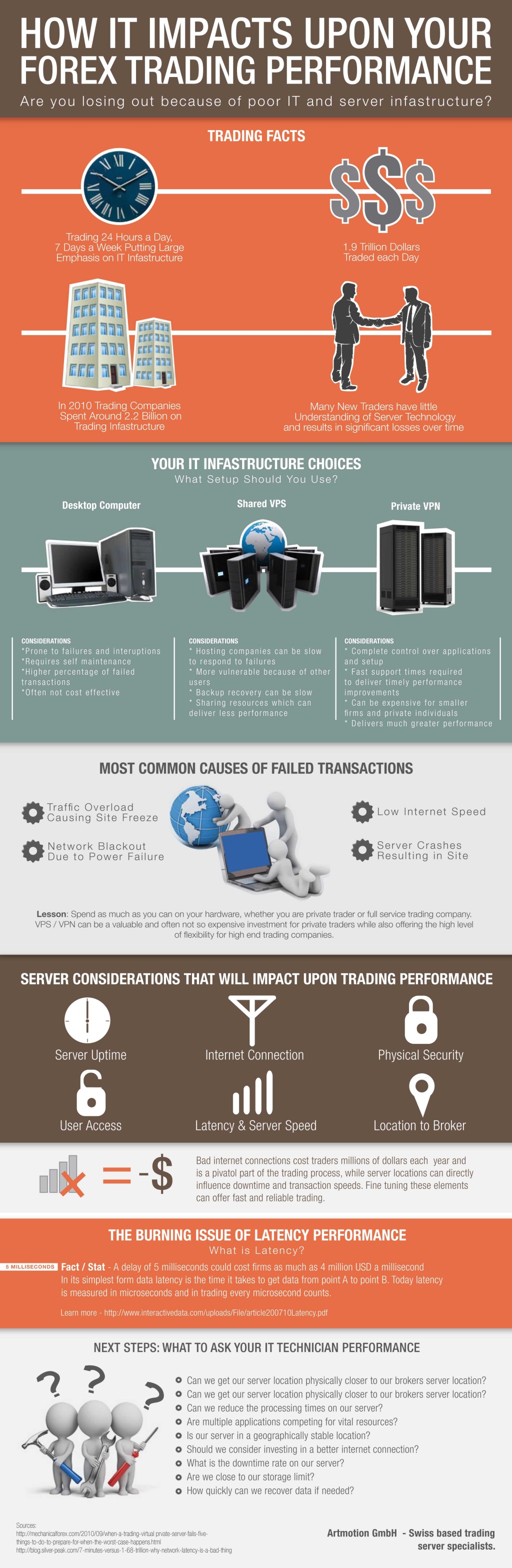

“A 5 millisecond server delay could cost a firm as much as 4 million USD every millisecond”

Technology has long played an important role in Forex trading but it’s an area that is not only evolving at an incredible pace but also one that many traders are failing to get to grip with. Recent stories have shown just how damaging poor server configuration can be with a number of high profile cases being reported.

Of course many traders believe that they only need a basic working knowledge of servers and how they fit into the overall process of trading. While this is partly true, traders are realizing more and more the need to understand the core concepts and how servers can impact upon their performance.

In truth there are many variables here which can play a role but few would doubt just how costly a delay or disruption to your server can cost. Companies invest millions in their infrastructure each year but which parts should traders focus on? It`s something many new traders ask and in turn there are a number of things they should know.

Servrer performance- click image to enlarge

It`s not just about hardware – It’s a simple mistake to make but things such as internet connection speeds and location are much more important. A bad internet connection can cause serious lag and drastically alter the price you pay. At the moment different countries operate different connection speeds so traders should think about positioning their servers in countries with fast connections. They should also think about the distance between the server and the broker.

Uptime is another burning issue. Down time can cost serious money especially if it is unexpected. Traders need to make sure there technicians have good maintenance schedules in place as well as a thoroughly tested data recovery plan. Many companies simply outsource their server requirements so again traders should also check out the credentials of these. Providers that specialize in trading servers are particularly useful.

Security is probably the most important consideration. A company can become seriously compromised without a secure and well maintained server. It sounds easy but it is becoming increasingly more difficult these days and some server setups are more secure than others. For example the cloud can be more open and in turn more susceptible to attacks.

Gaining through Knowledge

Simply put, traders don’t need to know everything about server technology but they do need to be able to work closely with their technicians to get the best possible performance. A technician might not have prior experience in the trading arena and in turn might miss crucial things. Careful collaboration and guidance is therefore a must.

To achieve this of course relies on the trader having a good level of knowledge. There are many online resources for understanding more about this. A trader with this level of knowledge will be able to stay ahead of their competitors.

In aspects of technology no one solutions fits all. The important thing here is to find a good setup and optimize it to your exact needs. This will take time but few would question its value. With an estimate 4 trillion dollars being traded each day it is easy to see how things can become congested and how trading continues to be a game of survival of the fittest.

Guest post by Mateo Meier of Artmotion GmbH Switzerland