Join me for a webinar on Tuesday, August 13th at 15:00 GMT for a webinar titled 5 points on trading the news. You can register here. News events certainly move markets, but not always as you expect. We will talk about 5 different aspects of trading the news, including the preparation, the conclusions we can draw … “5 points on trading the news – upcoming webinar on”

Month: August 2013

Aussie Ignores Domestic Fundamentals, Pays Attention to News from China

Fundamental data from Australia was rather negative today, but it did not hinder the Australian dollar’s rally. The currency gained as Chinese imports increased last month, improving prospects for Australian goods. The Customs General Administration of China reported that the trade surplus decreased $17.8 billion in July from $21.1 billion in June as imports advanced 10.9 percent from a year ago. Imports were down 0.7 percent … “Aussie Ignores Domestic Fundamentals, Pays Attention to News from China”

US Dollar Struggles on Jobless Data, Fed Uncertainty

US dollar is struggling today, heading lower against many of its counterparts, thanks to uncertainty over when the Federal Reserve will begin tapering its asset purchases, as well as the latest jobless data. The question everyone wants answered — from stock investors to Forex traders — is when the Federal Reserve will begin tapering its asset purchases. Recent comments from members of the Federal Reserve Board indicate that … “US Dollar Struggles on Jobless Data, Fed Uncertainty”

Is the UK economy strengthening and giving Sterling a

Recent data from the UK has been much better than expected. GDP came in at 0.6% for the second quarter of 2013 versus expectations of 0.3%. The much better than expected PMI (Purchasing Manager’s Index) data out in the UK a couple of days ago certainly demonstrates that the economy is starting to perform well. … “Is the UK economy strengthening and giving Sterling a”

Yen Erases Losses as Policy Makers Refrain from Expanding Stimulus

The Japanese yen erased earlier losses and was little changed today after the Bank of Japan left interest rates and the asset purchase program unchanged, confirming that policy makers are not ready to expand stimulus even more. The BoJ left interest rates near zero and maintained the asset purchase program at ¥60–70 trillion (mostly through purchase of Japanese government bonds). Such decision was widely expected by market participants. … “Yen Erases Losses as Policy Makers Refrain from Expanding Stimulus”

Leadership or Lack Thereof – Part II

The first article under this title was published in June and was regarding President Obama’s agreement with the GOP extending a mandate for employers until 2015 under the Affordable Care Act aka ObamaCare. This article is completely different but discusses the same subject matter; that being lack of leadership. On June 19th the FOMC conducted … “Leadership or Lack Thereof – Part II”

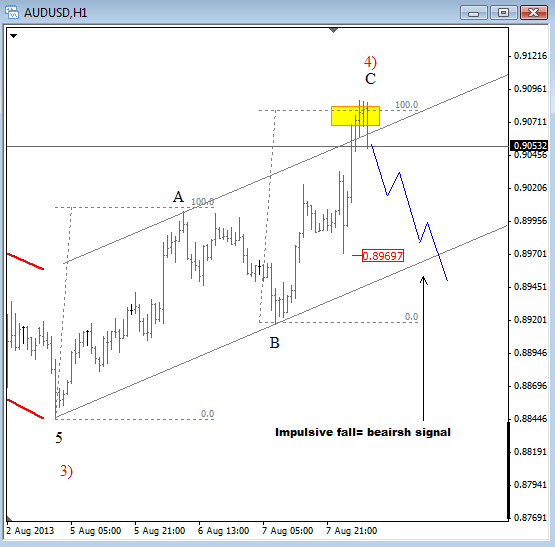

AUD/USD Technicals Remain Bearish – Elliott Wave Analysis

Markets are slightly in the risk-on mode after good Chinese trade balance numbers. As it usually happens, AUD will be impacted the most on any news from China, so the currency found support in Asian trading and is now one of the strongest on the day despite the fact that employment figures reported in Australia … “AUD/USD Technicals Remain Bearish – Elliott Wave Analysis”

GBP direction hinges on jobs numbers

Mark Carney, the new governor of the Bank of England placed jobless numbers centre stage on Wednesday tying monetary policy to a 7% unemployment figure before it will be reviewed. With an economic recovery under way in the UK, GBP’s bias over the short- to medium-term is likely to be upwards. With the housing market … “GBP direction hinges on jobs numbers”

USD/CAD: Trading Canadian Employment August 2013

The Canadian employment change is an important leading indicator which provides a snapshot of the health of the employment market. A reading higher than the forecast is bullish for the Canadian dollar. Here are the details and 5 possible outcomes for USD/CAD. Published on Friday at 12:30 GMT. Indicator Background Job creation is one of the … “USD/CAD: Trading Canadian Employment August 2013”

Franc Gains Despite Unfavorable Data

The Swiss franc gained today even as fundamentals were not supportive for the currency, suggesting that the central bank will keep the cap on the currency intact. The franc lost to the Japanese yen during the current session. Consumer sentiment fell from -5 to -9 in July instead of improving to -2 as economists have hoped for. The Consumer Price Index fell by 0.4 percent last month, in line forecasts. Consumer prices rose 0.1 percent … “Franc Gains Despite Unfavorable Data”