The Swedish krona fell today as industrial production unexpectedly declined in April, putting pressure on the central bank to cut interest rates. Statistics Sweden reported that industrial production fell 0.5 percent in April on a seasonally adjusted basis. The annual decrease was at 0.8 percent. Market participants have hoped for an increase by 0.7 percent. The Riksbank kept rates unchanged on its last meeting, but today’s data suggested that an interest rate … “Krona Falls as Swedish Industrial Production Declines”

Month: June 2013

Indian Rupee Drops to Record Low

The Indian rupee dropped today to the record low against the US dollar today on concerns that the US Federal Reserve will remove monetary stimulus. Last week’s US non-farm payrolls boosted the dollar against other currencies, including the rupee. The weakening currency may lead to an increase of the Indian current account deficit. The rupee fell below the previous record low of 57.3275 set in June 2012. USD/INR jumped from 57.0655 to 57.9550 … “Indian Rupee Drops to Record Low”

FxPro’s Agency Model – One Year On

Forex broker FxPro is celebrating one year to its launching of the agency model. For the first anniversary of this big change in the broker’s model, here is an article taking a look back in retrospective. It has been a year since FxPro transitioned to an Agency Model of order execution across all of our trading … “FxPro’s Agency Model – One Year On”

GBP/USD: Trading the British Manufacturing Jun 2013

The British Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the health of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 8:30 GMT. Indicator Background … “GBP/USD: Trading the British Manufacturing Jun 2013”

EUR/USD & EUR/AUD Surge Over Week, EUR/GBP & EUR/JPY Down

The euro had a stellar week against the US and Australian dollars, but performance against some other currencies, including the Great Britain pound and the Japanese yen, was less impressive. The most important event for the euro this week was the monetary policy decision of the European Central Bank. As was expected the policy remained unchanged. The announcement turned out to be very bullish for the currency. Other central banks also kept their policies … “EUR/USD & EUR/AUD Surge Over Week, EUR/GBP & EUR/JPY Down”

Pound Closes Lower vs. Dollar, Gains on Yen

The Great Britain pound fell against the dollar as US employment growth exceeded expectations. The currency erased losses versus the Japanese yen and trimmed its drop against the euro as the UK trade balance deficit narrowed. US non-farm payrolls grew by 175,000 jobs in May, beating the analysts’ forecast of 167,000. The data suggested that the Federal Reserve may indeed reduce its monetary stimulus. Such outlook bolstered the dollar against the sterling. … “Pound Closes Lower vs. Dollar, Gains on Yen”

Canadian Dollar Jumps on Biggest Employment Growth in Decade

Perhaps, US employment data was the most important event today, but it was Canadian employment that shocked the Forex market. And it surprised in a positive way, allowing the Canadian dollar to surge. Analysts have predicted an increase by 16,100 in May, following the March’s rise by 12,500. But in fact Canadian employment grew by mind-boggling 95,000. It was the biggest job gain since August 2002. Additionally, the unemployment rate unexpectedly … “Canadian Dollar Jumps on Biggest Employment Growth in Decade”

Greenback Gets Upper Hand on Payrolls Data

US dollar is heading higher today following the most recent payrolls data. The result is adding a bit of confusion, though, since it muddies the water as to what might be next for the Federal Reserve. The nonfarm payrolls report for May is in for the United States, and the result has surprised analysts. Payrolls showed an increase of 175,000, even though the unemployment rate ticked higher, to 7.6 per cent. The result is that the greenback … “Greenback Gets Upper Hand on Payrolls Data”

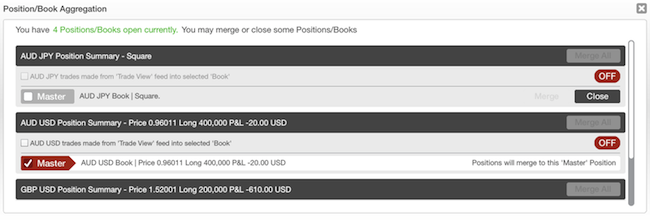

MahiFX presents new, simple trade view features

New Zealand based forex broker MahiFX launches new trading features. The new design is meant to simplify trading for forex traders. MahiFX recently won the Best Trading System at the FStech Awards. More details are available from the press release below: 07 June 2013 – Monitoring numerous open positions can be challenging for even the most … “MahiFX presents new, simple trade view features”

Euro Pulls Back After Yesterday’s Bounce

Euro is heading lower today, pulling back after yesterday’s bounce. Once again, Forex traders are looking to the future, and wondering if — perhaps — Mario Draghi’s optimism yesterday was a bit overdone. Yesterday, with the ECB holding off on further stimulus measures, and with ECB President Mario Draghi painting an upbeat picture of the economic forecast for the eurozone, the euro bounced higher against the US dollar. Today, though, the euro … “Euro Pulls Back After Yesterday’s Bounce”