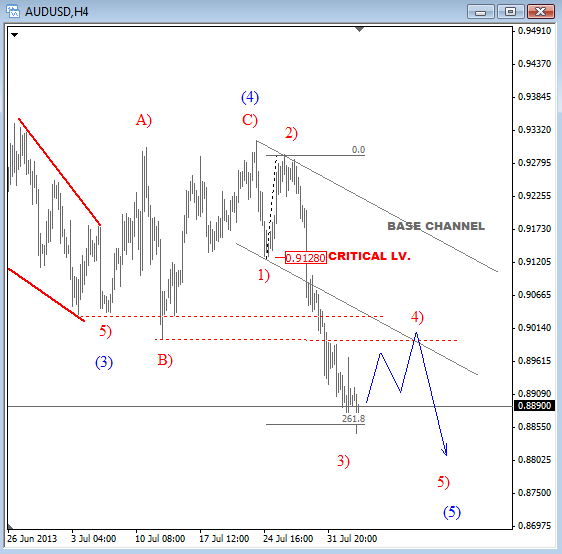

AUD has been one of the weakest currencies in the last two weeks after the pair reversed down from around the 0.9300 region: a move which has been expected because of a corrective price action since start of July. We are talking about a blue wave (4) that was an expanded flat. If that is … “AUD/USD: Corrective Rally Could Be A Short Opportunity –”

Month: August 2013

EURUSD: Continues To Retain Its Broader Upside Tone (Weekly

EURUSD: Despite its flat close the past week, EUR remains biased to the upside with eyes on the 1.3415 level. A break through here will set the stage for more upside towards the 1.3500 level with a break resuming its broader upside and turning attention to the 1.3550 level. Its weekly RSI is bullish and … “EURUSD: Continues To Retain Its Broader Upside Tone (Weekly”

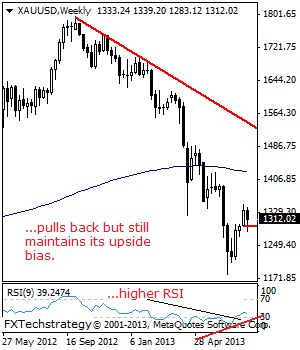

Gold Pulls Back; Remains Biased to the Upside

GOLD: Despite its lower close the past week, GOLD continues to retain its upside bias. However, it will have to return above the 1,348.10 level to trigger that uptrend. Above here will call for a run at the 1,400.00 level, its psycho level followed by the 1,450.00 level, its psycho level. A cap may occur … “Gold Pulls Back; Remains Biased to the Upside”

Weekly Losses of Sterling Limited by Positive Fundamentals

The Great Britain pound weakened this week against the US dollar and the euro, but losses were limited because of favorable fundamentals. The currency was also falling versus the Japanese yen, but managed to rebound by the weekend. The pound was soft ahead of the Bank of England policy meeting on speculations that stimulus will remain in place. Yet the currency surged after the gathering even though the central bank indeed kept monetary accommodation. … “Weekly Losses of Sterling Limited by Positive Fundamentals”

The Sitzkrieg Jobs Report

On Friday, August 2nd the Labor Department announced the long awaited and much anticipated monthly jobs report. In the United States we informally call this Jobs Friday. Well the report came out with a net gain of 162,000 new jobs with an expectation of 184,000. Obviously this report did not meet expectations. The interesting aspect … “The Sitzkrieg Jobs Report”

Weaker jobs number is not end of USD rally

Given the US Federal Reserve’s focus on jobs creation as a key metric governing the pace of its quantitative easing measures it was not surprising that a weaker-than anticipated number caused a sell-off in USD. However, signs are the US economy is doing far better than many of its rivals suggesting an end to the … “Weaker jobs number is not end of USD rally”

Pound Climbs with House Prices & Construction

The Great Britain pound climbed today as house prices grew with pace that was two times above the forecast and as construction expanded much faster than was expected. The Nationwide House Price Index rose 0.8 percent in July, twice the predicted rate of 0.4 percent. The annual growth of 3.9 percent was fastest since August 2010. The seasonally adjusted Markit/CIPS UK Construction Purchasing Managersâ Index climbed from … “Pound Climbs with House Prices & Construction”

Dollar Drops on Worse-Than-Expected Non-Farm Payrolls

The US dollar slumped today against most major currencies as non-farm payrolls came out worse that was predicted by analysts, fueling speculations that the Federal Reserve will refrain from trimming of monetary stimulus. Non-farm payrolls rose 162,000 in July, trailing the forecast of 184,000. What is more, the June’s increase was revised negatively from 195,000 to 188,000. At the same time, the unemployment rate ticked down from 7.6 … “Dollar Drops on Worse-Than-Expected Non-Farm Payrolls”

India Rupee Lead Asian Currencies in Weekly Decline

The Indian rupee fell today, leading other Asian currencies in weekly decline, as comments of the US Federal Reserve did not alleviate fears of quantitative easing tampering, making traders unwilling to buy riskier currencies of emerging markets. Market participants remain worried about possible QE reduction, paying more attention to positive data from the United States than to the words of policy makers. Today’s non-farm payrolls are expected to show … “India Rupee Lead Asian Currencies in Weekly Decline”

Malaysian Ringgit Heads to Weekly Decline

The Malaysian ringgit fell today and headed to the biggest weekly decline in more than a month as Fitch Rating cut the nation’s credit rating, driving investors away from the country’s assets. Fitch lowered Malaysia’s credit grade on concerns about rising debt levels. Prime Minister Najib Razak promised yesterday that the government will address the issue. Analysts predicted that next week’s report will show a drop of exports by 7.3 … “Malaysian Ringgit Heads to Weekly Decline”