The South Korean won recovered a bit today, following the previous massive slump. The currency was still heading to a big weekly loss. The prospects for an end to Federal Reserve quantitative easing scared investors and led to capital outflows from emerging economies. The won sank because of that, but now is attempting to recover, following some other risky currencies. Still, the South Korean currency is 2.5 percent down over the week … “Won Recovers, Still Heading to Weekly Loss”

Month: June 2013

Zloty Rebounds with Bonds

The Polish zloty gained today, bouncing from the previous huge slump, as nation’s bonds rallied and traders speculated that the drop was excessive. The yield on bonds maturing in 10 years dropped seven basis points to 4.19 percent. It jumped 40 basis points yesterday, the biggest gain since October 2008. Risky currencies demonstrated massive losses after the US Federal Reserve suggested that it may reduce its … “Zloty Rebounds with Bonds”

Intra-day Elliott Wave Review For EURUSD and E-mini S&P

The FX market did not move much in the last two sessions, which is not a surprise as price action needs a break after very strong moves following the big FOMC decision on Wednesday. This pause is called a corrective price action, it is a contra-trend movement that is part of larger on-going trend. In … “Intra-day Elliott Wave Review For EURUSD and E-mini S&P”

Franc Stronger After SNB Meeting

The Swiss franc rose today after the central bank left its monetary policy unchanged, keeping the cap on the currency intact, but refraining from any unconventional measures to spur growth. The Swiss National Bank left its interest rates near zero and the franc’s ceiling at 1.20 per euro. Chairman Thomas Jordan explained the necessity of the cap at the press conference after the announcement: An appreciation of the Swiss franc would compromise price stability … “Franc Stronger After SNB Meeting”

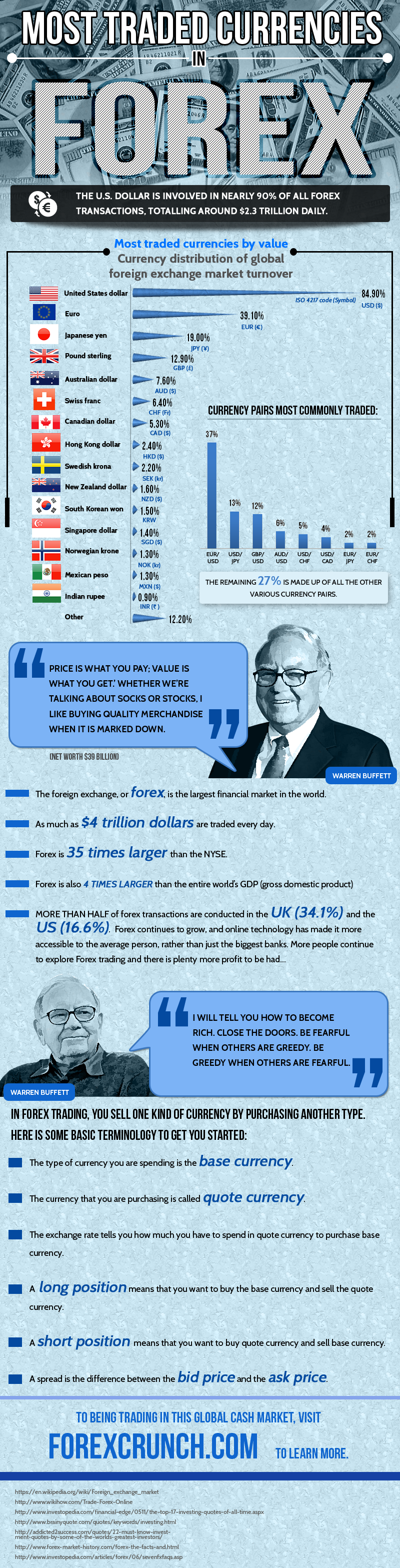

Most Traded Currencies – Infographic

Not all currencies enjoy the same popularity and not all currency pairs have the same popularity or the same spreads. There is a clear hierarchy. The infographic below show the most traded currencies in the world. The image is courtesy of Marcus Holland of financialtrading.com

QExit talk is overdone, but USD rally likely for time

Ben Bernanke reiterated on Wednesday plans to slowly wind down the US Federal Reserve’s quantitative easing programme, which the markets seem to be increasingly treating as a given. However, it’s far from certain that QE will end and could be quickly reintroduced even if it is stopped. But for as long as the forex markets … “QExit talk is overdone, but USD rally likely for time”

Bernanke Announcement Prompts US Dollar Rally

Yesterday’s policy announcement from the Federal Reserve is boosting the US dollar today as Forex traders look to the removal of a drag on the currency. Yesterday, the Federal Reserve’s FOMC completed a two-day policy meeting and Fed Chair Ben Bernanke described the policy decision from the body. Bernanke said that if the economy continues to improve, the Fed could begin tapering its asset purchase program by the end of this year, and that quantitative easing … “Bernanke Announcement Prompts US Dollar Rally”

Japanese Yen Weakens Against Major Counterparts

Japanese yen is weaker today, dropping against its major counterparts as domestic news weighs on performance. Additionally, USD/JPY is extending gains on the latest news out of the United States. Japanese yen is heading lower today against its major counterparts as weakness shows through. Part of the difficulty is the aggressive easing being practiced by the Bank of Japan at the behest of Prime Minister Shinzo Abe. However, other factors are … “Japanese Yen Weakens Against Major Counterparts”

Cambridge Morning Commentary- June 20, 2013

The big news overnight was the fallout/euphoria from the US Federal Reserve rate announcement, statement, and press conference. As expected, no policy changes, however everyone is talking about the hawkish update to the Fed’s economic outlook and press conference. Let’s start with the outlook, as mentioned in yesterday’s ‘post-Fed’ Cambridge Market Update, markets were caught … “Cambridge Morning Commentary- June 20, 2013 “

Aussies Falls with China’s Manufacturing PMI

The Australian dollar touched the lowest level in more than two years against its US peer today as China’s manufacturing slowed more than was expected and the US Federal Reserve signaled that it may tamper its quantitative easing later this year. The HSBC Flash China Manufacturing Purchasing Managersâ Index fell from 49.2 in May to 48.3 in June. Market participants have anticipated a small increase to 49.4. … “Aussies Falls with China’s Manufacturing PMI”