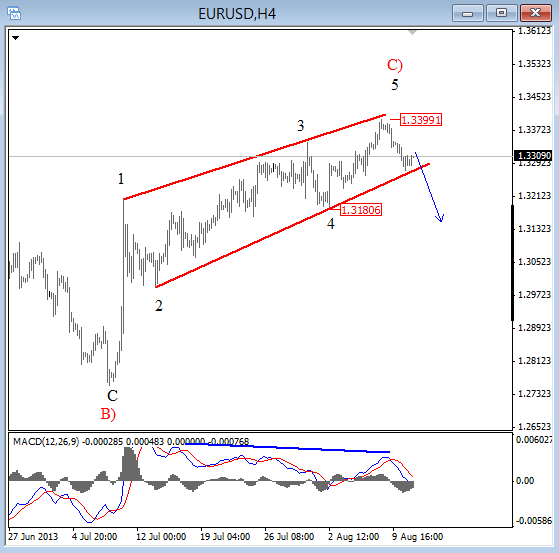

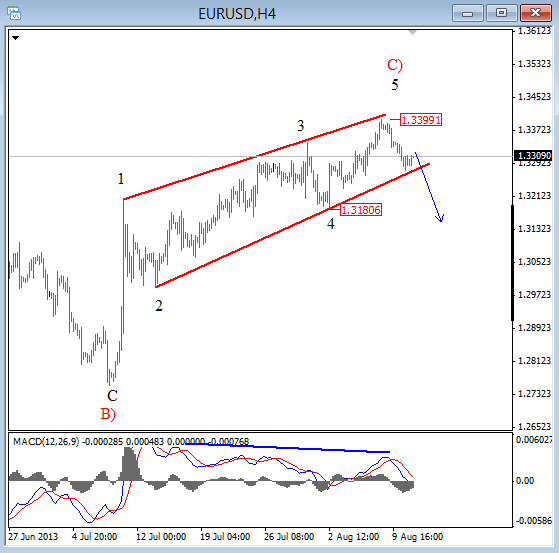

EURUSD has been trading higher last week and reached highs around the 1.3400 region from where the pair reversed impulsively, and this suggests that the highs are in. As such, a larger ending diagonal appears complete and is now pointing for a weaker EURUSD.

We will be looking for a sizable decline once 1.3180 support is taken out. Why is 1.3180 support important? Because that’s the swing low of wave four, and when the floor of wave four is broken this means that the trend has changed and that bearish waves are underway.

What is an Ending Diagonal?

An ending diagonal is a special type of pattern that occurs at times when the preceding move has gone too far and too fast, as Elliott put it. A very small percentage of ending diagonals appear in the C wave position of A-B- C formations. In double or triple threes, they appear only as the final “C” wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement.

- The structure is 3-3-3-3-3

- A wedge shape within two converging lines

- Wave 4 must trade into a territory of a wave 1

- It appears primarily in the fifth wave position, in the C wave position of A-B- C and in double or triple threes as the final “C” wave