Japanese yen continues to show weakness today, although it is showing some gains against a weak US dollar. For the most part, though, yen is likely to remain vulnerable against its major counterparts. Japanese yen is lower against the euro and the UK pound today, even though it is gaining against the US dollar. With the idea that the Fed will begin tapering its asset purchase … “Yen Continues to Show Weakness”

Month: July 2013

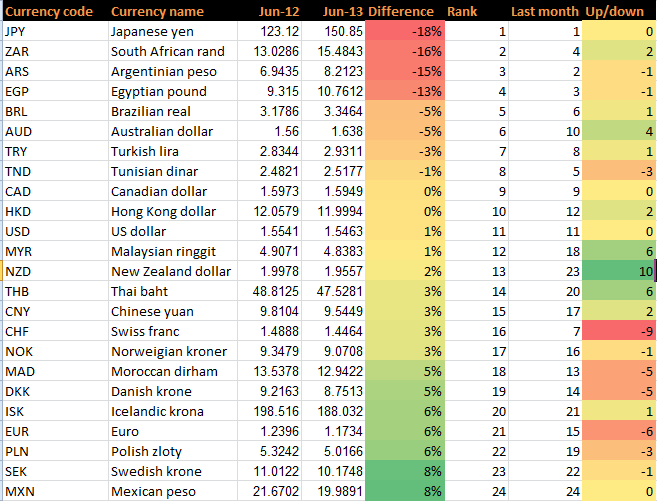

Year-on-year trends of the top traded currencies – June

The Japanese yen (JPY) has remained the biggest loser shedding 18 per cent against the pound following a fundamental shift in monetary policy from the Bank of Japan to a more aggressive approach – favouring a weaker JPY. The commodity currencies have recently unwound sharply from strong levels following expectations that the US Federal Reserve … “Year-on-year trends of the top traded currencies – June”

Uncertain Greek Outlook Doesn’t Phase Euro

After last week’s crash, the euro appears to be starting this week on a slightly better note. Even with uncertainty surrounding Greece, the euro is managing to log gains today. Concerns about whether or not Greece will be able to meet the obligations placed on it by the bailout program instituted by the ECB and IMF are having very little negative impact on the euro right now. However, things could change later … “Uncertain Greek Outlook Doesn’t Phase Euro”

“Good” Jobs Report?

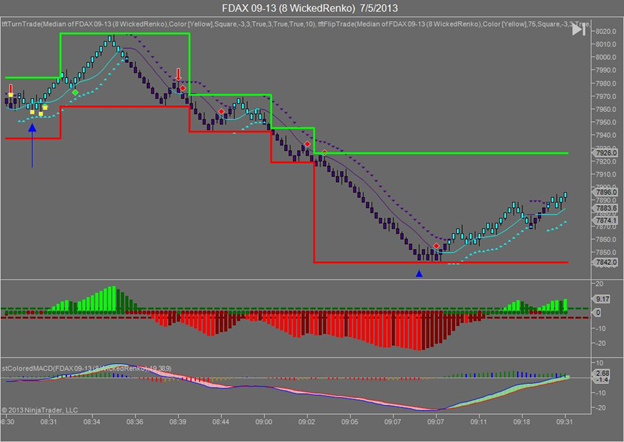

On Friday, July 5th the entire global markets were waiting for the one major economic report to be issued on that day; this being the payroll report. Well the report came out at 8:30 AM EST and showed a gain of 195,000 which was far better than was expected that being 163,000. Well on Friday … ““Good” Jobs Report?”

No End to Dollar’s Gains? It Looks So for Third Week

The US dollar showed no signs that it is going to stop its rally, demonstrating solid gains for the third consecutive week. Speculations about tighter monetary policy continue to help the currency in the environment of widespread monetary accommodation. The major event this week was the release of US non-farm payrolls. They came out much better than expected, reinforcing the opinion that the Federal Reserve may tamper back its … “No End to Dollar’s Gains? It Looks So for Third Week”

CAD Gains on Employment Report, Loses to USD

The Canadian dollar gained today as the employment report came out better than was expected. The currency remained soft against the US dollar as employment data from the United States was good too. Canadian employment contracted by 400 jobs in June from May when it has jumped by 95,000. It was not a very good figure, but it was certainly better than the expected drop by 4,200. The unemployment … “CAD Gains on Employment Report, Loses to USD”

Non-Farm Payrolls Bring Dollar Higher

The US dollar jumped today as growth of nonfarm payrolls exceed forecasts, suggesting that the Federal Reserve can reduce stimulus without damaging the economy too much. US non-farm payrolls grew by 195,000 in June, maintaining the same rate of expansion as in the preceding month. Experts have predicted an increase by just 163,000. At the same time, the unemployment rate stayed at 7.6 percent, disappointing market participants who have expected a decrease to 7.5 percent. … “Non-Farm Payrolls Bring Dollar Higher”

3 reasons why this jobs report is really great

The headline job gains number for June showed a gain of 195K jobs and no change in the unemployment rate which stands at 7.6%. After a strong ADP number and a good employment component in the ISM Non-Manufacturing PMI, this headline number was not such a big surprise. Revisions were strong, but in the past … “3 reasons why this jobs report is really great”

EUR/USD: Trading the US NFP Jul 2013

US Non-Farm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Indicator Background … “EUR/USD: Trading the US NFP Jul 2013”

Bearish Pattern on 30 Year US Bonds Could Cause Risk-Off

USD is in bullish mode since yesterday’s ECB and BOE rate decisions when both banks decided to leave the policy unchanged but made very dovish statements. USD is up against the EUR, GBP and CHF, but slightly down against the JPY and commodity currencies. So, the picture is quite mixed across the market, especially if … “Bearish Pattern on 30 Year US Bonds Could Cause Risk-Off”