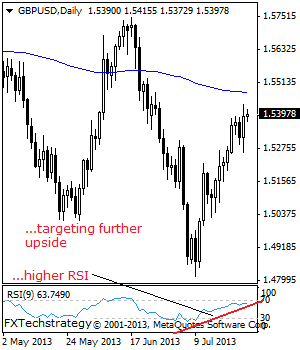

GBPUSD: With GBP returning above the 1.5304 level, further upside offensive is likely towards the 1.5450 level. Further out, resistance stands at the 1.5500 level where a violation will aim at the 1.5550 level. Its daily RSI is bullish and pointing higher suggesting further upside. On the downside, support lies at the 1.5304 level where … “GBPUSD: Maintains Bullish Momentum, Targets Higher Prices”

Month: July 2013

Euro Strong vs. Dollar & Pound, Weak vs. Yen

The euro climbed against the US dollar and rose versus the Great Britain pound as German business climate continue to improve and Spanish unemployment shrank. The currency fell for the second day against the Japanese yen, erasing the big advance that it has made on Wednesday. The German Ifo Business Climate Index rose for the third straight month, advancing from 105.9 in June to 106.2 in July. Spanish unemployment ticked down by 0.9 percentage point … “Euro Strong vs. Dollar & Pound, Weak vs. Yen”

Greenback Slumps as Focus Shifts Away From Currencies

US dollar is slumping a little bit today, thanks in part to a shift of focus away from currencies. The latest economic data release hasn’t done a lot to encourage the greenback, and many institutional Forex traders are instead looking at earnings and focusing on stocks right now. The latest durable goods data released in the United States shows a stronger than expected performance. However, this news was offset a little bit by a rise … “Greenback Slumps as Focus Shifts Away From Currencies”

Falling Crude Oil Drags Ruble Down

The Russian ruble slid today as the decline of crude oil reduced attractiveness of assets related to the major oil-exporting country. Futures for crude slipped 0.6 percent to $104.72 per barrel in New York today. Oil together with natural gas makes up about 50 percent of export revenue for the biggest energy-exporting country in the world. Crude oil was weakening as traders were concerned about global economic growth. Such concerns were … “Falling Crude Oil Drags Ruble Down”

Worsening Eurozone debt levels could see September Euro sell-off

While volatility levels have been dropping in forex markets recently fault lines in the Eurozone have been deepening, which could see the Euro under pressure come September when institutional investors return to their desks and re-evaluate Eurozone asset markets. Asset markets have generally been soothed by comments supporting economic growth from the US Federal Reserve, … “Worsening Eurozone debt levels could see September Euro sell-off”

NZ Dollar Jumps as RBNZ Signals About Monetary Tightening

The New Zealand dollar jumped today as the central bank signaled that it is going to tighten its monetary policy even though this is not going to happen this year. The Reserve Bank of New Zealand kept its main interest rate today. Reserve Bank Governor Graeme Wheeler said that the currency remains excessively strong: Despite having fallen on a trade-weighted basis since May 2013, the New … “NZ Dollar Jumps as RBNZ Signals About Monetary Tightening”

UK Pound Drops on Latest GDP Data

UK pound is lower against the euro today, thanks in large part to the latest GDP data. Sterling hasn’t changed much against the US dollar, and is higher against the Japanese yen. Sterling is struggling today as the latest GDP data has been released. The Office for National Statistics reports that second quarter GDP for the United Kingdom expanded at a rate of 0.6 per cent. This was in line with some … “UK Pound Drops on Latest GDP Data”

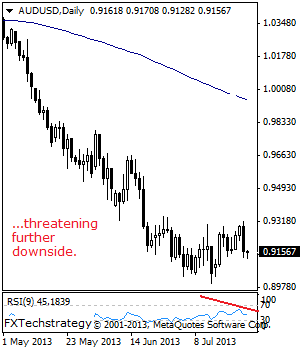

AUDUSD: Bearish, Risk Points To The 0.8997 Level

AUDUSD: With a sell of ending AUDUSD’s recovery on Wednesday, it faces the risk of an eventual return to the 0.9000/0.8997 levels. A breach of here will call for a run at the 0.8900 level and possibly lower towards the 0.8850 level. Its daily RSI is bearish and pointing lower supporting this view. Conversely, AUDUSD … “AUDUSD: Bearish, Risk Points To The 0.8997 Level”

UK GDP figures as expected – continue to sell Sterling

Britain’s recovery picked up pace in the second quarter, official figures have confirmed, with GDP expanding by 0.6% which was the expected figure, so no surprises. The 0.6% rate of growth was twice the pace of the first three months of 2013, and exactly as predicted by economists, after signs of a pickup in retail … “UK GDP figures as expected – continue to sell Sterling”

Euro Gains on Improving PMI, Down vs. Dollar

Euro gained as positive data from the eurozone was surprisingly good, giving hope that the European economy will be able to emerge from recession without additional stimulating measures from policy makers. The Markit Flash Eurozone Services Purchasing Managers’ Index rose from 48.3 in June to 49.6 in July, reaching the highest level in 18 months. The Markit Flash Eurozone Manufacturing PMI climbed from 48.8 to 50.1 this … “Euro Gains on Improving PMI, Down vs. Dollar”