There are a lot of traders out in “FX Land” scratching their heads at the moment, wondering “what happened today”? Earlier this morning, the US posts good news as the jobless claims number was better than expected, and Euro news showed a disappointing EMU employment number. Well, if we follow what has happened the last … “And then they changed the rules again…”

Month: March 2013

Swiss Franc Strong Even as SNB Maintains Ceiling

The Swiss franc jumped today even after the Swiss National Bank maintained the cap on the currency and signaled that the exchange rate is still high. The SNB left interest rates near zero and the ceiling at 1.20 francs per euro today. The central bank said that the currency “is still high”. The bank also revised its inflation projections to -0.2 percent for 2013 and 0.2 percent for 2014, down from -0.1 for this … “Swiss Franc Strong Even as SNB Maintains Ceiling”

Norges Bank Sees No Interest Rate Increase Until 2014

The Norwegian krone weakened today after the central bank left interest rates stable and signaled that no change to the monetary policy is expected until the next year. Norges Bank left its key interest rate at 1.5 percent today. Governor Oeystein Olsen said that Norway’s economic growth and inflation “have been slightly lower than projected”. The central bank stated: The key policy rate is low … “Norges Bank Sees No Interest Rate Increase Until 2014”

UK Pound Sees Some Gains

UK pound’s recent sell off seems to be over — for now. Sterling is seeing some success today, helped by positional factors, as well as by a general feeling of risk appetite in the markets. Today, UK pound is making a mostly strong showing today against its major counterparts. Risk appetite is helping a bit. Equities, by and large, are rallying today. Even though gains by major indices have been somewhat … “UK Pound Sees Some Gains”

Better Economic Data Boosts Loonie

Better news in the United States and in Canada is helping the loonie today. Between unexpectedly low jobless claims in the United States, and higher housing prices in Canada, plus events around the world resulting in risk-on sentiment today, the loonie is heading mostly higher today. Canadian dollar is up against most of its trading counterparts today, thanks in large part to improved sentiment around the world. The latest initial jobless claims … “Better Economic Data Boosts Loonie”

Could China be forced to unpeg CNY?

Aggressive quantitative easing programmes from the US and Japan are creating a dilemma for the Chinese leadership, which may only be resolved by revaluing the China Yuan upwards versus the US Dollar. Inflation and unemployment are two major preoccupations for the Chinese leadership as a nasty bout of either can create social instability. But at … “Could China be forced to unpeg CNY?”

RBNZ Does Not Anticipate Higher Interest Rates This Year

The New Zealand dollar rose today after yesterday’s drop, but gains were limited after the central bank said that an interest rate hike is not likely to happen this year. The kiwi was trying to follow its Australian counterpart in gains, but it was hard to do after the Reserve Bank of New Zealand signaled that it puts interest rates on hold. The RBNZ kept its key … “RBNZ Does Not Anticipate Higher Interest Rates This Year”

Good Employment Makes Australian Dollar Stronger

The Australian dollar climbed today after the employment data came out much better than was predicted by analysts, reducing bets on an interest rate cut by the central bank. Australian employers added 71,500 jobs in February. This is compared to the consensus forecast of 9,500. The unemployment rate remained steady at 5.4 percent. Market participants have feared that it would go up by 0.1 percentage point. AUD/USD went up … “Good Employment Makes Australian Dollar Stronger”

EUR/USD: Trading the UOM sentiment March 2013

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence leads to more consumer spending which is critical for economic growth. A reading which is higher than the estimate is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday … “EUR/USD: Trading the UOM sentiment March 2013”

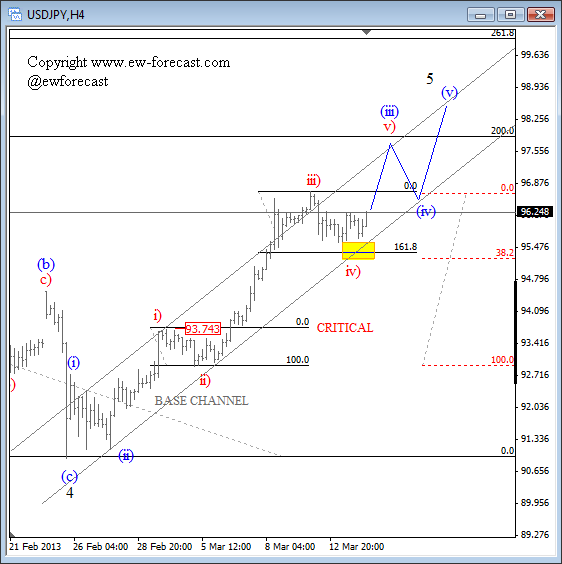

USD/JPY Now Underway To 98.00 (Elliott Wave Analysis)

USDJPY is trying to stay with a larger uptrend now after a recent reversal down to the 95.50 support line, which appears to be wave iv). Wave iv) found support around the trend-line connected from 91.00 and also near 38.2% Fibonacci support zone which was ideal start point for wave v). This wave v) could … “USD/JPY Now Underway To 98.00 (Elliott Wave Analysis)”