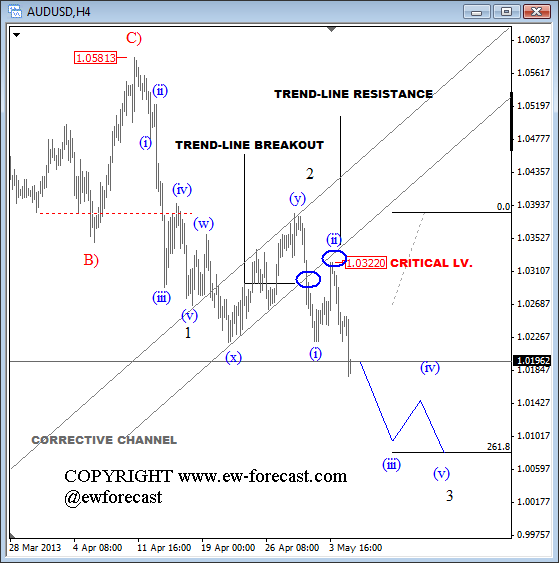

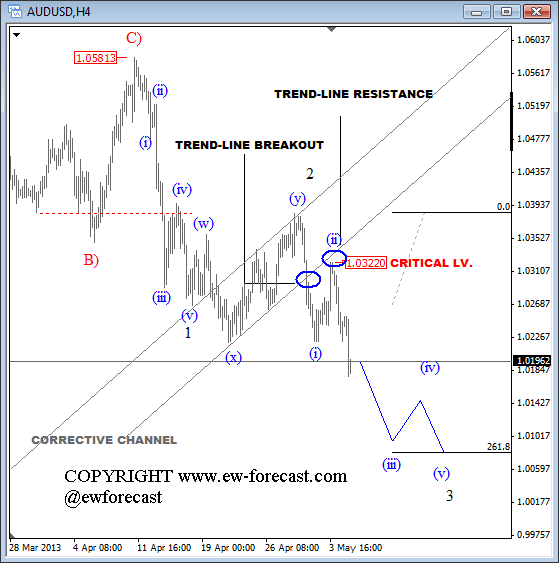

AUDUSD fell through the 1.0220 support today, which was expected after last week’s break through the lower side of a corrective channel followed by a pull-back on Friday that found a top at 1.0322 after the NFP report, exactly at that channel line that turned into a resistance.

That’s a very nice clear continuation pattern that could send the AUDUSD even down to 1.0100 level in this week. The reason is that the wave count that shows a potential scenario for wave three of three sell-off which is typically the strongest wave in a five wave sequence. As such, the pair remains in bearish mode as long as 1.0322 swing high is not breached.

The reason for a sell-off today was the RBA rate cut from 3 to 2.75%, which was in eyes of speculators already days ago after very bad recent economic indicators in Australian and China. With that said, technicals were right again and fundamentals just a catalyst. Current weakness was already evident a week ago.

For more details on AUDUSD please check our video below the chart, recorded on April 29th 2013; it also includes GBPUSD.

For more analysis visit our website and Try our services absolutely free for 7-days!

http://www.ew-forecast.com/service/