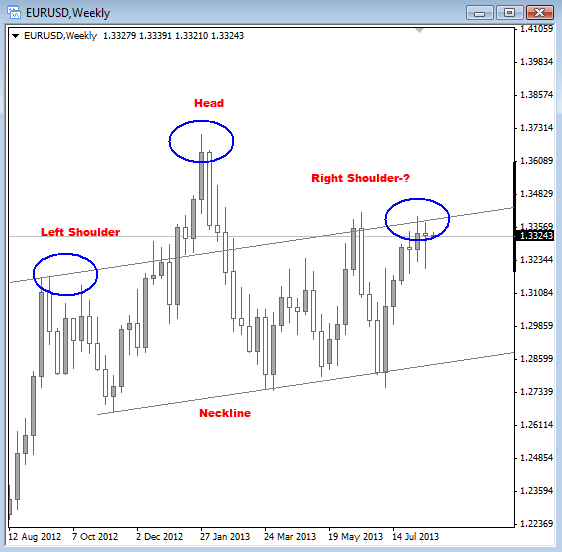

EURUSD reversed higher few weeks back from around the 1.2750 level, but the recovery since early April still has a corrective look. With that said, we think that the move is a complex correction, probably a flat one and that the larger trend will continue lower, especially if we consider a five wave decline from … “EUR/USD Rally From 1.2750 Is Looking Corrective – Elliott”

Month: August 2013

Turbulent Week for US Dollar Behind

The US dollar experienced a turbulent week, rising in the first half of the week, but sharply dropping in the second as Forex traders were attempting to guess what steps the Federal Reserve will take next month. Market participants were speculating whether the Fed is going to tamper its asset purchases in September. At first positive data supported the case for stimulus reduction. Yet a bunch of negative reports was released later, resulting in a sharp … “Turbulent Week for US Dollar Behind”

Canadian Dollar Drops as Fundamentals Do Not Look Good

The Canadian dollar closed lower today on concerns that the nation’s economy is struggling and this will not allow the Bank of Canada to perform an interest rate hike that it was promising for some time. Manufacturing sales declined 0.5 percent in June, demonstrating the fourth decrease in six months. Analysts have predicted an increase by the same rate. This week most currencies were especially susceptible to domestic news. There were … “Canadian Dollar Drops as Fundamentals Do Not Look Good”

Dollar Mixed as US Data Leaves Traders Confused

The US dollar was heading lower against the euro for the most part of today’s trading session, but currently managed to recover. The currency also rose against the Japanese yen, while staying flat versus the Great Britain pound. Most Forex market participants believed that the Federal Reserve will scale back it stimulus program next month. Yet this week’s string of negative economic reports made traders uncertain … “Dollar Mixed as US Data Leaves Traders Confused”

Expectations for a Weaker Yen Continue

Recently, with the uncertainty and upheaval, the yen has shown some strength. However, the yen is weakening again, and there are expectations that a weaker yen will be the norm moving forward. At least, yen weakness is seen as the most likely “sure bet” in the markets in the near to medium-term future. For the most part, focus in the markets is on what’s happening in the United States. Forex traders combing through US data, looking for clues … “Expectations for a Weaker Yen Continue”

Confidence in the Euro Grows

Confidence in the euro is growing right now, as evidenced by the increased issuance of euro-denominated debt. With the news that the eurozone has returned to growth after 18 months of recession, and with the debt crisis seemingly under control, confidence in the euro is growing, and the 17-nation currency is getting a little help. Thanks to the recent troubles in the eurozone, borrowing costs have been somewhat low. However, nervousness about the fate of the euro has held … “Confidence in the Euro Grows”

Indian Rupee Drops on Regulations Worries & Fed Speculations

The Indian rupee slumped today as attempts of policy makers to prevent further currency’s depreciation actually made investors less willing to bring money into the country. Uncertainty about stimulus tampering by the Federal Reserve did not help the currency either. The Reserve Bank of India announced this week that it is going to take measures for reducing capital outflows out of the country. Traders did not welcome the news as they were … “Indian Rupee Drops on Regulations Worries & Fed Speculations”

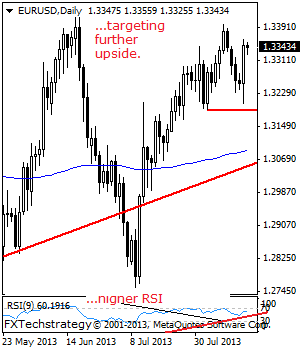

EURUSD: Upside Pressure Remains With Eyes On The 1.3400

With EUR bullish and targeting further upside, the risk is for it to re-take its key resistance at the 1.3400 level to resume its broader upside. This if seen will aim at the 1.3450 level. Further out, resistance resides at the 1.3500 level and possibly higher towards the 1.3600 level. Conversely, support lies at the … “EURUSD: Upside Pressure Remains With Eyes On The 1.3400”

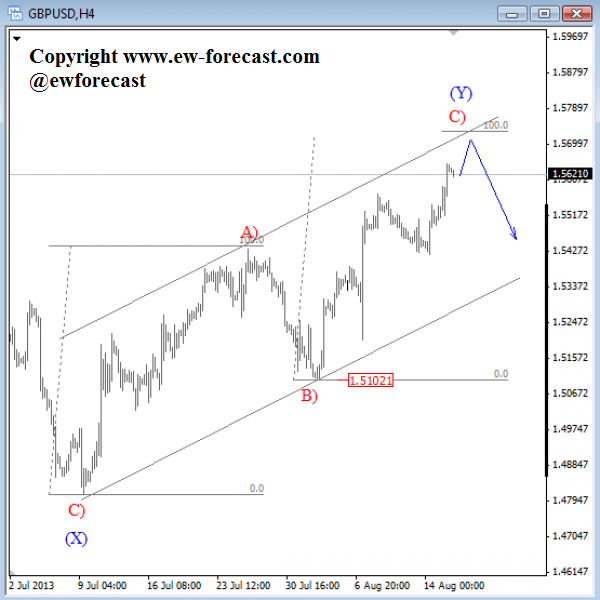

GBPUSD: Three Wave Rally From July Low Suggests A

GBPUSD is moving higher, but the rally from July’s low is still in three legs with wave C) now near completion as the price is approaching the upper trend line of a corrective channel as well as an equality level compared to wave A). We can also count five waves up from 1.5100 wave B) … “GBPUSD: Three Wave Rally From July Low Suggests A”

Sterling Flat, Heads to Weekly Gain

With absence of any macroeconomic data today, the Great Britain pound was trading flat. Still, the currency was heading to a weekly gain as the previous favorable reports helped the currency to rally over the week. The sterling jumped yesterday against the US dollar on the positive retail sales report. Against the Japanese yen, the UK currency was rallying every trading session this week. Next week, the very important second estimate of economic … “Sterling Flat, Heads to Weekly Gain”