PFSOFT’s Protrader platform continues evolving and it now provides liquidity from Sucden Financial. This follows the integration of SkyonFX. For more about this news, here is the official press release: FX Liquidity from Sucden Financial is now on offer via the PFSOFT Protrader multi-asset trading platform. In addition Sucden Financial can offer access to futures, equities … “PFSOFT now provides liquidity from Sucden Financial”

Month: March 2013

Indonesian Rupiah Falls on Concerns About Excessive Inflation

The Indonesian rupiah fell today after data showed that inflation accelerated more than was expected by analysts, threatening the nation’s economy. Indonesian consumer prices jumped 5.31 percent in February, according to the government data. Analysts’ projections have pointed at 4.81 percent as a likely figure. Excessive inflation is dangerous to an economy as it erodes purchasing power of consumers. Yet economists think that the Bank Indonesia will not change … “Indonesian Rupiah Falls on Concerns About Excessive Inflation”

GBP/USD:Trading the British Services PMI Mar. 2013

The British Services PMI (purchasing managers’ index) is an important leading indicator which focuses on the services sector of the economy. The PMI comes out at the beginning of each month, providing analysts with an early snapshot of the UK Services sector. A reading that is higher than the forecast is bullish for the pound. … “GBP/USD:Trading the British Services PMI Mar. 2013”

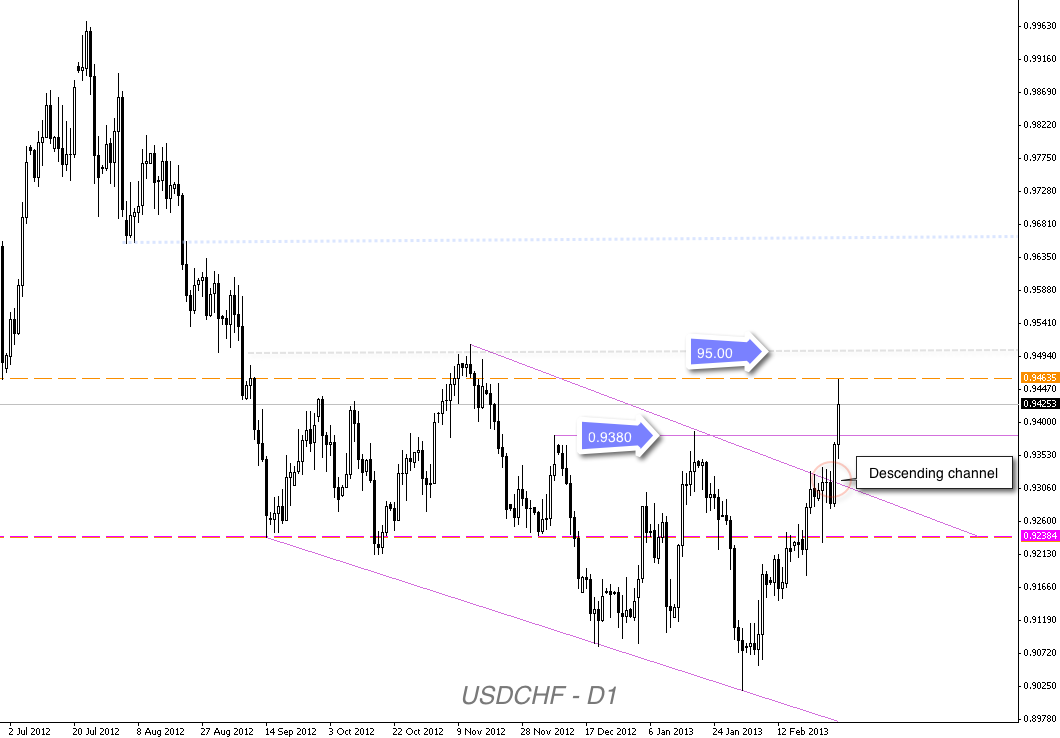

USD/CHF Technical Analysis March 4 8 2013

USDCHF has broken above the upper trend line line of the descending channel, as per the daily timeframe dollar/Swiss chart below. This comes as the US dollar index is trading around the USDX 82.30 area, a price not seen since late August 2012, after a break above recent range resistance. Guest post by Nick Simpson … “USD/CHF Technical Analysis March 4 8 2013”

Yen Posts Weekly Gains Despite Intervention Threat

The Japanese yen rallied this week amid fears caused by the election in Italy and the threat of automatic budget cuts in the United States. The rally surprised some investors as they have expected that the currency would stay weak because of the intervention threat. The yen surged tremendously at the start of this week as traders were afraid that the Italian election would produce weak and divided government. The outcome of the vote was exactly the one market participants … “Yen Posts Weekly Gains Despite Intervention Threat”

Yen Up Against High Beta Currencies

Yen is gaining against high beta currencies today, thanks in large part to concerns about the global economy. A bit of safe haven demand has emerged, and that usually means a higher yen.

US Dollar Gains on Downbeat Data Out of Europe

European data released earlier is disappointing, and concerns about the situation are prompting gains for the US dollar. Even though the US economy is recovering at a sluggish pace, and even though the sequester has hit, the US dollar is still in a stronger position than its European counterparts. Greenback is higher so far on the first day of the budget sequester. For the most part, US dollar is being seen as a safe haven. … “US Dollar Gains on Downbeat Data Out of Europe”

Rand Drops as South African Trade Deficit Swells

The South African rand declined today as the nation’s trade balance deficit widened more than experts have predicted, driving investors away from South African assets. The South African trade gap swelled to 24.5 billion rand ($2.7 billion) in January from 2.7 billion rand in December. Analysts have anticipated a shortage of 9.7 billion rand. The rand dipped after the report, heading to the biggest weekly drop in five months. … “Rand Drops as South African Trade Deficit Swells”

GBP/USD Touches Lowest Since July 2010

The Great Britain pound dropped today after a report showed that the manufacturing sector unexpectedly contracted last month. The currency reached the lowest level since July 2010 against the US dollar. The Markit/CIPS UK Manufacturing Purchasing Managers’ Index dropped from 50.5 in January to 47.9 in February, the first reading below the neutral 50.0 level since November. Analysts have predicted that the index would stay little changed. Most … “GBP/USD Touches Lowest Since July 2010”

All hands on deck – rough waters ahead for the pound

The pound has been the whipping boy of the currency markets since the turn of the year. Recent declines in sterling are arguably justified given the uncertain outlook for the UK economy over the next few months. The economy is stuck between meagre growth and recession with higher inflation an extra kick in the teeth … “All hands on deck – rough waters ahead for the pound”