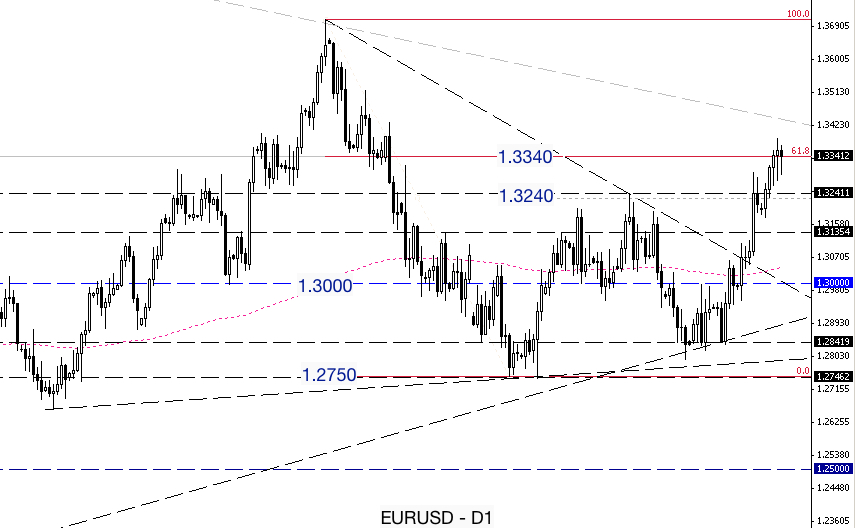

EURUSD finished last week close to the 61.8% Fibonacci retrace area, as shown on the attached chart, an area aligned with the weekly 200 period SMA. Euro/dollar bulls will be looking for near term support in the 1.3240 area, a level that marks a significant previous swing high. Price action developments around this area could help provide a directional bias … “EUR/USD Technical Analysis June 17-21”

Month: June 2013

Why is the euro so high? Join a webinar

The euro is hit by a debt crisis and hopeless economic weakness, yet it remains relatively strong, frustrating many. We will explore what is keeping up the single currency and especially EUR/USD, the world’s most popular pair. On Monday, June 17th, at 14:00, I will hold on a webinar, courtesy of FXstreet, on the topic, … “Why is the euro so high? Join a webinar”

Fourth Weekly Gain for Yen

The Japanese yen gained this week as policy makers disappointed those Forex market participants who counted on continuous aggressive easing from the Bank of Japan. It was the fourth consecutive weekly gain. The BoJ frustrated traders, who hoped for additional stimulus, as the bank left its monetary policy unchanged this week. Moreover, on last month’s meeting some policy makers suggested that the term for quantitative easing should be … “Fourth Weekly Gain for Yen”

CAD Reaches Monthly Record vs. USD Before Retreating

The Canadian dollar touched the highest level in a month against its US peer before retreating below the opening level yesterday. The currency fell against the Japanese yen as well because domestic fundamentals were not supportive for the currency. Positive data from the United States led some traders to believe that the Bank of Canada will raise interest rates. The USA is the biggest trading partner of Canada, therefore the good health of the US … “CAD Reaches Monthly Record vs. USD Before Retreating”

Yen Closes Higher After BoJ Minutes

The Japanese yen closed noticeably higher today as the minutes of the Bank of Japan meeting in May showed that some policy members suggested limiting the term for quantitative easing. The BoJ meeting revealed that the members of the bank’s Board believed that the economy will start to recover this year, but acknowledged that “there remained a high degree of uncertainty concerning the economy”. One of the policy makers suggested: In a situation where it seemed difficult … “Yen Closes Higher After BoJ Minutes”

Norway Krone Falls as Officials Talk About Stimulus, Rebounds

The Norwegian krone fell today on signs that policy makers are ready to stimulate economy if its growth slows further. As of now, the currency managed to return above the opening level. The Norwegian economy is not particularly bad, but officials are concerned about possible spillover of problems from the rest of the European Union. Sigbjoern Johnsen, the Norwegian Minister of Finance, said earlier this week: To be faithful now, in a more … “Norway Krone Falls as Officials Talk About Stimulus, Rebounds”

Calling time on commodity currencies

Commodity currencies, such as AUD, NZD, ZAR and CAD, have been on a downward trend versus USD due to a series of short-term factors. But given the commodity super-cycle has more or less run its course, it is unlikely that these currencies will make significant sustained recoveries over the longer-term. In the short-term, the selling … “Calling time on commodity currencies”

Good Domestic Fundamentals Do Not Help NZ Dollar

The New Zealand dollar retreated today even though domestic macroeconomic data was rather good and suggested that the economy is faring well. The BusinessNZ manufacturing Purchasing Managers’ Index rose from 55.2 in April to 59.2 in May. The Food Price Index grew 0.3 percent last month. The New Zealand dollar was rising for three sessions in the previous four days. Currently, the kiwi is trying to erase the drop versus … “Good Domestic Fundamentals Do Not Help NZ Dollar”

Positive US Indicators Bring CAD Higher

The Canadian dollar rallied today as positive macroeconomic data from the United States improved prospects for Canadian exports, increasing the appeal of the nation’s assets. The currency remained below the opening level against the Japanese yen and dropped versus the Australian dollar. Usually, good reports from the USA are positive for CAD as the country is the biggest trading partner of Canada. Yet nowadays any good news makes traders worry that the Federal Reserve … “Positive US Indicators Bring CAD Higher”

Positive Australian Employment Data Boosts Aussie

The Australian dollar jumped today after employment data turned out to be much more positive than was expected by Forex market participants. The report allowed the currency to gain against the US dollar and the euro, while against the Japanese yen the Aussie managed to erase losses. Australian employment grew by 1,100 in May from April. It was much better reading than a drop by 9,800 anticipated by traders. Moreover, the unemployment rate … “Positive Australian Employment Data Boosts Aussie”