The Great Britain pound rose against the euro today as house prices increased last month in the United Kingdom. The sterling was soft against other most-traded currencies, including the US dollar. The Rightmove House Price Index advanced 2.1 percent in April after increasing 1.7 percent in March. It was the fourth consecutive monthly increase. The pound rose against the euro on the news, but was weak versus the dollar, effectively reversing … “GBP Gains on EUR as House Prices Grow, Soft vs. USD”

Month: April 2013

EUR/USD:Trading the German ZEW Economic Sentiment

The German ZEW Economic Sentiment Index is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the Euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 9:00 GMT. … “EUR/USD:Trading the German ZEW Economic Sentiment”

Effects of Sequestration…thus far

Well we’re about 6 weeks into the sequester and apparently the sky hasn’t fallen yet. Each day on Wall Street seems to be better than the day before. It seems that each day the Dow and S&P are going to new all time highs. Yet, I have to wonder “are we letting ourselves in for … “Effects of Sequestration…thus far”

GBP Posts Weekly Gains vs. USD & JPY, Losses vs. EUR & AUD

This week was not bad for the Great Britain pound as the currency strengthened against the US dollar and the Japanese yen. At the same time, the sterling closed weaker against the euro and the Australian dollar. As it was expected, fundamentals were mixed for Britain’s currency. This led to some confusion for the currency, but the general direction was up against the US dollar and the yen, even though the pound weakened on Friday. The yen unexpectedly climbed by the end … “GBP Posts Weekly Gains vs. USD & JPY, Losses vs. EUR & AUD”

Gold bugs busted?

Recent events were bullish for gold and the Cyprus bailout fiasco should have been a catalyst for higher prices, but it wasn’t. So is this the end of the Bull Run for gold All the factors for higher gold prices should be there. Central banks remain committed to easy money and the Bank of Japan … “Gold bugs busted?”

EUR/USD Closes Near Opening After Drop

The euro dropped against the US dollar amid concerns about the debt issue in the eurozone, but managed to rebound and closed near the opening. The currency rose against the Great Britain pound and weakened versus the Japanese yen. Eurozone finance ministers have started a two-day meeting in Dublin yesterday to discuss loan extension for Ireland and Portugal. Problems of Cyprus will also be one of the discussed topics. Traders were a bit tense ahead of the meeting, … “EUR/USD Closes Near Opening After Drop”

USD/JPY Fails to Breach 100 Level as Yen Advances

The Japanese yen closed higher against other most-traded currencies, failing to breach the 100 per dollar level and trimming weekly losses, as Forex traders felt aversion to risk amid uncertainty about global economic growth. Concerns about the eurozone are returning and the US economy has its share of problems. Market participants were less inclined to risk as the trading environment did not look favorable. Stocks dropped as the Standard & … “USD/JPY Fails to Breach 100 Level as Yen Advances”

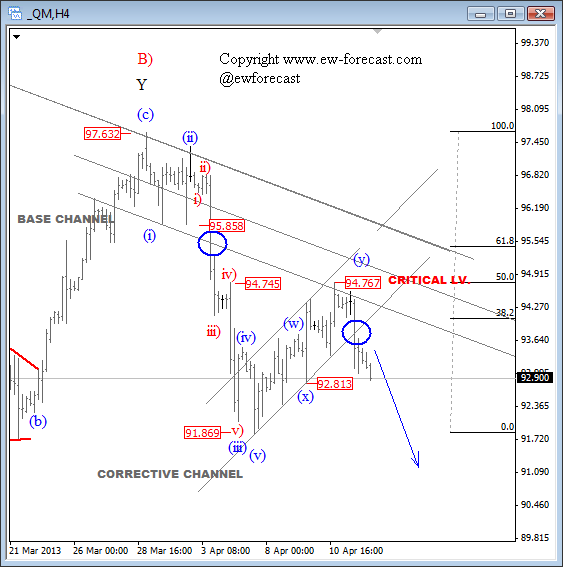

Crude Oil: Correction Appears Complete; Weakness Could Extend To

Oil recovered nicely in the last few days from 91.80 back to 94.75 – a move which was expected after it completed a five wave pattern down. We were tracking a corrective bounce in the last few days which has unfolded very nicely and stopped at 94.75, almost on a tick at wave four resistance … “Crude Oil: Correction Appears Complete; Weakness Could Extend To”

Loonie Retreats on United States, Europe, and Commodities

After enjoying a solid performance earlier, the Canadian dollar is now heading much lower on a variety of economic concerns and a drop in commodities. Loonie is headed lower today as the latest US economic data bodes ill for Canada’s largest trading partner. On top of that, there are concerns about the eurozone, and that is weighing on risk appetite in general. Cyprus is once again throwing a wrench into the workings of the eurozone, and there … “Loonie Retreats on United States, Europe, and Commodities”

US Dollar Mostly Higher as Risk Appetite Flees

US dollar is mostly higher today, gaining against European currencies as risk appetite flees the scene. The state of Cyprus is once again in the news and having an effect. US dollar is moving lower against the Japanese yen, thanks in large part to worse than expected business inventories in the United States. For February, business inventories only increased 0.1%, rather than the expected 0.4%. As a result, first quarter GDP forecasts … “US Dollar Mostly Higher as Risk Appetite Flees”