British Retail Sales measures change in the total value of sales at the retail level. It is considered one of the most important indicators of consumer spending, and is released on a monthly basis. A reading that is higher than the market forecast is bullish for the British pound. Here are all the details, and 5 possible outcomes … “GBP/USD: Trading the British Retail Sales Mar 2013”

Month: March 2013

Euro Dips as Cyprus Levy Goes to a Vote

Euro is heading lower against its major counterparts today, thanks in large part to uncertainty over the vote in Cyprus. Once again, questions about the euro’s stability are being raise, and that is weighing on the 17-nation currency. Voters in Cyprus are heading to the polls to determine whether or not they are in favor of a levy on retail bank deposits. The measure is meant to raise money so that Cyprus can meet … “Euro Dips as Cyprus Levy Goes to a Vote”

NZD/USD: Trading the New Zealand GDP March 2013

New Zealand Gross Domestic Product (GDP) is a key economic indicator, released each quarter. GDP measures production and growth of the economy, and analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the New Zealand dollar. Here are all the details, and 5 possible outcomes for … “NZD/USD: Trading the New Zealand GDP March 2013”

UK Pound Prepares for Possible Monetary Policy Change

Tomorrow, George Osborne, the Chancellor of the Exchequer in the United Kingdom, is set to release his latest budget. The result has been mixed for the UK pound for now, but many expect that more weakness is probably ahead for the sterling. George Osborne‘s grand austerity plans have failed to boost the UK economy, and they haven’t actually helped reduce the deficit, either. His new budget isn’t likely to offer huge changes … “UK Pound Prepares for Possible Monetary Policy Change”

Raid on Cypriot bank depositors looks like Eurocide

The EUR once again needs to be viewed as a high-risk currency with existential issues following measures by Eurozone policy makers and the IMF to make Cypriot savers pay for the bailout of their country. This could haunt the Eurozone with a vengeance should other much larger members need to be rescued. The novel idea … “Raid on Cypriot bank depositors looks like Eurocide”

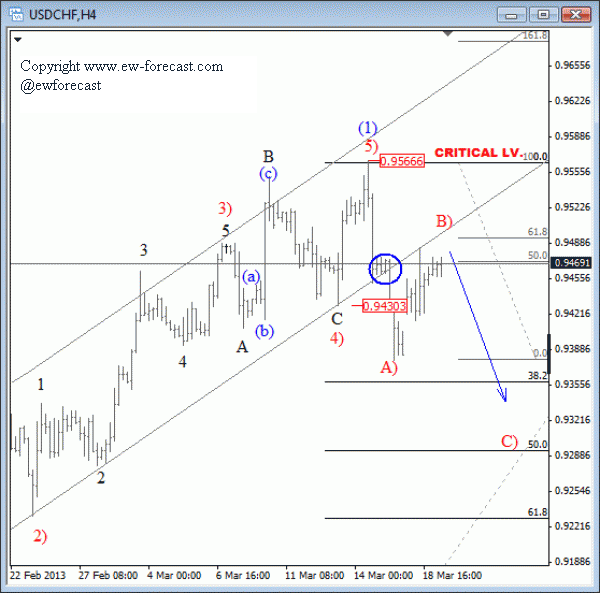

USDCHF Is Looking Bearish Towards 0.9300 Against 0.9566 (Elliott

USDCHF reversed sharply lower in the past week from the 0.9566 peak and also closed on a daily and weekly basis beneath the 0.9430 swing. In fact, the move from 0.9566 was very sharp so we believe it’s only the first leg of a minimum three-wave decline, labeled as A)-B)-C). Ideally pair is now in … “USDCHF Is Looking Bearish Towards 0.9300 Against 0.9566 (Elliott”

What’s Next for the US Dollar? Could Dollar Strength Continue?

Right now, even though the US dollar is a bit lower against the euro, there is still evidence of dollar strength. The US dollar index has shown itself resilient this year, and there is a good chance that the greenback will continue to show relative strength as uncertainty wracks the financial markets. While there is no way to say for certain what will happen next in any financial market, … “What’s Next for the US Dollar? Could Dollar Strength Continue?”

Euro Manages to Log Gains after Offering Flexibility to Cyprus

Euro plunged in value to start the week, thanks in large part to the latest banking crisis, located in Cyprus. An unprecedented bank tax caused consternation over the weekend, and renewed fears about banking problems and bailout prospects. However, announced flexibility from eurozone leaders is supporting the euro right now. In order to keep the bailout on track, eurozone leaders are offering to be flexible in the matter of the bank tax just announced by Cyprus. A vote … “Euro Manages to Log Gains after Offering Flexibility to Cyprus”

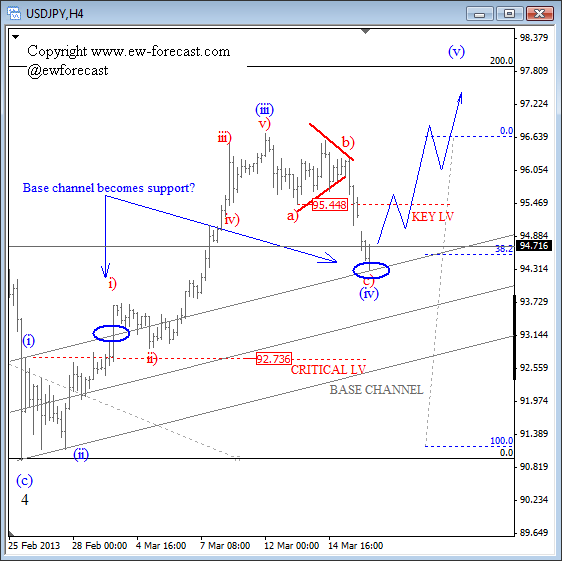

USDJPY : The Rise Above 95.45 Puts the Pair Back

Despite a big gap down on USDJPY, the pair remains in bullish mode as the decline is actually still in a three wave pattern, which we think it’s wave (iv). Notice that wave (iv) is actually testing some interesting levels around 94.30, where we can see an upper line of a base channel as well as … “USDJPY : The Rise Above 95.45 Puts the Pair Back”

EUR/USD: Trading the German ZEW Mar 2013

The German ZEW Economic Sentiment Index is based on a monthly survey of institutional investors and analysts which examines their views of the health and direction of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. … “EUR/USD: Trading the German ZEW Mar 2013”