported and exported goods and services each month. A reading which is higher than the forecast is bullish for the yen. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Thursday at 23:50 GMT. Indicator Background Japanese Current Account provides a snapshot of the … “USD/JPY: Trading the Japanese Current Account March 2013”

USD/CAD Jumps After BoC Meeting

The Canadian dollar dropped sharply against its US counterpart today after the Bank of Canada left interest rates unchanged, signaling that the accommodative policy will persist for some time. The BoC kept its key interest rate at 1 percent today. Bank’s Governor Mark Carney voiced belief that growth of the Canadian economy will accelerate this year. At the same time, he said that consumer inflation “has … “USD/CAD Jumps After BoC Meeting”

US Dollar Index Heads Higher Today

US dollar index is heading higher today, gaining ground as a bit of uncertainty sets in ahead of central bank announcements out of the eurozone and the United Kingdom. European currencies are casualties against the greenback today as speculation about what’s next permeates the markets. Even though risk assets — stocks — are gaining ground today, high beta currencies are faltering. The US dollar index is gaining ground today, thanks … “US Dollar Index Heads Higher Today”

Euro Struggles Below 1.30 Against US Dollar

Euro continues to struggle, dropping below the 1.30 level against the US dollar today. Concerns about what might be coming are weighing on the 17-nation currency, causing it to lag behind some of its high beta peers. The European Central Bank is expected to make a policy announcement tomorrow regarding interest rates. Many expect the ECB to keep the benchmark steady, but there is speculation about the future. Forex … “Euro Struggles Below 1.30 Against US Dollar”

Growing Australian Economy Makes AUD More Appealing

Australia’s economy demonstrated stable growth last quarter and this increased the appeal of the nation’s currency. It is not a surprise that the Australian dollar rose today, considering the positive domestic data. Australian gross domestic product expanded 0.6 percent in the fourth quarter of 2012, matching forecasts. The third quarter growth was revised upwardly from 0.5 percent to 0.7 percent. The Reserve Bank of Australia has kept interest rates … “Growing Australian Economy Makes AUD More Appealing”