FXCM announced that it has made an official offer to buy Gain Capital (forex.com). Both are publicly traded companies. If the proposal turns into a deal, it would create a broker with $1.6 billion of client assets. FXCM CEO Drew Niv sent an official letter to Gain’s board of directors and will detail about it … “FXCM Proposes Buying Gain Capital – Could Create a”

Month: April 2013

Weakness in the Euro-Zone

The focus was on Cyprus in March, but issues in the euro-zone are far and wide. Here is a review. * This article is part of the April 2013 monthly forex report. You can download the full report by joining the newsletter in the form below. Italy The February 24-25 elections left Italy with a … “Weakness in the Euro-Zone”

Yen Pauses Downfall, Remains Weak

The Japanese yen paused its downfall today, but still trades near multi-year lows against other majors and is likely to continue experience weakness as the aggressive monetary policy erodes currency’s strength. The Bank of Japan announced an impressive stimulating program last week, debasing the yen. The currency was falling since then and it does not look like the drop will end anytime soon. Usually, some form of correction … “Yen Pauses Downfall, Remains Weak”

CAD Fluctuates amid Uncertainty About Canada’s Economic Growth

The Canadian dollar fluctuated against its US peer as investors were unsure about prospects for the Canadian economy. The currency fell against the euro and rallied versus the Japanese yen. The last week’s terrible employment data shocked the Forex market, being worse than even most pessimistic forecasts. Market participants remained shaken by the bad report and this translated into weakness of the Canadian currency. Yet some confidence returned, partly helped … “CAD Fluctuates amid Uncertainty About Canada’s Economic Growth”

Mixed Views on Pound’s Performance This Week

The Great Britain pound was rallying recently following weakness in the first half of March. Is the rally sustainable or it is just a pause before a drop to new lows? Analysts have mixed view on this matter. There are factors that are supportive for the sterling. First of all, the neutral monetary stance, demonstrated by the Bank of England last week, showed yet again that policy makers are reluctant to expand already … “Mixed Views on Pound’s Performance This Week”

Forint Climbs as Central Bank Discusses Methods to Spur Growth

The Hungarian forint gained today as the central bank started meeting with commercial lenders to discuss plans to encourage loans and spur economic growth as a result. The Magyar Nemzeti Bank discusses with private banks an introduction of interest-free loans that should help small businesses. It is one of unconventional methods used by the Bank to revive the economy. Today’s gains of the forint followed the last week’s rally, which was biggest in nine months. … “Forint Climbs as Central Bank Discusses Methods to Spur Growth”

UK Pound Mostly Lower on Continued Economic Weakness

UK pound is mostly lower today, thanks in large part to economic weakness. Economic reports point to continued difficulties in the United Kingdom, and that is leading to expectations of more easing — and continued weakness for the pound. Economic reports continue to threaten the British economy with a triple-dip recession. The Bank of England has been asked to do what it takes to stimulate the economy, and that might mean an increase in quantitative easing efforts down … “UK Pound Mostly Lower on Continued Economic Weakness”

Chilean Inflation Beats Forecast, Making Peso Stronger

The Chilean peso advanced today as consumer inflation accelerated more than analysts have expected. The data spurred speculations that the central bank may raise interest rates to slow growth of consumer prices. The Consumer Price Index rose 0.4 percent in March from February. The median forecast was at 0.3 percent. Annual inflation accelerated from 1.3 percent to 1.5 percent. Economists think that the Central Bank of Chile may … “Chilean Inflation Beats Forecast, Making Peso Stronger”

Euro Higher, Even with Latest Portugal Concerns

Euro is higher right now, gaining across the board, even with the latest portugal concerns. Traders are looking for yield, and that is helping the euro right now. But there are whispers that the breakup trade could be back on the table. Right now, investors and traders are looking for yield. Spanish and Italian bonds are in demand, and high beta currencies are gaining. This comes even as concerns … “Euro Higher, Even with Latest Portugal Concerns”

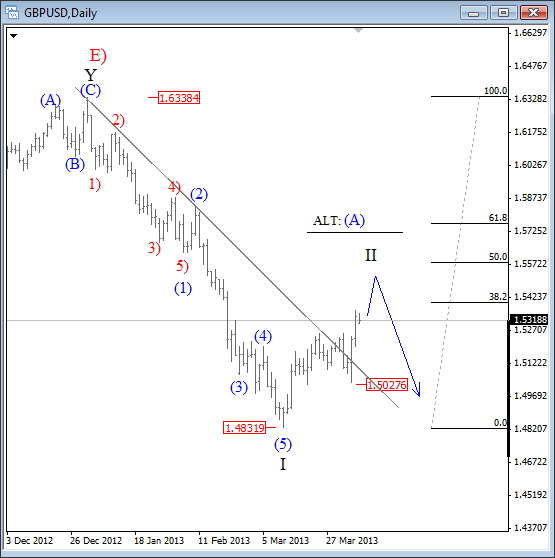

Cable Could Be Targeting 50% Fibo Level From January

GBPUSD closed strongly higher last week after crossing the recently broken trend-line connected from above 1.6300. This suggests that recovery from 1.4830 could be deeper than firstly thought. As such, we labeled the recent big fall as a completed five wave move in wave I, followed by a corrective bounce which we think is wave … “Cable Could Be Targeting 50% Fibo Level From January”