In a big week for economic data, the UK pound is mixed following today’s earlier releases. Pound drifted higher briefly, before falling against its low-beta counterparts, even while remaining higher against the euro. UK mortgage approvals data was released earlier, indicating that things aren’t going quite as well as hoped. Expectations were for an increase in mortgage approvals of 597,000, but instead that number came in at 577,000. … “UK Pound Mixed After Economic Releases”

Month: July 2013

Is the smart money fleeing stocks?

Institutional investors have been net sellers of stocks for the most of the past year or so.. Since late June, this trend increased, with the 4 week average flirting with sales of 1 billion dollars. On the other hand, retail investors have been net buyers since early June, temporarily reaching levels last see two years … “Is the smart money fleeing stocks?”

Euro Lower Ahead of Busy Week

This week is expected to be very busy, and the euro is lower today in anticipation. There is a lot of economic data expected this week, as well as central bank decisions to be made. Many Forex traders will be watching this week for signs that global economies are on the mend. There is special interest in the eurozone and in the United States. However, expectations are that the US economy will come … “Euro Lower Ahead of Busy Week”

Fed Chair impact on USD: Summers up, Yellen down

It is now quite clear the Fed Chairman Ben Bernanke will not continue in his position when his term ends in January 2014. The debate about his successor is heating up, and two main candidates are emerging: Janet Yellen and Larry Summers. US President Barack Obama is reportedly thinking about the nomination and will present … “Fed Chair impact on USD: Summers up, Yellen down”

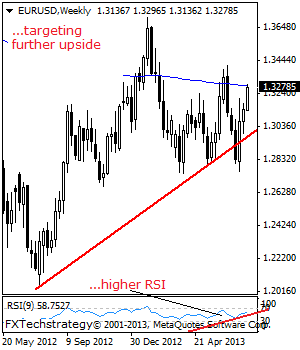

EURUSD: Pressure Builds On The 1.3415 Level

EURUSD: With a strong rally pushing the pair higher for a third consecutive week, further strength is expected in the new week. This development has left the pair targeting further upside towards the 1.3415 level with a break resuming its broader upside and turning attention to the 1.3450 level. A cut through here will aim … “EURUSD: Pressure Builds On The 1.3415 Level”

AUD/USD: Trading the Australian Building July 2013

Australian Buildings indicator measures the change in the number of new building approvals issued. It is one of the most important indicators of the construction sector. A reading that is higher than the market prediction is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Tuesday … “AUD/USD: Trading the Australian Building July 2013”

Dollar Soft Ahead of Fed Meeting

The US dollar was broadly lower this week against most currencies, including the Japanese yen, which was unexpectedly strong. Traders were selling dollar ahead of next week’s meeting of the Federal Reserve members. Without any important event during the current week, traders were focusing on the future and speculating if the US central bank maintains stimulus or no. The Fed members will meet next week and will announce … “Dollar Soft Ahead of Fed Meeting”

Canadian Dollar Mostly Flat in Thin Trading

After gaining some ground earlier on oil prices, the Canadian dollar is mostly flat today. Trading is thin, and the loonie is looking for direction — much like other currencies. US dollar took a dive after last nights article in the Wall Street Journal suggested that the Federal Reserve is likely to put off tapering its bond buying program. With the prospect of a weaker greenback, the loonie got a boost. … “Canadian Dollar Mostly Flat in Thin Trading”

Abenomics Spurs Gains for the Japanese Yen

There is evidence that the Japanese economy is on the upswing, and many people are crediting Abenomics with the fact that significant inflation might be coming to Japan for the first time in nearly 20 years. The latest economic data indicates that core inflation in Japan has increased by 0.4 per cent. This is the fastest rate since November of 2008, when core inflation increased by 0.1 per cent. For the last … “Abenomics Spurs Gains for the Japanese Yen”

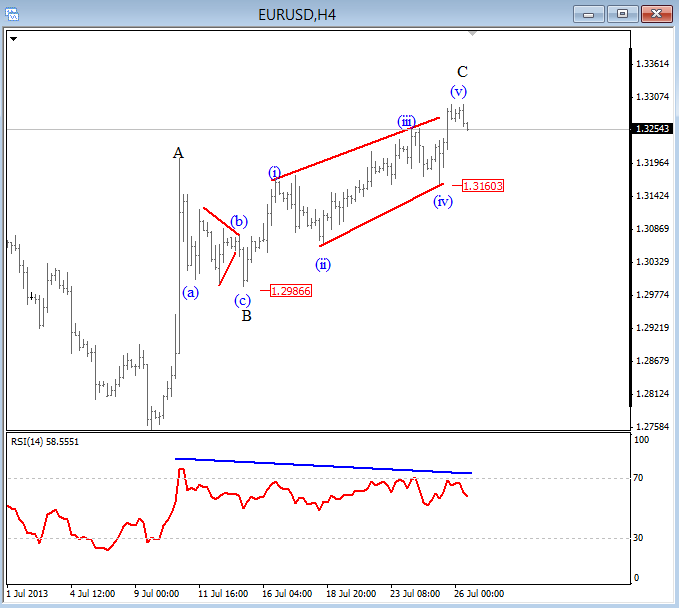

EURUSD: Prices to go up before falling – Elliott Wave

EURUSD is moving higher for the last few days but on a very low volume and momentum, which is usually an early signal for a trend change. This is clearly evident on RSI with bearish divergence. From an Elliott Wave Perspective we can also see a three wave A-B-C rise from 1.2750 which is a … “EURUSD: Prices to go up before falling – Elliott Wave”