The Swiss franc declined today, further moving away from the cap of 1.20 francs per euro, set by Swiss National Bank. Demand for the currency as a safe haven was limited among signs of economic growth in the United States. Yesterday’s data spurred risk appetite on the Forex market, trimming demand for safe currencies. Traders remained optimistic today as they expect more positive reports, including non-farm payrolls, which rose 161,000 … “Signs of Economic Growth Make Traders Part with Franc”

Month: March 2013

Forex Trades To Watch In A Record Breaking Week

In what comes as more than a bit of a surprise, considering ongoing uncertainty over US sequestration (Budget sequestration is a procedure in United States law that limits the size of the Federal budget and involves setting a hard cap on the amount of government spending within broadly-defined categories) no concrete signs of an end … “Forex Trades To Watch In A Record Breaking Week”

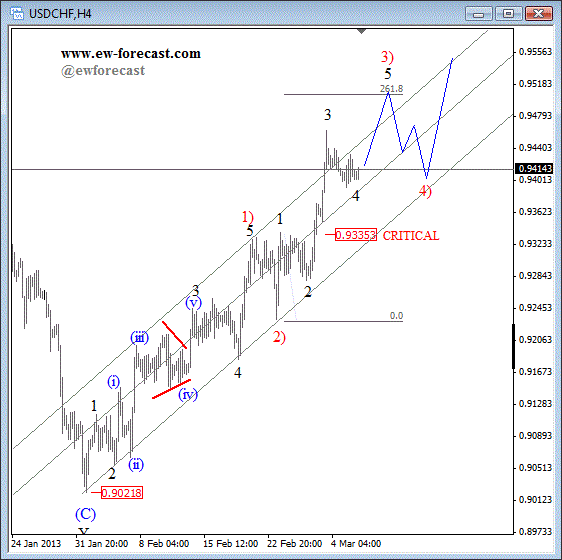

USDCHF: A Minor Pull-back Within Uptrend (Elliott Wave Analysis)

USDCHF accelerated higher at the end of the last week and traded slightly through the upper channel resistance line which is a bullish signal for the pair. As such, we are now observing a new Elliott wave count with a possible impulsive rally underway to 0.9500 area while 0.9335 is not breached. Notice that current … “USDCHF: A Minor Pull-back Within Uptrend (Elliott Wave Analysis)”

FxPro consolidates operations: closes Australian offices and focuses on

Forex broker FxPro has recently closed its Australian offices and will consolidate its activity in Cyprus and in London. The Cyprus based, FSA regulated ECN broker now redirects traffic from its Australian site back to the main site. Here is what we heard from FxPro: “FxPro took the strategic decision to close its Australian office … “FxPro consolidates operations: closes Australian offices and focuses on”

MarketsPulse launches a CRM System offering a full view

MarketsPulse continues developing products for the binary options industry. The latest product is a Customer Relations Management system which a high level of efficiency for sales and retention. MarketsPulse recently launched a MetaTrader 4 integration for binary options. For more details about the CRM system, here is the official press release: LONDON- MarketsPulse has introduced a … “MarketsPulse launches a CRM System offering a full view”

Positive Data from USA Boosts Appeal of Indian Rupee

The Indian rupee gained today as signs of stable economic growth in the United States made Forex traders more willing to risk and propped up demand for currencies with higher yield. The US non-manufacturing Purchasing Managers’ Index rose from 55.2 percent in January to 56.0 percent in February. Analysts have thought that the index would fall a little to 55.0 percent. Other important reports will be released this week, including … “Positive Data from USA Boosts Appeal of Indian Rupee”

Chilean Peso Higher as Economic Activity Beats Forecasts

The Chilean peso advanced on speculations that monetary stimulus in Europe will bolster economic growth of the South American nation, which continues to beat analysts’ forecasts. IMACEC, the central bank’s index of economic activity, grew 6.7 percent in January from a year ago, more than specialists have anticipated. The increase followed the December’s growth by 6.5 percent. Copper rallied 0.5 percent to $3.5175 per in New York yesterday. The metal makes … “Chilean Peso Higher as Economic Activity Beats Forecasts”

More Downward Pressure on the Canadian Dollar

Once again, the Canadian dollar appears to be struggling. Even though there is a measure of enthusiasm for risk assets today, there is just too much, fundamentally, dragging on the loonie to help it enjoy some of the gains other currencies are seeing against the US dollar today. Even though the euro and pound have seen their earlier rally against the dollar fizzle a bit, they are still gaining against … “More Downward Pressure on the Canadian Dollar”

US Dollar Drops as Risk Appetite Returns on Economic Data

Eurozone economic data is providing a jolt to risk assets, and that is sending the US dollar lower today. Also, many Forex traders might be ready to let the dollar weaken, after a run of relative strength. There is a bit of enthusiasm in the markets today, as the Dow Jones Industrial Average reaches an all-time high, and as risk assets in general see demand. In this climate, there isn’t much demand for the US dollar, … “US Dollar Drops as Risk Appetite Returns on Economic Data”

Threat of Intervention Does Not Stop Yen’s Rally

The Japanese yen continued to rally today even though the threat of an intervention continues to loom over the currency, reducing its attractiveness. The yen inexplicably continues to rally even as the newly appointed Bank of Japan Governor Haruhiko Kuroda said that he is going to ease the monetary policy further. Some analysts say that it is because traders do not expect the central bank to act until Kuroda will officially … “Threat of Intervention Does Not Stop Yen’s Rally”