Hopes for the UK economy are driving the UK pound higher, especially against the US dollar, today. Rising home prices are providing optimism that the UK economy is improving, and that is reflected in sterling gains today. The latest home prices news is in, and it appears that asking prices for homes in the United Kingdom rose by 2.1 per cent in May. This brings the total increase for the year so … “UK Pound Gains as Home Prices Rise”

Month: May 2013

GOLD Bearish Reversal in Progress, Could Hit 1300 –

GOLD reversed nicely, in a perfectly lower manner from the $1490 area seen two weeks back to where the base channel turned into a resistance line as discussed in our latest video analysis. Notice that the fall from that zone is now very sharp, showing evidence of an increase in volume and momentum, so we … “GOLD Bearish Reversal in Progress, Could Hit 1300 –”

Taiwan Dollar Attractive for Investors

The Taiwan dollar gained today on signs that nation’s assets were attractive to overseas investors, leading to inflows of foreign funds, and as politicians were planning to review taxes on capital gains. Speculators have bought $996 million more Taiwanese shares than they sold by the end of last week, and this yearâs net purchases totaled $4.8 billion. Deputy Finance Minister Tseng Ming-Chung said that the government will form a committee … “Taiwan Dollar Attractive for Investors”

Yen Rebounds on Concerns Weak Currency Can Hurt Economy

The Japanese yen gained today as politicians were worried that the excessive drop of the currency may be not that beneficial for the country and may actually hurt the economy. Japanese Economy Minister Akira Amari said that “excessive yen gains have been corrected a lot”. He voiced concern that further depreciation can make negative impact on Japanese consumers. The yen gained on the news, but the rally was limited and the currency … “Yen Rebounds on Concerns Weak Currency Can Hurt Economy”

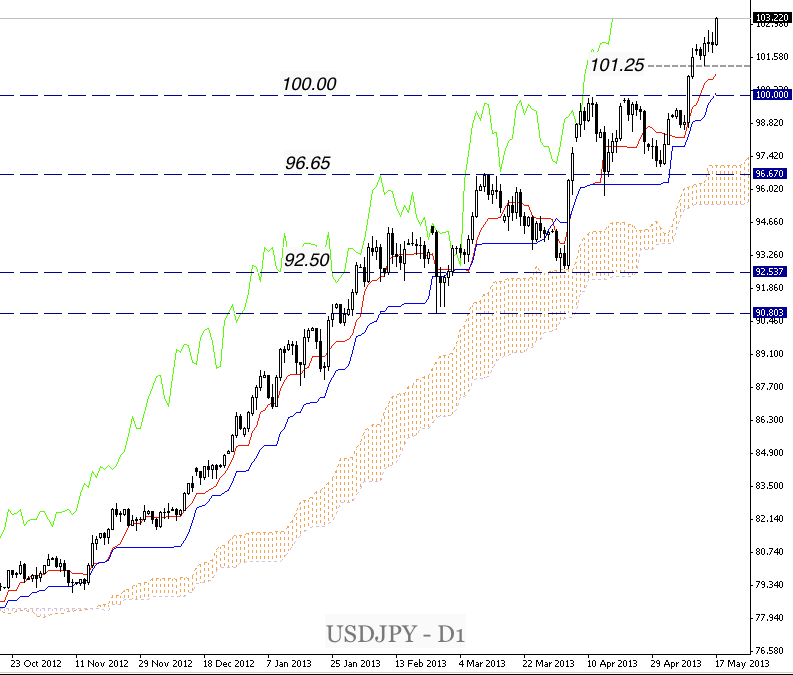

USD/JPY Technical Update: No Pullback So Far – Where

Dollar/Yen is trading over 300-pips above the key psychological 100.00 round number area, after breaking above the consolidation range resistance on the 9th May. There has been no pullback to the previous resistance area during subsequent trading and this remains as a key technical point of interest going forward – with any retrace to this … “USD/JPY Technical Update: No Pullback So Far – Where”

Speculations About End of QE Pushes Dollar Upward

This week was relatively quiet in terms of news, though some important macroeconomic reports were released. Meanwhile, the US dollar was rising against other most-traded currencies and the Dollar Index surged to the highest level in almost three years. As was expected, the dollar managed to rally despite possible obstacles. The major driver of the gains was speculation that the Federal Reserve will end its quantitative easing program. This week’s … “Speculations About End of QE Pushes Dollar Upward”

AUD/USD: Where next after the collapse? A look at the

The Aussie crashed against the US dollar. It lost the long term range, the parity line and then the uptrend support line that accompanied it since mid 2011. Where is it headed now? Some think it could fall as low as 0.60. Here’s a view at the levels lost and the big levels ahead. The … “AUD/USD: Where next after the collapse? A look at the”

Canadian Dollar Slumps as Inflation Decelerates

The Canadian dollar slumped today, touching the lowest level since March against its US peer, as inflation slowed last month, decreasing probability of an interest rate hike from the Bank of Canada. The Consumer Price Index rose 0.4 percent in April from a year ago. It was the slowest growth since October 2009. Consumer prices fell 0.2 percent, month-on-month. The BoC was talking about raising interest rates … “Canadian Dollar Slumps as Inflation Decelerates”

Chilean Peso Drops vs. Dollar even as Monetary Policy Remains Stable

The Chilean peso weakened today against the US dollar even though the central bank refrained from cutting interest rates yesterday. The currency advanced versus the euro. The Central Bank of Chile kept its main interest rate at 5 percent. The central bank said in the statement that “international financial conditions show some improvement”. Regarding Chile’s fundamentals, the bank noted: Domestically, first-quarter indicators show decelerating output and demand. The labor … “Chilean Peso Drops vs. Dollar even as Monetary Policy Remains Stable”

Political Infighting Takes Toll on Euro

Disagreement over the vision of the eurozone is starting to take its toll on the euro. Lack of unified leadership at a time of economic difficult and continued sovereign debt crisis is contributing to the euro hitting a six week low in earlier trading. French President Francois Hollande is once again pressing for greater integration in the eurozone, and the ECB has been announced as the bank supervisor for the eurozone. However, even though the French president is interested in greater … “Political Infighting Takes Toll on Euro”