British Retail Sales is considered one of the most important indicators of consumer spending. The indicator is released on a quarterly basis, magnifying its impact. A reading that is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator … “GBP/USD: Trading the British Retail Sales Aug 2013”

Month: August 2013

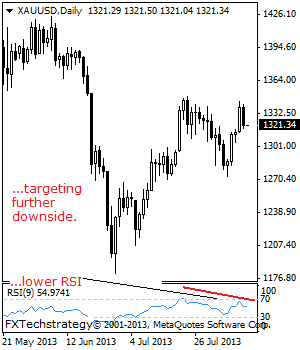

GOLD: Turns Ahead Of Key Resistance.

GOLD: Unless GOLD returns above the 1,348 level, there is risk of further declines following its Tuesday weakness. Support comes in at the 1,272.12 level with a turn below here turning attention to the 1,250.00 level and then the 1,215.00 level. Further down, a violation of here will call for a run at the 1,180.22 level. … “GOLD: Turns Ahead Of Key Resistance.”

US Dollar Gets Help From Latest Retail Sales Data

US dollar is getting a boost today, thanks to the latest retail sales data. While the data wasn’t super-impressive, it still showed solid gains, and that is supporting speculation that Fed tapering will end sooner rather than later. July retail sales showed an increase of 0.2 per cent. This was a little below expectations of 0.3 per cent, but some of the disappointment was offset by the fact … “US Dollar Gets Help From Latest Retail Sales Data”

Japanese Yen Sinks on Latest from Shinzo Abe

After gaining some ground, the Japanese yen is dropping against its major counterparts, mainly due to a combination of the latest plan from Prime Minister Shinzo Abe and the idea that the yen was probably overbought recently. The latest plan by Japanese Prime Minister Shinzo Abe is mulling over an idea to cut corporate taxes. He is trying to consider ways to offset a proposed increase to sales taxes. The news about … “Japanese Yen Sinks on Latest from Shinzo Abe”

Forex Crunch app for iPhone and Android launched

The Forex Crunch mobile application is available for download for iOS and for Android. You’re welcome to download the app, use it, report any bugs and rate it. The first version of the application consists of many features, and future versions are already in the works. Apart from updates from Forex Crunch, the app contains the elaborate FXstreet … “Forex Crunch app for iPhone and Android launched”

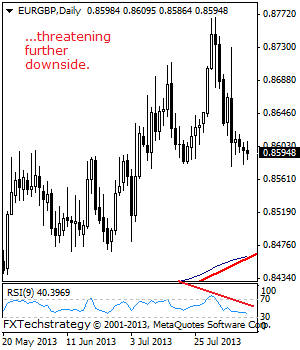

EURGBP- Weak, Vulnerable

EURGBP- With the cross facing downside pressure despite its broader medium term uptrend, further bear threat is a concern. Support comes in at the 0.8550 level with a cut through there turning focus to the 0.8500 level. Further down, support lies at the 0.8450 level and then the 0.8400 level. Its daily RSI is bearish … “EURGBP- Weak, Vulnerable”

CitiFX Pro Launches New MetaTrader 4 with Free VPS

CitiFX Pro now offers an enhanced MT4 offering, with VPS available to both demo and live accounts. CitiFX recently partnered with tradable to offer FX Liquidity. For more details about the new MT4 offering, here is the official press release: NEW YORK – CitiFX Pro, the award-winning margin FX platform from Citi has launched a … “CitiFX Pro Launches New MetaTrader 4 with Free VPS”

Septaper is a close call both for markets and the Fed

There are good chances that the Fed will taper its bond buys on its meeting on September 18th, but it is a close call, both for markets and the Fed, says Simon Smith of FxPro. It’s important to note August’s payrolls. In the interview below, Smith also discusses the direction for the UK economy, Japan’s … “Septaper is a close call both for markets and the Fed”

Accelerating Inflation Reduces Chances of Rate Cut, Makes Krona Stronger

The Swedish krona rose today as consumer inflation accelerated last month, reducing incentive for the central bank to cut interest rates that are already quite low. Statistic Sweden reported that the Consumer Price Index advanced 0.1 percent in July after falling at the same rate in June. Economists did not expect any changes. Without any major news, the Forex market does not show a general trend, making … “Accelerating Inflation Reduces Chances of Rate Cut, Makes Krona Stronger”

Australian Dollar Drops with Business Confidence, Manages to Recover

The Australian dollar fell today against its US peer after the release of business confidence report, but managed to recover as of now. The currency advanced versus the Japanese yen. NAB Business Confidence slipped from 0 to -3 in July, the lowest level in 8 months. The report mentioned the adverse effect of the depreciating currency on business activity: Weaker AUD hurting wholesale and retail purchase costs but weak activity sees this reflected … “Australian Dollar Drops with Business Confidence, Manages to Recover”