Euro/pound fell below the 0.86 line and continues dropping. The relative strength of the British economy together with weakness in the euro-zone continues to weigh on the pair after it failed to conquer the 0.87 handle. Since that attempt, the pair is clearly trading in a downtrend parallel channel. It still has a way to … “EUR/GBP drifting lower in a downtrend parallel channel”

Month: July 2013

Weekly overview (15-19 July 2013) Even poor financial performance

Indices As Microsoft (MSFT) published its financial results for the second quarter ending 30 June, it became clear that the technological giant has felt the effects of declining demand of personal computers. The company’s profit for the period was $0.52 per share, which contrasted sharply with the expected $0.75 per share. Reasonably, after the weak … “Weekly overview (15-19 July 2013) Even poor financial performance”

OANDA launches automated technical analysis powered by Autochartist

OANDA continues to explore technological options and now integrates Autochartist’s automated technical analysis. The new enhancement is available for live accounts and is available with some limitations for demo accounts. OANDA recently launched an impressive mobile application. For more details about the Autochartist integration, here is the official press release: LONDON – July 22, 2013 … “OANDA launches automated technical analysis powered by Autochartist”

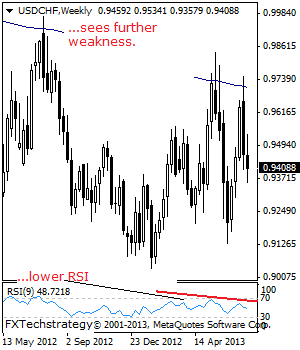

USDCHF: Reverses Gains, Vulnerable (The Week Ahead)

USDCHF – With corrective weakness seeing USDCHF declining and taking back its previous week gains the past week, further downside is envisaged. On further decline, the 0.9400 level comes in as its minimum target with a cut through here extending its correction towards the 0.9303 level and possibly lower towards the 0.9200 level. Its weekly … “USDCHF: Reverses Gains, Vulnerable (The Week Ahead)”

Dollar After Bernanke’s Week

This week could be called Ben Bernanke’s week as attention of all Forex traders was focused on the testimony of the Federal Reserve Chairman. The dollar was rising ahead for the speech, but tumbled afterwards. Bernanke explained that policy makers will perform trimming of asset purchases when economic conditions warrant such a move and not at some predetermined date. At the same time, he thought it may well happen this … “Dollar After Bernanke’s Week”

It’s hot in the North Hemisphere and things are

One of the things we tell our traders to do at the end of the week is to examine the Weekly charts, to reflect on the weeks movements and tie in with your Daily chart analysis. At the end of this week we looked over the markets and spotted a significant price action event that … “It’s hot in the North Hemisphere and things are”

Pound Ends Week on Positive Note on Hopes for Sustainable Growth

The Great Britain pound ended this week on a positive note, gaining on Friday against all other major counterparts as hopes for sustainable growth increased the appeal of the currency, especially to those investors who seek a refuge from economic problems of the European Union. Analysts estimated ahead on the next week’s official report that the UK economy expanded 0.6 percent in the second quarter of 2013. The expansion in the first quarter was slower (0.3 percent). … “Pound Ends Week on Positive Note on Hopes for Sustainable Growth”

Canadian Dollar Ends Friday Mixed

The Canadian dollar was mixed after inflation report on Friday. The currency rose against the US dollar, fell against the euro and closed flat versus the Japanese yen. As was expected, annual inflation accelerated to 1.2 percent in June from the May’s reading of 0.7 percent. Consumer prices were unchanged on a monthly basis, while an increase by 0.2 percent was expected by analysts. Core inflation fell 0.2 percent after rising at the same … “Canadian Dollar Ends Friday Mixed”

The End of Risk On and Risk Off – What

Q3 reveals that the financial markets are in the thick of complicated and divergent market behavior. With world markets awash in policies around quantitative easing, the fed tapering and major central bank announcements. Capital market users and investors find themselves in a new market environment: One that seems to promise the return to “normal trading … “The End of Risk On and Risk Off – What”

A bold G20 stance on economic growth could boost risk

Financial stability, economic growth and jobs creation are likely to be top of the agenda at the G20 summit in Moscow and any commitment to closer global coordination over economic and monetary policies could prove bullish for commodity and risk currencies. This week’s G20 gathering of finance ministers and central bankers (though US Fed chairman … “A bold G20 stance on economic growth could boost risk”