The Japanese yen fell today as comments of US policy makers made investors less scared and reduced demand for the currency as a safe haven. Not that need for safety was helping the yen previously. US policy makers were trying to hush speculations about an end to quantitative easing. They were successful to some degree. It is interesting to see that the yen suffered more than the dollar. To tell the truth, currently the yen … “Yen Falls as Investors Less Scared of QE End”

Month: June 2013

Dollar Mixed as Policy Makers Say QE End Is Not Near

US policy makers are trying to downplay expectations of stimulus reductions that spurred risk aversion on the Forex market. Such attempts weakened the US dollar against some currencies, including the euro, but the greenback retain strength versus some other majors like the Great Britain pound and the yen. Yesterday, Jeffrey Lacker, the President of the Federal Reserve Bank of Richmond said: Markets got a little bit ahead of us in terms of what … “Dollar Mixed as Policy Makers Say QE End Is Not Near”

6 Months in, What do the Forex Markets Have in

Guest post by Alfonso Esparza, Senior Currency Strategist at Alfonso Esparza What dates and events will have most impact on the currency markets in 2013? Certain economic indicators have risen in the ranks as they now dictate more than the underlying figures they represent. The United States has started to strengthen its economic recovery narrative. Every … “6 Months in, What do the Forex Markets Have in”

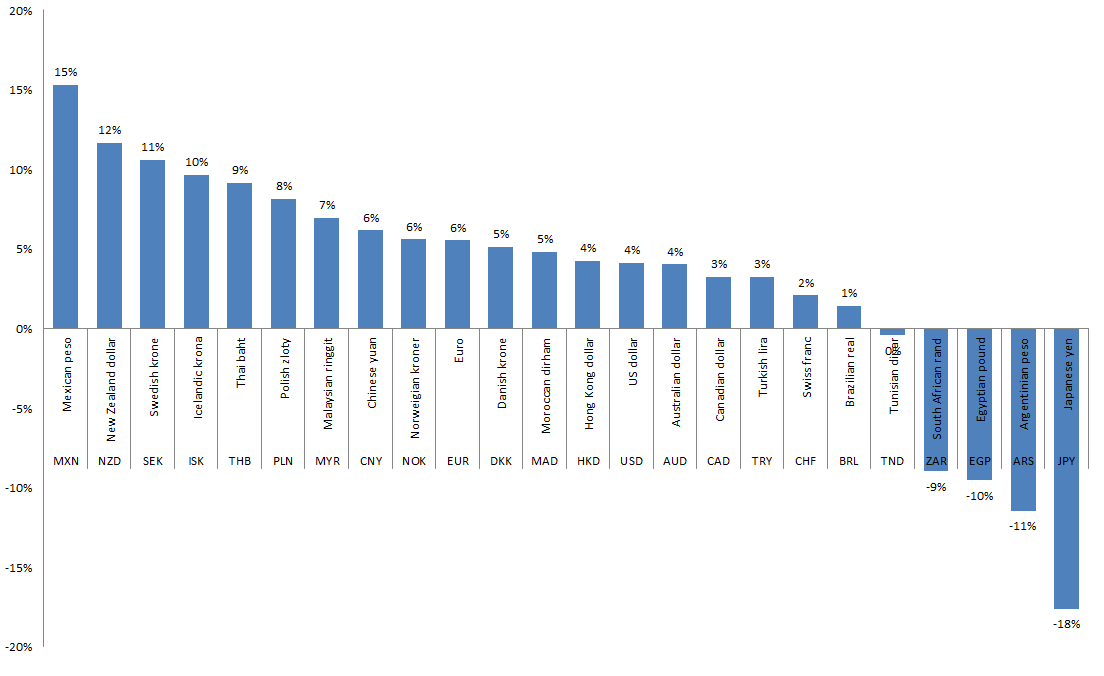

Year-on-year trends of the top traded currencies: May review

Overall it has been another volatile year in the currency markets with seismic moves which included the major currencies. The impact of Central Banks stepping up their aggression to help boost domestic growth has had a huge impact on currency movements and momentum. The Japanese Yen (JPY) has been the biggest loser shedding 21 per … “Year-on-year trends of the top traded currencies: May review”

Risk Appetite Helps Canadian Dollar

Canadian dollar is getting a bit of help today, thanks largely to the risk appetite brought on by European confidence. Risk assets are in demand today, and that is providing some support to the loonie against the greenback. Canadian dollar is rising against its US counterpart today as risk appetite reduces the interest in safe haven and as Forex traders come out looking for yield. The latest news from the eurozone, showing improving sentiment, … “Risk Appetite Helps Canadian Dollar”

Pound Falls as Current-Account Deficit Widens

The Great Britain pound dropped today as the current account deficit widened unexpectedly last quarter, leading to concerns about sustainability of economic growth. UK economic growth remained unrevised in the final estimate, showing 0.3 percent increase in the first quarter of 2013 after the contraction by 0.2 percent in the preceding quarter. Yet the current account showed a deficit of £14.5 billion in Q1 2013. It was above £13.6 billion in Q4 2012 and the forecast … “Pound Falls as Current-Account Deficit Widens”

Euro Gets Boost After Confidence Report

Euro is getting a boost today, thanks in part to the latest confidence report out of the eurozone. Also helping the situation for the euro is the fact that there has been some improvement in Germany’s numbers as well. If consumers are getting ready to spend, and if things are improving in Germany, there is a chance that the eurozone could start moving out of recession. The European Commission reported that the Economic Sentiment Indicator … “Euro Gets Boost After Confidence Report”

NZ Dollar Rises with Business Confidence

The New Zealand dollar gained today as business confidence improved this month. The currency advanced even as trade surplus unexpectedly shrank last month. The ANZ Business Confidence index rose from 41.8 in May to 50.1 in June. Meanwhile, the New Zealand trade surplus narrowed from NZ$174 million in April to NZ$71 million in May. Market analysts have promised an increase to NZ$412 million. NZD/USD rose from 0.7784 to 0.7843 and NZD/JPY … “NZ Dollar Rises with Business Confidence”

USD/CAD: Trading the Canadian GDP Jun 2013

Canadian Gross Domestic Product (GDP) is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on … “USD/CAD: Trading the Canadian GDP Jun 2013”

USD/CAD: Correction Within Uptrend; Can We See 1.0600?

USDCAD is in a pull-back mode from latest high which we think is just another correction within a larger incomplete uptrend. We are tracking an impulsive structure from 1.0134 that needs to be made by five smaller waves. For now that’s not the case so we think that the current bearish reversal represents a corrective … “USD/CAD: Correction Within Uptrend; Can We See 1.0600?”