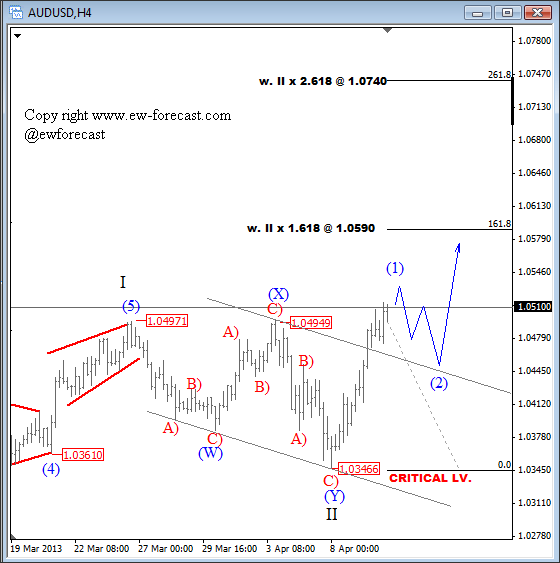

AUDUSD moved through 1.0500 swings which means that a wave II pull-back is complete and that a larger uptrend is back in progress again. The rise from 1.0346 cannot be counted impulsively so we believe that AUDUSD will move much higher in the next few days, maybe even weeks if we consider a possible wave … “AUDUSD Turns Back In Bullish Mode As Price Exceeds”

Month: April 2013

US Economy: Decline in Velocity of Money Serves as a

The ongoing QE programs of the Federal Reserve are having less and less impact on the real US economy, and the decline in the velocity of money does not go hand in hand with a sustained expansion, says Kristian Kerr of DailyFX. In the interview below, Kerr also discusses the relative strength of the euro, … “US Economy: Decline in Velocity of Money Serves as a”

US – Fed expansion vs. Government tightening

Early in 2013, the US economy showed signs of accelerated growth through a wide array of economic indicators. This hasn’t convinced the Federal Reserve to alter its policy, and perhaps with a good reason. While the US avoided big tax hikes in a last minute deal, the expiration of the payroll tax cut and the … “US – Fed expansion vs. Government tightening”

AUD Extends Gains as China Increases Imports

The Australian dollar extended its gains today as China, the major Australia’s trading partner, increased its imports, improving trading prospects of the South Pacific nation. According to the Customs General Administration of China, imports grew 14.1 percent in March from a year ago, beating the median forecast of 6 percent. At the same time, exports advanced 10 percent. The resulting trade deficit was $880 million. Yesterday, China’s National Bureau of Statistics … “AUD Extends Gains as China Increases Imports”

Mixed Fundamentals Left Pound Without Direction to Move

The Great Britain rose against the US dollar and the Japanese yen, but was stable against the euro after weakening yesterday. The moves were small as mixed fundamentals did not give the currency reasons to go in any particular direction. UK manufacturing production rose 0.8 percent in February from January, when it fell 1.9 percent. The actual increase was twice as big as the forecast figure of 0.4 percent. The trade balance … “Mixed Fundamentals Left Pound Without Direction to Move”

AUD/USD: Trading the Australian jobs Apr 2013

The Australian Employment Change indicator, released monthly, is an important leading indicator which often has a significant impact on the markets. Employment figures are important as they provide a snapshot of the health of the economy. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details … “AUD/USD: Trading the Australian jobs Apr 2013”

Euro Struggles on German Export Data

Euro is struggling today. Even though the 17-nation currency is gaining ground against the US dollar, it has been down against other majors (but it seems to be making progress now). The latest German export data, and concerns about continued eurozone recession, are weighing on the euro. Even though the euro is higher against the US dollar right now, it is struggling against other … “Euro Struggles on German Export Data”

Japan’s QE Leads to Stronger Thai Baht

The Thai baht gained today, reaching above 29 per dollar for the first time since 1997, as excessive quantitative easing in Japan led to capital inflows to other Asian nations, including Thailand. The near-zero interest rates in Japan drive investors to take money from the country and invest them in economies with higher returns (the practice known as carry trade). Thailand looks an attractive option with its stable economic and political environment. … “Japan’s QE Leads to Stronger Thai Baht”

US Dollar Pulls Back on Risk Appetite

US dollar is pulling back against high beta currencies today, heading a little bit lower as risk appetite appears. Good news out of China is helping the situation, even though there are still concerns about eurozone recession. Dollar is also poised to rally against the yen, and breach the 100-yen level. US dollar is lower against its major counterparts today. Even against the euro, … “US Dollar Pulls Back on Risk Appetite”

QE in USA & Japan Boosts Demand for Higher Yield, Aussie Profits

The Australian dollar climbed against the US dollar and the Japanese yen today as quantitative easing in the United States and Japan increased attractiveness of currencies with higher yield. Excessive accommodative monetary policies are prevalent in developed nations, making investors seek profit from riskier assets. The Aussie profited in this situation, surging against its US counterpart. The gain versus the yen was more limited, perhaps because the Japanese currency has … “QE in USA & Japan Boosts Demand for Higher Yield, Aussie Profits”