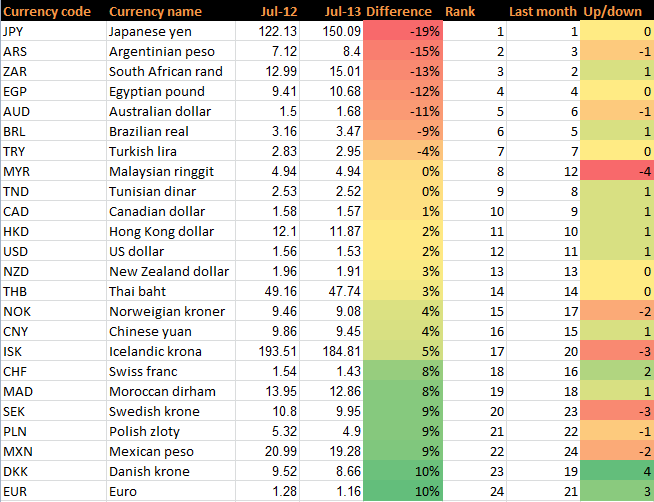

In July last year GBP/EUR was hitting levels of 1.28 with talk of a break of 1.30 on the cards. Since that low for the euro we have seen a huge upturn in fortunes with the euro gaining confidence and momentum. The euro has been lifted by the European Central Bank vowing to do everything … “Year-on-year trends of the top traded currencies – July”

Month: August 2013

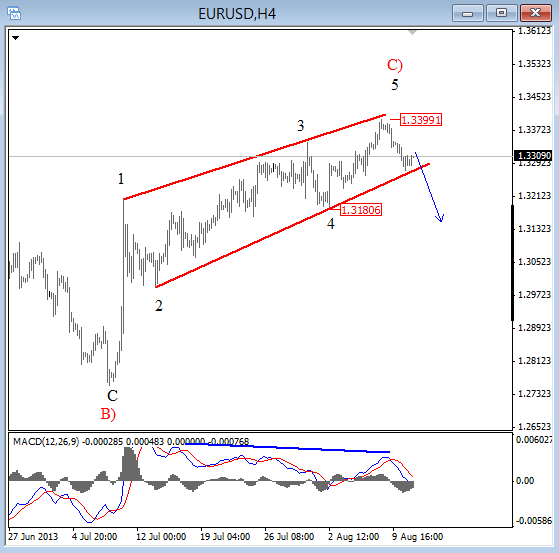

EURUSD: Bearish Reversal Is Unfolding-Elliott Wave Analysis

EURUSD has been trading higher last week and reached highs around the 1.3400 region from where the pair reversed impulsively, and this suggests that the highs are in. As such, a larger ending diagonal appears complete and is now pointing for a weaker EURUSD. We will be looking for a sizable decline once 1.3180 support … “EURUSD: Bearish Reversal Is Unfolding-Elliott Wave Analysis”

EUR/USD: Trading the Preliminary German GDP

German Preliminary GDP is a key release which is published every quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes … “EUR/USD: Trading the Preliminary German GDP”

Canadian Dollar Mixed as Week Starts

The Canadian dollar was mixed at the start of the week with absence of any major news to drive the currency in any particular direction. The loonie did not show a noticeable trend today either. It looks like markets are uncertain in which direction to move. Stocks were falling, while crude oil was rising. Both losses and gains were small though, not giving an edge to either bulls or bears. The Canadian currency … “Canadian Dollar Mixed as Week Starts”

End of Eurozone Recession Not Helping the Euro Right Now

Expectations are that the eurozone recession ended the second quarter of 2013. However, even with this optimistic expectation, the euro is still struggling. The 17-nation currency is down against many of its major counterparts, but good news could help the euro regain the upper hand later this week. Right now, economists and analysts feel that the eurozone probably moved out of recession during the second quarter of 2013. … “End of Eurozone Recession Not Helping the Euro Right Now”

US Dollar Back in Demand as Stocks Falter

US dollar is back in demand after a bit of earlier weakness today. Stocks are faltering a bit, especially the S&P 500, which is below the swing top seen in May. With risk aversion on the rise, the greenback is demand and gaining against its major counterparts. While US stocks are a little higher in trading, they aren’t doing that well. Indeed, they are struggling a bit, with the S&P … “US Dollar Back in Demand as Stocks Falter”

NZD/USD: Trading the NZ Retail Sales August 2013

New Zealand Retail Sales is considered one of the most important indicators of consumer spending. A such, it is often a market-mover and can affect the direction of NZD/USD. A reading that is higher than the market forecast is bullish for the New Zealand dollar. Here are all the details, and 5 possible outcomes for NZD/USD. Published on Tuesday at … “NZD/USD: Trading the NZ Retail Sales August 2013”

Swiss Franc Drops After Danthine’s Comments

Swiss National Bank Vice President Jean-Pierre Danthine said that the central bank will drop the currency cap when it starts raising interest rates. Such comments could have boosted the Swiss franc if not the fact that the SNB is not going to lift rates in the foreseeable future. Danthine said: The day the SNB decides to raise rates, there can no longer be a restricting minimum exchange … “Swiss Franc Drops After Danthine’s Comments”

Yen Falls as Japanese GDP Slows More than Expected

The Japanese yen fell today as the nation’s economy slowed last month more than was expected by market participants, sparking talks about additional monetary easing from policy makers. Japanese gross domestic product grew 0.6 percent in the second quarter of 2013, compared to the forecast of 0.9 percent. Annual growth slowed from 3.8 percent in Q1 to 2.6 percent in Q2, while it was expected to be little-changed at 3.6 … “Yen Falls as Japanese GDP Slows More than Expected”

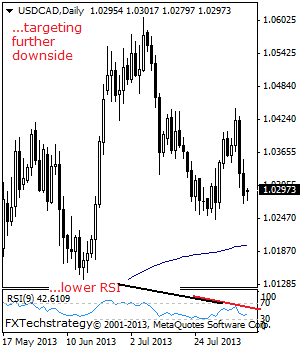

USDCAD: Bearish, Sets Up To Resume Weakness

USDCAD: A re-take of the 1.0244 level is now underway following a sell off the past week. Below the mentioned level will open the door for more downside towards the 1.0200 level. A turn below here will shift risk to the downside towards the 1.0136 level and then the 1.0100 level. On the upside, resistance … “USDCAD: Bearish, Sets Up To Resume Weakness”