Once again, concerns are returning to the eurozone, and the 17-nation currency is struggling because of it. After last week’s performance, and mixed results for the US dollar, the euro had the upper hand. But today there is a lot of uncertainty and speculation about what’s next for the eurozone. On Thursday, the ECB Monthly Bulletin was released. A lot of the initial release was swallowed up in the release of the most recent Federal Reserve minutes. However, Forex … “Euro Struggles as Concerns Return”

Month: July 2013

Falling inflation could push QE tapering towards late 2013

The market moving comments from Ben Bernanke came in the Q&A and were not part of the carefully structured message. However, falling inflation expectations could be a key element to push QE tapering back from September towards later in the year, says Simon Smith of FxPro. In the interview below, Smith also discusses the gentle … “Falling inflation could push QE tapering towards late 2013”

US Dollar Heads Higher After Last Week’s Sell Off

US dollar is seeing some gains today, thanks to expectations of economic improvement. Greenback is also getting some help following last week’s sell off as Forex traders look to get back into the dollar at a bargain. Greenback is heading higher today as Forex traders expected better US retail sales data. There is speculation that an improved number could weigh on the decision to begin tapering the Federal … “US Dollar Heads Higher After Last Week’s Sell Off”

Market commentary – July 15 2013

The main focus over the weekend was the slew of Chinese data released late Sunday night. Special attention was paid to the GDP numbers for the world’s second largest economy in Q2, especially after comments from the Finance Minister last week that suggested China was becoming increasingly tolerant of lower growth moving forward. The comments … “Market commentary – July 15 2013”

USD/IDR Rises Above 10,000 as China’s Growth Disappoints

The Indonesian rupiah fell today, dropping below the 10,000 per dollar level for the first time since 2009, as slower-than-expected China’s economic growth damped prospects for Indonesia’s exports. Growth of the biggest Asian economy disappointed traders and spurred mild risk aversion, being below market expectations. China is the biggest importer of Indonesian goods. The Indonesian central bank was attempting to support the currency, selling dollars, but it looks like … “USD/IDR Rises Above 10,000 as China’s Growth Disappoints”

Aussie Loses Gains vs. Greenback as China’s Growth Misses Expectations

The Australian dollar rallied today even as China’s growth estimate missed analysts’ forecasts. The currency erased the gains against the US dollar later, but remained firm versus the Japanese yen. China’s gross domestic product expanded 7.5 percent in the second quarter of 2013, according to the National Bureau of Statistics. Market participants have hoped that growth would stay at the first quarter’s rate of 7.7 percent. China is the biggest trading … “Aussie Loses Gains vs. Greenback as China’s Growth Misses Expectations”

Bernanke’s comments undermine the dollar; What to expect this

Forex: The US dollar was not able to hold its previous gains and lost ground against its major counterparts over the past week. Following the FOMC meeting’s minutes release, it became clear that the Fed will continue its stimulus measures as Chairman Bernanke said the central bank has no intention to change its aggressive policy in … “Bernanke’s comments undermine the dollar; What to expect this”

Selling England by the pound – GBP/USD on the defensive

The Bernanke effect last Wednesday pushed the dollar weaker and subsequently Sterling was a major beneficiary of Ben Bernanke’s remarks about the US economy and strengthened. Federal Reserve Chairman Ben Bernanke sought to reassure markets on Wednesday that highly accommodative monetary policy is set to remain in place for the foreseeable future. Speaking at a conference, just … “Selling England by the pound – GBP/USD on the defensive”

EUR/USD: Trading the German ZEW Jul 2013

The German ZEW Economic Sentiment Index is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Tuesday at 9:00 GMT. … “EUR/USD: Trading the German ZEW Jul 2013”

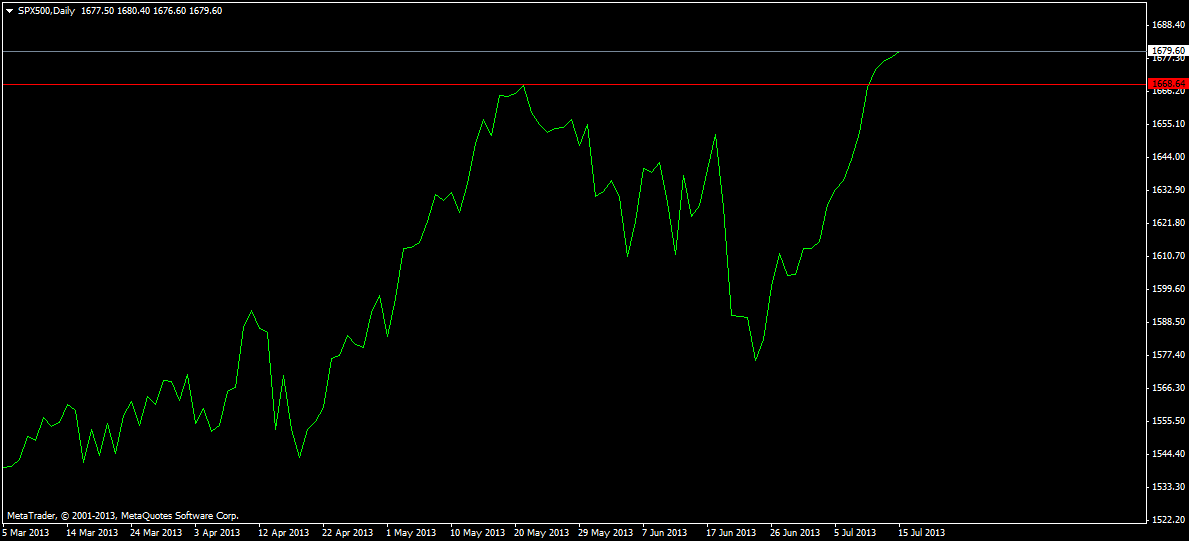

Earning season starts

Let’s see how this affects indices. My bet is that it will make them a bit choppy, but push them to upside. The bottom line is that all US indexes closed last week at new all-time highs. The new historical record in Russel shows how broad and deep the positive sentiment on US markets is. … “Earning season starts”