The New Zealand Employment Change indicator is an important leading indicator which often has a significant impact on the markets. Employment Change is released together with the Unemployment Rate. A reading which is better than the market forecast is bullish for the New Zealand dollar. Here are the details and 5 possible outcomes for NZD/USD. Published on Wednesday at 22:45 … “NZD/USD: Trading the New Zealand Employment May 2013”

Month: May 2013

German Data Helps Euro

Euro is heading higher today, receiving some help from the latest German economic data. Industrial orders for March beat estimates, and that has provided some support for the 17-nation currency. Germany, as the largest economy in the eurozone, has a great deal of influence over what happens with the euro on the Forex market. Germany tends to prop up the eurozone economy, and help the 17-nation currency. The news that German industrial orders rose … “German Data Helps Euro”

Yen Gains on Comments from Taro Aso

Japanese yen is gaining ground today, thanks to the latest comments from Japan’s Finance Minister. Some Forex traders now believe that the recent yen weakness was overdone, and that some strength is in order. As a result, yen is gaining against many of its major counterparts. Japanese Finance Minister Taro Aso made some comments earlier that seemed to signal that the recent drops in the yen were … “Yen Gains on Comments from Taro Aso”

Yuan Gains as China Plans Reforms

The Chinese yuan gained today on signs that the government is planning to ease control over the currency and allow capital to move more freely in and out of the country. The Peopleâs Bank of China set its reference rate up 0.05 percent to 6.2083 per dollar today. Premier Li Keqiang promised fiscal reforms, including regulations that will allow individuals to invest overseas. The pledge followed speculations that the central bank will … “Yuan Gains as China Plans Reforms”

Aussies Sinks as RBA Surprises FX Market

The Australian dollar slumped today as the Reserve Bank of Australia surprised Forex market participants by cutting its interest rates and suggesting that further rate cuts are possible. The RBA cut its main interest rate by 25 basis points to the record low 2.75 percent today. There was some negative fundamental data recently, but analysts did not expect such move nevertheless. The bank said in the accompanying statement: … “Aussies Sinks as RBA Surprises FX Market”

FXCM Reports Record Revenue in Q1, High Trading Volume

US based Forex Broker FXCM reports its quarterly financial report, which saw revenues of $122.9 million, 20% more than the same quarter in 2012. The company also released operating metrics for April, which saw retail customer volume jump 48% in comparison with April 2012 and institutional volume leap 78%, and reach the highest levels ever … “FXCM Reports Record Revenue in Q1, High Trading Volume”

Rajesh Yohannan Named OANDA Managing Director and CEO in

Rajesh Yohannan, who formerly worked at Citibank will manage OANDA’s Asia Pacific operations. The region does not include Japan, which has a unique market. Mobile trading will be in focus. OANDA recently launched a shiny new mobile trading application. For more on the appointment, here is the official press release: LONDON – May 7, 2013 … “Rajesh Yohannan Named OANDA Managing Director and CEO in”

Trader of the Year 2013 Contest – Registration is Open

The 6th edition of FXstreet’s Trader or the Year contest is now open for registration. Registration closes on June 1st and the contest begins on June 2nd. Various prizes are offered to the winners. Are you a skilled trader? Show it. More details are in the press release below: FXstreet.com, in collaboration with AFB FX, … “Trader of the Year 2013 Contest – Registration is Open”

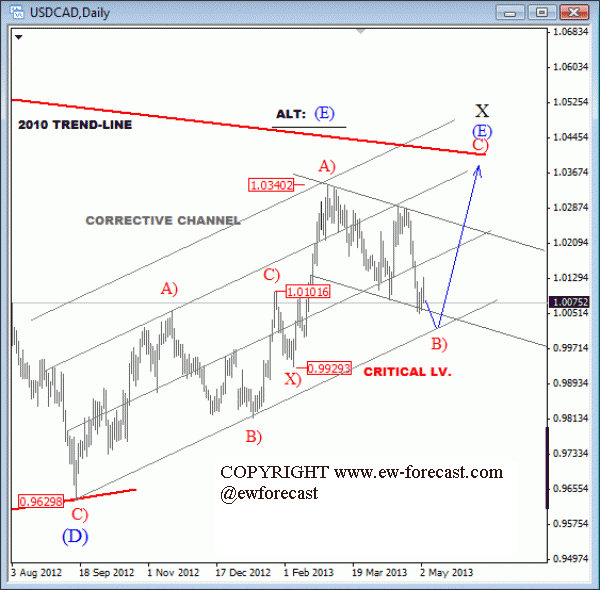

USDCAD Could Look for a Support This Week at Trend-line

The Canadian dollar has been one of the best performers last week and it gained strongly against the USD. We can see a sharp fall on USDCAD back to 1.0050 area, but still only into a third leg of decline from 1.0340, which is a a structure of a contra-trend movements. Notice that the pair … “USDCAD Could Look for a Support This Week at Trend-line”

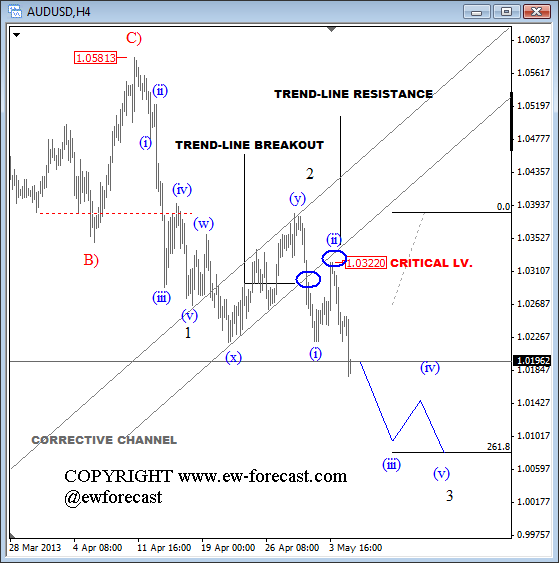

AUDUSD: Break of 1.0220 Support After RBA Puts 1.0100 In

AUDUSD fell through the 1.0220 support today, which was expected after last week’s break through the lower side of a corrective channel followed by a pull-back on Friday that found a top at 1.0322 after the NFP report, exactly at that channel line that turned into a resistance. That’s a very nice clear continuation pattern … “AUDUSD: Break of 1.0220 Support After RBA Puts 1.0100 In”