On Wednesday, volatility finally arrived. That was the most volatile day in EUR/USD since May. What happened? The dollar dropped against most of its major peers. Only on Tuesday, it tested the lowest levels since April 10th. But on Wednesday, after Bernanke’s dovish speech, the sentiment turned around and started weakening the dollar.

The FED pushed out the expectation that the tapering of QE will come soon. The main scenario seems now that tapering comes for sure in the fall, but the pace might be slower than the market had previously expected.

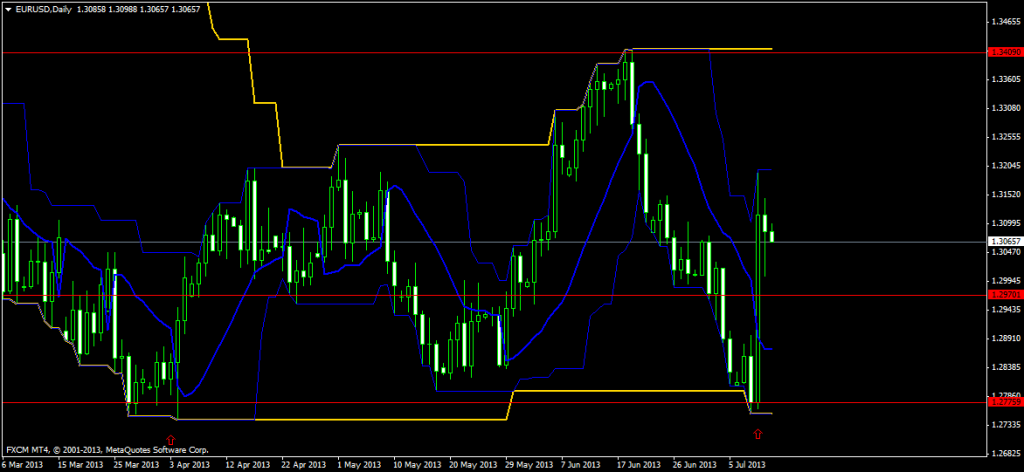

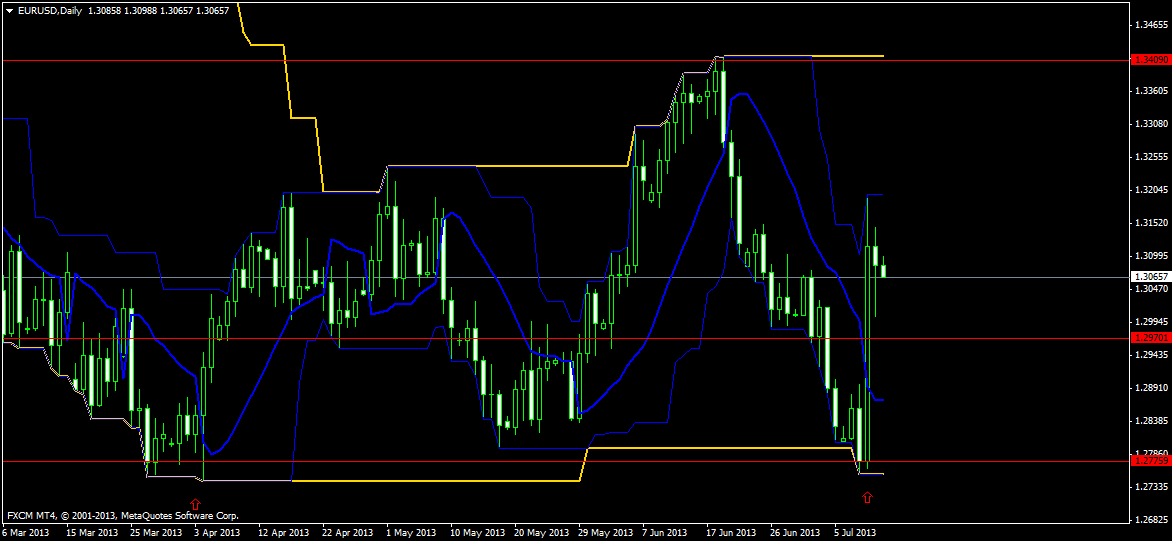

On the technical side we see bullish sentiment on EUR/USD: Firstly, the pair tested on Tuesday the lowest levels since April, and built a double bottom at 1.2775.

Secondly after the big gain on Wednesday, it only made a slight correction on Thursday. So in our scenario we are buying this pair. It might be back test at 1.2970, but in a few days period our target is at 1.3400.