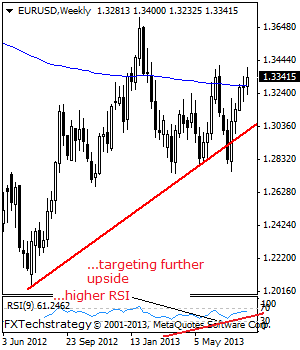

EURUSD: With EUR bullish and targeting further upside, it looks to recapture the 1.3415 level. A break through here will set the stage for more strength towards the 1.3500 level with a break resuming its broader upside and turning attention to the 1.3550 level. Its weekly RSI is bullish and pointing higher supporting this view. … “EURUSD: Bullish, The 13415 level Beckons.”

Month: August 2013

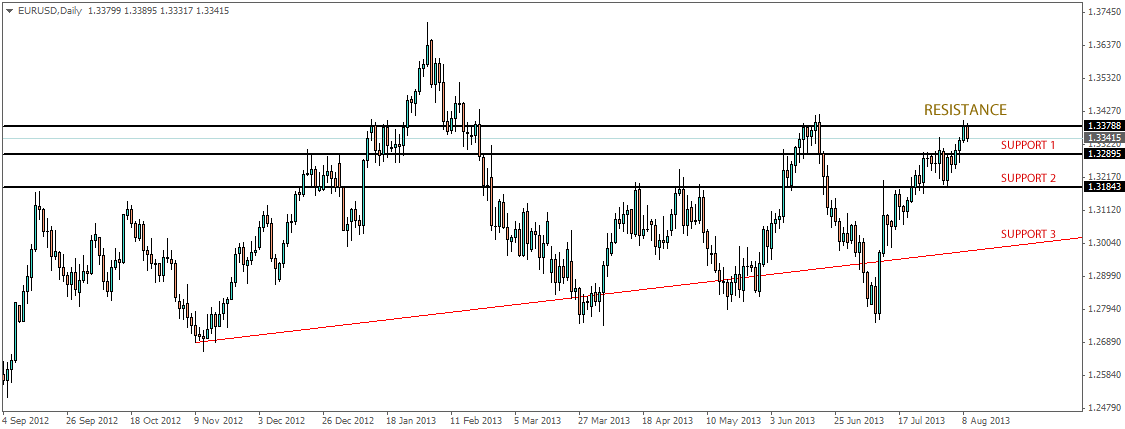

EUR/USD Fails To Pierce 1.3378 Once Again

With EURUSD encountering heavy resistance at 1.3378, it is likely going to hit the downtrend yet again. Consistently failing to break the 1.3378, price will encounter supports at 1.3289 and 1.3184. These two spots are the only significant obstacles for EURUSD to carry on with the downtrend. Considering the absence of uptrend above 1.3378 since … “EUR/USD Fails To Pierce 1.3378 Once Again”

Aussie Ends Week with Solid Gains

Traders were rather pessimistic about the Australian dollar at the start of this week, making it surprising to see that the currency ended the week with solid gains. The Aussie rallied mainly on overseas news, not domestic fundamentals. The Australian currency started the week poorly and market analysts have thought that the Aussie would fall to new lows. The main concern was a possible interest rate cut by the Reserve Bank of Australia. Indeed, … “Aussie Ends Week with Solid Gains”

Positive Fundamentals Do Not Help Pound Again

Great Britain released yet another positive macroeconomic report. Yet, as it often was happening lately, favorable fundamentals did not help the pound, which fell against other major currencies today. Britain’s trade balance deficit shrank to £8.1 billion in June from £8.7 billion in May. Forecaster predicted a deficit of £8.4 billion. Most of UK macroeconomic data was fairly good. Mark Carney said that … “Positive Fundamentals Do Not Help Pound Again”

Won Rallies as BoK Speaks About Growth & China’s Data Still Good

The South Korean won advanced today as the central bank spoke about economic growth of the Asian nation and after China released yet another positive report. The Bank of Korea left its main interest rate at 2.5 percent yesterday and said: In Korea, the Committee appraises economic growth to be continuing, albeit moderately, mainly led by exports. China’s industrial production jumped 9.7 percent in July from a year ago. The data added … “Won Rallies as BoK Speaks About Growth & China’s Data Still Good”

Thai Baht Rallies on Positive Sentiment, Loses Gains

The Thai baht was rising because of the positive market sentiment, but was unable to keep gains and currently trades below the opening level against the US dollar. The positive data from China eased concerns about slower economic growth and boosted Asian currency, as well as other currencies associated with risk. Most of Thai exports go to China, making the good news from the Asian country especially beneficial to the baht. Yet … “Thai Baht Rallies on Positive Sentiment, Loses Gains”

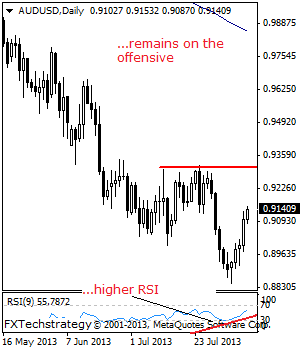

AUDUSD: Remains On Corrective Recovery Offensive.

AUDUSD: With a fifth day of upside correction underway, further strength is now envisaged. This leaves AUDUSD targeting the 0.9209 level where a break will aim at the 0.9250 level and then the 0.9317 level. Its daily RSI is bullish and pointing higher supporting this view. On the downside, the risk to this analysis will … “AUDUSD: Remains On Corrective Recovery Offensive.”

Signs of Growth Lift Mexican Peso

The Mexican peso gained today on speculations that the US Federal Reserve will keep stimulus. At the same time, signs of economic growth in the United States improved prospects for Mexican exports. Poor non-farm payrolls made traders believe that the Fed will maintain accommodative policy for longer time than was previously thought. Most other US reports were positive and this is good to Mexico as it ships the vast majority … “Signs of Growth Lift Mexican Peso”

Market Sentiment Makes Canadian Dollar Stronger

Positive market sentiment allowed the Canadian dollar to overcome poor domestic fundamentals, resulting in a sharp advanced against the US dollar and gains against other most-traded currencies. The general market sentiment was risk-positive today as good data from China and Europe made traders less concerned about economic growth. Riskier currencies appreciated as a result. The optimistic mood helped the Canadian currency to shrug off the negative impact of yesterday’s macroeconomic reports. … “Market Sentiment Makes Canadian Dollar Stronger”

German Data, Risk Appetite Help Euro

German data is helping the euro today, as is the latest speculation that the eurozone economy might be returning to growth. Good news elsewhere is spurring on risk appetite, and that is providing some help for the 17-nation currency as well. The latest news out of Germany is that exports rose 0.6 per cent from May to June. The Federal Statistics Office reports that exports are on the rise for Germany. This … “German Data, Risk Appetite Help Euro”