The Australian dollar slumped today as the decline of China’s manufacturing unexpectedly accelerated last quarter, reigniting concerns about growth in the major Asian economy and the biggest trading partner of Australia. Inflation report from Australia came out today, but hardly affected the currency as it was stable and in line with forecasts. Consumer prices rose 0.4 percent in the second quarter of 2013, at the same rate as in the first quarter. Data about China’s manufacturing … “Aussie Suffers from Decline of China’s Manufacturing”

Month: July 2013

Czech Koruna Gains Even as Policy Makers Ready to Weaken Currency

The Czech koruna managed to gain today despite signs that policy makers may refer to weakening the currency as a measure for spurring economic growth in the country. Czech National Bank Governor Miroslav Singer said in an interview to Bloomberg today that he is going to keep monetary policy accommodative as long as risk of inflation missing the central bank’s target remains. He indicated that interest rates should remain near zero: From … “Czech Koruna Gains Even as Policy Makers Ready to Weaken Currency”

Rupee Rises as RBI Tightens Regulations

The Indian rupee rose today after the central bank took measures to limit banks’ access to cash in an attempt to halt the currency’s slide. The rupee reacted favorably to the bank’s action. The Reserve Bank of India announced yesterday several measures to address the exchange market volatility. The RBI limited amount banks can borrow in repurchase actions (the Liquidity adjustment facility) to 0.5 percent of their deposits. Additionally, the central bank set the Cash Reserve Ratio, … “Rupee Rises as RBI Tightens Regulations”

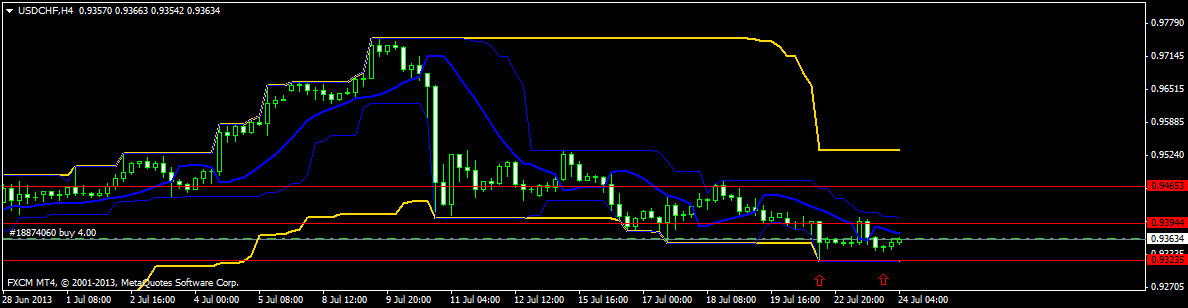

USDCHF long opportunity?

For today, there might be long opportunities on this pair – which means a sell option on EURUSD simultaneously. Yesterday the pair was pushed sharply lower close to the big support line at 0,9323. In the last two days it traded only under the 0,9394 area and so far it has not been able to … “USDCHF long opportunity?”

GBP/USD: Trading the British Preliminary GDP Jul 2013

British Preliminary Gross Domestic Product (GDP) is considered one of the most important economic indicators. It is published each quarter, which magnifies its impact. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator Background British Preliminary GDP … “GBP/USD: Trading the British Preliminary GDP Jul 2013”

Turkish Central Bank Boosts Interest Rates, Lira Still Down

The Turkish central bank performed a significant interest rate hike yesterday following the big drop of the Turkish lira. So far, the currency did not respond to the action in any noticeable manner. The Central Bank of the Republic of Turkey performed a significant rate hike by 75 basis points to 7.25 percent. The central bank explained: Recently, several developments have affected inflation adversely. Under such circumstances, “a measured monetary tightening is deemed … “Turkish Central Bank Boosts Interest Rates, Lira Still Down”

Canadian Retail Sales Make Loonie Rally

The Canadian dollar rose today as May’s retail sales beat forecasts, giving hope that the nation’s economy will continue to improve and policy makers will raise interest rates eventually. Just one important report from Canada was scheduled for this week and it came out very positive. Retail sales were up 1.9 percent in May, compared to the forecast of 0.4 percent. Core sales (retail sales excluding … “Canadian Retail Sales Make Loonie Rally”

Weak Manufacturing Data Weighs on US Dollar

Once again, economic data indicates that things in the United States are far from certain. As a result, the US dollar is down against many of its counterparts today. The culprit in this case appears to be the latest manufacturing data. The Richmond Federal Reserve reports on the manufacturing performances in the mid-Atlantic and the upper Southeast regions of the United States, and the latest data is somewhat disappointing. The performance measure for July shows that there is … “Weak Manufacturing Data Weighs on US Dollar”

Consumer Confidence Data Helps Euro

The latest consumer confidence data out of the eurozone indicates that the recession might be coming to an end. This is good news for many who are hoping that the 17-nation currency region will pick up a bit so that it can truly leave the sovereign debt crisis behind. For now, the news has resulted in gains for the euro. Euro is higher almost across the board today, strengthening as the latest consumer … “Consumer Confidence Data Helps Euro”

EUR/USD above 1.32 and GBP/USD above 1.5350 could be

Last week’s Bank of England minutes pushed Sterling sharply higher against the US dollar as The Bank of England’s monetary policy committee voted 9-0 to leave interest rates and quantitative easing unchanged. This sharp rally in Sterling should be used as an opportunity to short the pound again against the US dollar. Sterling has continued … “EUR/USD above 1.32 and GBP/USD above 1.5350 could be”